Poland’s Boardroom Shakeup Will Challenge Post-Election Rally

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- A post-election rally in Polish stocks will face its first big test as the new government starts a broad management reshuffle of state-controlled companies.

Most Read from Bloomberg

Musk Pay Package Voided, Threatening World’s Biggest Fortune

Tech Giants Slide in Late Trading After Earnings: Markets Wrap

UPS CEO Kicks Off Productivity Drive by Cutting 12,000 Managers

Microsoft Sales Top Estimates; Cloud Growth Disappoints Some

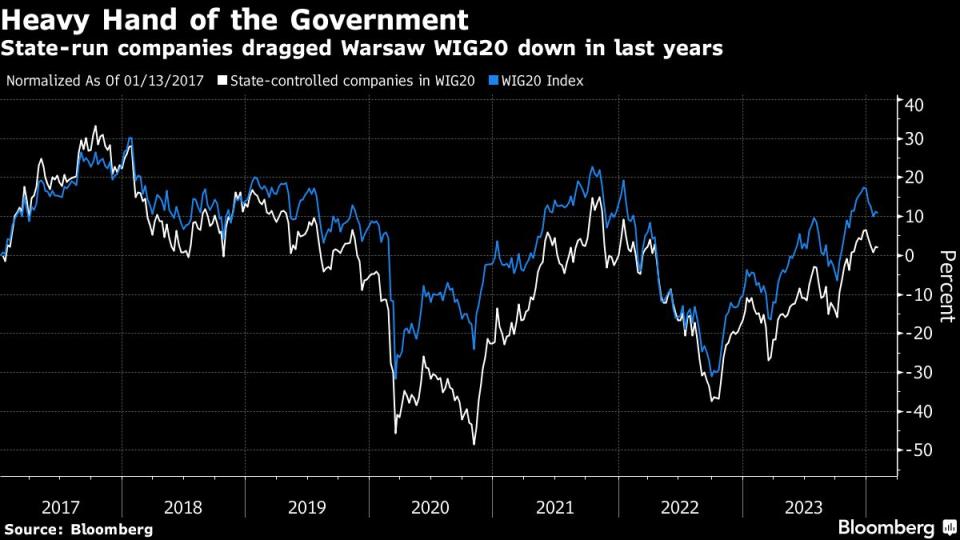

Warsaw’s WIG20 index has gained 12% since a pro-European Union alliance won Oct. 15 vote to end eight years of populist rule. State-run companies were often used to bankroll pet project of the previous government. Investors are betting the administration of Prime Minister Donald Tusk will improve governance standards.

“The market has given the new government a visible benefit of the doubt,” said Kamil Stolarski, head of equity analysts at Santander Bank Polska SA brokerage. “Now, it seems we’re approaching the check moment regarding the quality of future managements, potential dividend increases as well as potential strategy shifts.”

Despite the recent gains, Warsaw-listed stocks are valued at a deep discount to their peers, largely because the previous cabinet put political goals ahead of corporate ones and slashed payouts to shareholders. The WIG20 trades at a price-to-earnings ratio of around 7, compared with nearly 15 by the MSCI emerging-market stocks index.

Tusk has promised to oust the managers in all state-run companies during his first 100 days in office, which end in late March. So far, officials haven’t indicated whether new board members will be selected through an open recruitment process and whether company strategies will quickly change.

Starting on Tuesday, shareholders of eight state-run companies listed in Warsaw will vote on changes in supervisory boards. Such moves will likely pave the way for the replacement of key executives.

From lenders PKO Bank Polski SA and Bank Pekao SA to energy company Orlen SA, state-owned companies have become trophies for politicians in power, offering well-paid posts for allies and financial support for their projects. Meanwhile, political infighting has led to bouts of management changes, adding to confusion over strategic targets and impacting the performance of their shares.

Since 2017, state-controlled companies that jointly have a 58% weighting in the benchmark index, have weighed down the WIG20. The gauge also includes private firms such as retailers Dino Polska SA and LPP SA as well as e-commerce platform Allegro.eu SA.

To be sure, nobody expects politics to disappear completely from state-owned companies. Tusk has made it his priority to audit the actions of his predecessors. Orlen has already been raided by the anti-corruption agency.

New managements will vet all “suspicious” agreements signed by their companies with people linked to the previous ruling party, State Assets Minister Borys Budka said on social media platform X this month.

Measuring the changes will come in stages, according to equity analysts. First, investors will want to know if the new executives have market credibility. Then, around mid-year, they will be looking for decisions about dividends. Finally, shareholders will be keen to see what longer-term strategic changes the new managements will seek to implement.

Most Read from Bloomberg Businessweek

There’s So Much Data Even Spies Are Struggling to Find Secrets

Basketball, Basketball, Basketball: Inside Steve Ballmer’s New $2 Billion Arena

Chinese Students Abroad Struggle With Tuition as Economy Falters

©2024 Bloomberg L.P.