Poll shows grocery tax opposition remains high in South Dakota

- Oops!Something went wrong.Please try again later.

A year after Gov. Kristi Noem vowed to eliminate the state sales tax on groceries, and several months after lawmakers failed to deliver on her promise, a strong majority of South Dakota voters still support dropping the sales tax on food.

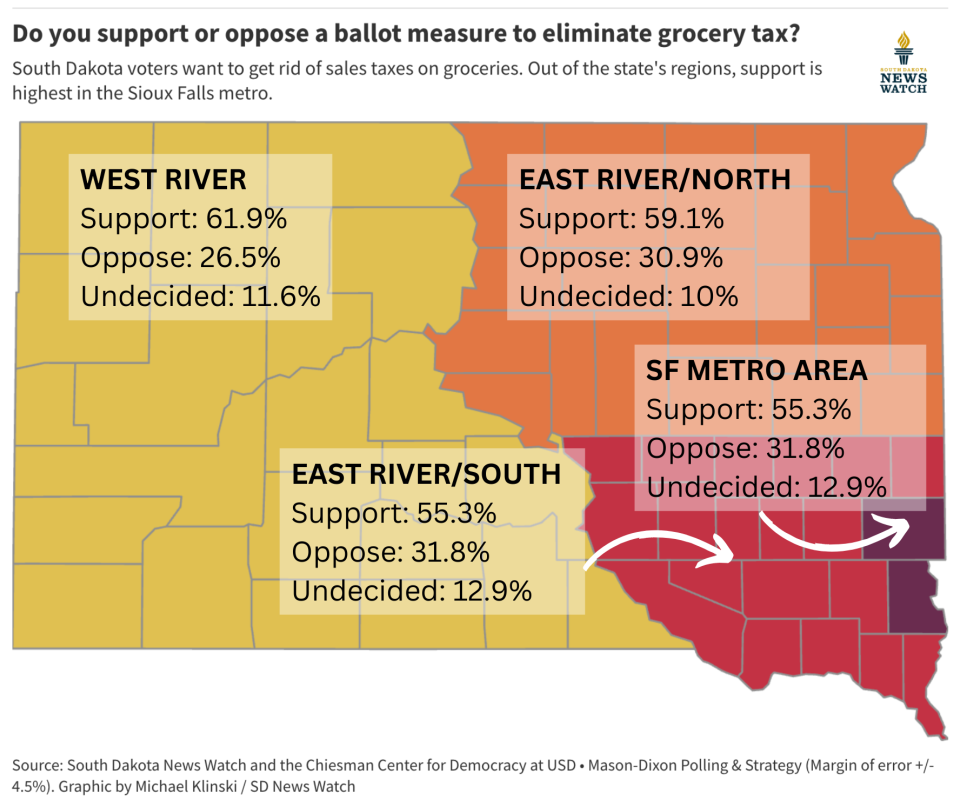

A new statewide poll co-sponsored by South Dakota News Watch showed that 60.6% of registered voters support a proposed statewide ballot measure that would eliminate the 4.2% state sales tax on groceries.

While 28.8% of overall voters opposed the cut and 9.6% were undecided, the poll showed majority support for eliminating the tax among Democrats, Republicans and Independent/No Party Affiliation voters across the state.

Some lawmakers and consumer advocates have been fighting without success to eliminate or reduce the grocery tax for decades, calling it a harmful tax on a staple need for individuals and families and a regressive tax that disproportionately affects low-income people who pay the same rate as wealthy residents.

South Dakota is one of 13 states that levies a sales tax on groceries. And it's one of two states that tax food at the full state sales tax rate without any offsetting tax credits. People who qualify for the Supplemental Nutrition Assistance Program, or food stamps, are exempt from the sales tax on food.

The state Department of Revenue didn't respond to a News Watch request to questions about the impact of cutting the grocery tax. But previous estimates put the cost of the tax on consumers – and the accompanying loss in state revenues – at about $100 million a year.

