Poland’s New Government Faces Growing Fiscal Shortfall

- Oops!Something went wrong.Please try again later.

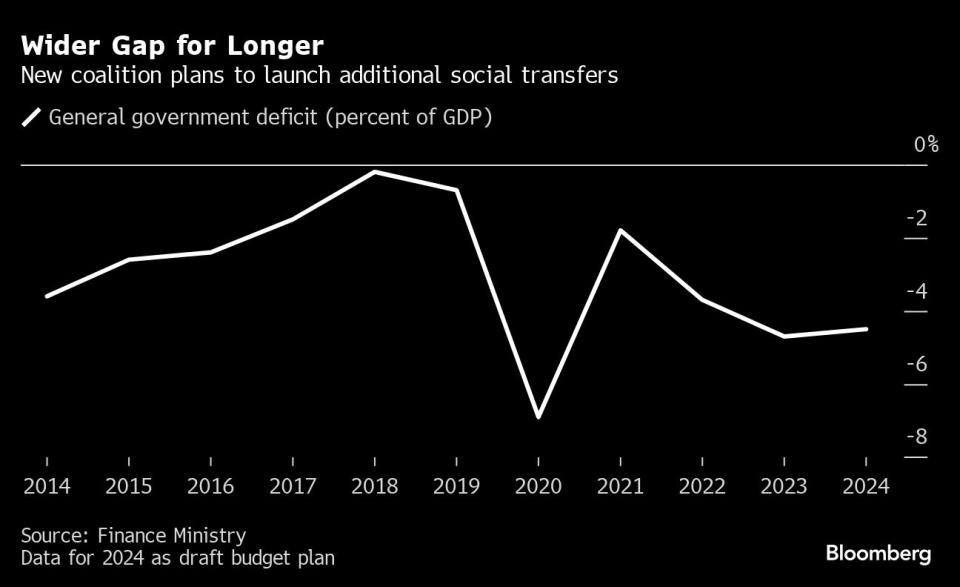

(Bloomberg) -- Poland’s new government faces a growing budget shortfall, with new spending pledges and falling revenue projections expected to raise next year’s fiscal deficit to the highest level since the coronavirus pandemic.

Most Read from Bloomberg

Wall Street Traders Go All-In on Great Monetary Pivot of 2024

Owner of the Philippines’ Largest Malls Says China Feud May Hurt Businesses

Citigroup Offers Partial Early Bonuses to Encourage Staff Departures

Finance Minister Andrzej Domanski acknowledged during his first day on the job on Wednesday that the deficit will change as the new administration presents its own version of the 2024 budget. He didn’t elaborate.

Despite the expansive spending plans, Poland’s borrowing costs have been kept in check since the Oct. 15 election as the new administration promises to unlock nearly €60 billion ($64.7 billion) in European Union aid withheld over the previous cabinet’s breaches of the bloc’s rule-of-law standards.

Rafal Benecki, chief economist at ING Bank Slaski SA, said the confirmation of pre-election spending pledges by Prime Minister Donald Tusk during Tuesday’s policy speech to lawmakers means that the new cabinet won’t start consolidating the deficit until next year.

“We assume that in the short term fiscal policy will remain expansionary and the general government deficit may reach 6% of GDP” next year, Benecki wrote in a note on Wednesday. “Financial markets are waiting for signals indicating whether concerns about high debt supplies are increasing or decreasing.”

In his speech, Tusk promised not to remove any of the social transfers introduced by the previous government while confirming that his cabinet will boost public worker salaries, offer an additional indexation of pensions if inflation tops 5%, introduce new benefits for families with young children and offer paid leave for the self-employed.

These budget items come on top of the previous government’s decision to extend a zero value-added tax rate on food into 2024 and an adjustment in the central bank contribution to the budget, which was reportedly slashed from 6 billion zloty ($1.5 billion) to zero.

Economists at Santander Bank Polska SA, MBank SA and Bank Millennium SA now all expect Poland’s wide fiscal gap to increase to more than 5% of gross domestic product next year from 4.5% in the current budget plan. A Bloomberg survey of analysts shows this year’s deficit at 5.2%. The deficit reached 6.9% in 2020, when Poland loosened policy to help companies cope with the Covid pandemic and repeated lockdowns.

Tusk said that the new cabinet won’t raise taxes on households without saying how his cabinet will finance the new outlays, which are additionally stoked by surging defense spending amid the war in neighboring Ukraine. The previous government’s 2024 budget draft already envisaged a 160% increase in net bond sales.

Domanski, a former fund manager who’s the new finance chief, will be under time pressure to amend the budget, with parliament scheduled to discuss next year’s fiscal plan on Dec. 21.

The yield on Poland’s two-year local-currency notes fell to 5.07% on Wednesday, the lowest level since the election. But the debt’s relative performance isn’t quite as rosy for the Polish government.

The additional yield investors demand to hold two-year zloty bonds over similar German notes has risen to 237 basis points from 212 points just before the election result showing pro-EU parties winning power.

(Updates with Finance Minister comments, details on parliamentary works from the second paragraph)

Most Read from Bloomberg Businessweek

SBF’s Lawyer Says His Client Was the ‘Worst’ Ever Under Cross Examination

Vanguard Is Closer Than Ever to Ending BlackRock’s ETF Reign

How Lab-Grown Chicken Became Another Expensive Silicon Valley Mess

©2023 Bloomberg L.P.