PNC Financial (PNC) Q3 Earnings & Revenues Top Estimates

PNC Financial PNC pulled off a third-quarter 2021 positive earnings surprise of 3.02% on substantial recapture of credit losses. Adjusted earnings per share (excluding pre-tax integration costs related to the BBVA USA acquisition) of $3.75 surpassed the Zacks Consensus Estimate of $3.64 and improved 42% sequentially.

The third quarter was the first full quarter of the company benefiting from the BBVA USA acquisition, which was completed on Jun 1, 2021. As of Oct 12, 2021, the company completed the conversion of 2.6 million customers, 9,000 employees and nearly 600 branches across seven states, merging BBVA USA into PNC Bank.

Fee income growth on higher asset management revenues, service charges on deposits and corporate services were tailwinds. However, higher expenses and a contraction of margin were negatives.

Net income in the third quarter was $1.49 billion, lower than $1.5 billion in the prior-year quarter.

Revenues Improve on Fee Income Growth, Expenses Rise

Total revenues in the reported quarter were $5.2 billion, up 21% year over year. The top line surpassed the Zacks Consensus Estimate of $5.03 billion.

Net interest income improved 15% from the year-ago quarter to $2.86 billion. The upswing is attributable to interest-earning assets acquired with BBVA USA and higher securities balances, partially offset by lower securities yields. However, the net interest margin contracted 12 basis points to 2.27%, reflecting lower securities yields.

Non-interest income grew 30% year over year to $2.34 billion on higher service charges on deposits, asset management, corporate services, and consumer services revenues.

PNC Financial’s non-interest expenses totaled $3.59 billion, up 42% from the year-ago figure. The rise primarily resulted from the hike in operating and integration expenses related to the BBVA USA acquisition as well as increased business and marketing activities.

The efficiency ratio was 69% compared with 59% in the year-ago quarter. A higher efficiency ratio indicates lower profitability.

As of Sep 30, 2021, total loans were down 2% sequentially to $290.2 billion. Total deposits declined 1% to $448.9 billion.

Credit Quality Improves

Net loan charge-offs were $81 million, down 48% year over year. The company reported the recapture of credit losses of $203 million compared with provisions of $52 million in the year-earlier quarter. Allowance for loan and lease losses declined 6.9% to $5.36 billion on a year-over-year basis.

Non-performing assets increased 21% year over year to $2.5 billion.

Capital Position Weak

As of Sep 30, 2021, the Basel III common equity tier 1 capital ratio was 10.2% compared with 11.7% as of Sep 30, 2020.

Return on average assets and average common equity came in at 1.06% and 10.95%, respectively, compared with 1.32% and 11.76% witnessed in the prior-year quarter.

Capital Deployment Activity

In the third quarter of 2021, PNC Financial returned $0.9 billion capital to shareholders through dividends on common shares of $0.5 billion and 2.1 million share repurchases amounting to $0.4 billion.

Our Viewpoint

The company displayed a strong performance in the quarter under review. A full quarter’s benefit from the BBVA USA acquisition bolstered results and drove fee income growth. Going forward, the company is well-poised to grow on the back of its diverse revenue mix. It remains on track to execute its goals, including technology initiatives, which bode well for the long term.

With the gradual recovery of the economic backdrop, the company’s provisions are reducing, which is encouraging. However, a lower net interest margin and escalating expenses are headwinds.

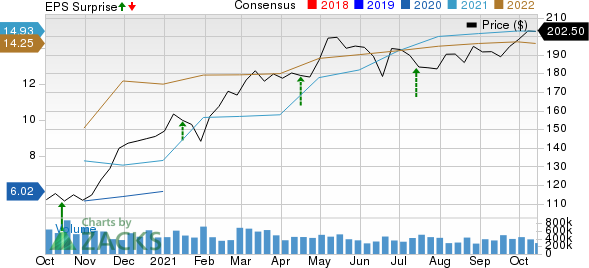

The PNC Financial Services Group, Inc Price, Consensus and EPS Surprise

The PNC Financial Services Group, Inc price-consensus-eps-surprise-chart | The PNC Financial Services Group, Inc Quote

Currently, PNC Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Banks

KeyCorp KEY and BankUnited, Inc. BKU are scheduled to release quarterly numbers on Oct 21, while Fifth Third Bancorp FITB will report results on Oct 19.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research