As previously reported by News Watch, the tax on groceries exists among a state taxation system that is rife with sales tax exemptions totaling more than $1 billion a year that overwhelmingly benefit the state’s largest industries such as agriculture, medical care, insurance and advertising.

Recent and ongoing efforts to eliminate the state sales tax on food would not affect the up to 2% sales tax on groceries charged by municipalities in South Dakota.

State Sen. Reynold Nesiba, D-Sioux Falls, opposes the grocery tax and is not surprised that most respondents in the statewide poll support eliminating it.

“It causes hunger,” he said. “We have a federal food system, we have all sorts of charities that try to address this and it seems wrong at the same time to be charging 4.2% by the state and 2% by the cities just to buy food.”

Nesiba, who has failed in previous attempts to eliminate the grocery tax through the legislative process, said he has drafted a bill to do so again in 2024 but is not sure if he will submit it.

“It’s a regressive tax because lower-income people pay a bigger share of their total paycheck on food. And beyond that, nobody should have to pay a tax to be able to eat,” Nesiba said.

South Dakota News Watch and the Chiesman Center for Democracy teamed up to enlist Mason-Dixon Polling & Strategy to conduct a cellphone and landline poll of 500 random registered South Dakota voters Nov. 27-29, 2023. The margin of error is plus or minus 4.5%.

For the past several years, South Dakota was one of three states, along with Alabama and Mississippi, that taxed groceries at the full state sales tax rate with no exemptions allowed.

But starting Sept. 1, 2023, a new law took effect in Alabama that dropped the sales tax on groceries from 4% to 3% in that state and which will reduce it again to 2% in 2024 if state revenues allow.

The calls to eliminate the grocery tax took on new momentum in late 2022 when Noem, facing reelection at the time, made high-visibility public announcements that she wanted to drop the tax.

But lawmakers did not abide and in a compromise move, approved a temporary 0.3% reduction in the overall state sales tax, from 4.5% to 4.2%, until 2027, while keeping the full grocery tax in place.

Noem continues to support elimination of the grocery tax but isn't convinced the Legislature will pass such a measure this year, according to Ian Fury, the governor's chief of communications.

“Governor Noem agrees with a majority of South Dakotans that a grocery tax cut is the best tax relief option for the people of South Dakota," Fury wrote in an email. "The legislature has not indicated that they are willing to pass such a tax cut. Should they change their mind, Governor Noem would love to work with them to deliver it for the people.”

Rep. Will Mortenson, R-Pierre, said it is "irresponsible" to talk about cutting a significant funding source like the sales tax on groceries without making significant corresponding cuts to expenses, including for the state's main spending areas of education, health care and state employees.

“I bet a strong majority of South Dakotans would favor a property tax cut and a strong majority would favor a sales tax cut, but there’s not just one side of the coin,” said Mortenson, the majority leader in the House of Representatives. “Unless you support less pay for teachers, closing more nursing homes and support less public safety, I don’t think you can responsibly talk about cutting something like the food sales tax without a plan to cut spending also.”

Rick Weiland, head of Dakotans For Health, said his organization is collecting voter signatures only for an initiated measure, which he said will almost surely appear on the statewide ballot in November 2024.

“It’s been voted on over 20 times over the past 20 years, and there’s support for it, but they can’t seem to get it done in the Legislature,” he said.

Cathy Brechtelsbauer of Sioux Falls, S.D., with the group Bread for the World, has fought to end the grocery tax in South Dakota for nearly 30 years.

“The poll shows people are not satisfied with the tax cut the Legislature did last year, and it shows they still need the tax off their food,” Brechtelsbauer said.

This article was produced by South Dakota News Watch, a non-profit journalism organization located online at sdnewswatch.org.

This article originally appeared on Sioux Falls Argus Leader: Poll shows grocery tax opposition remains high in South Dakota