Polyplank (STO:POLY) Is Making Moderate Use Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Polyplank AB (publ) (STO:POLY) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Polyplank

What Is Polyplank's Net Debt?

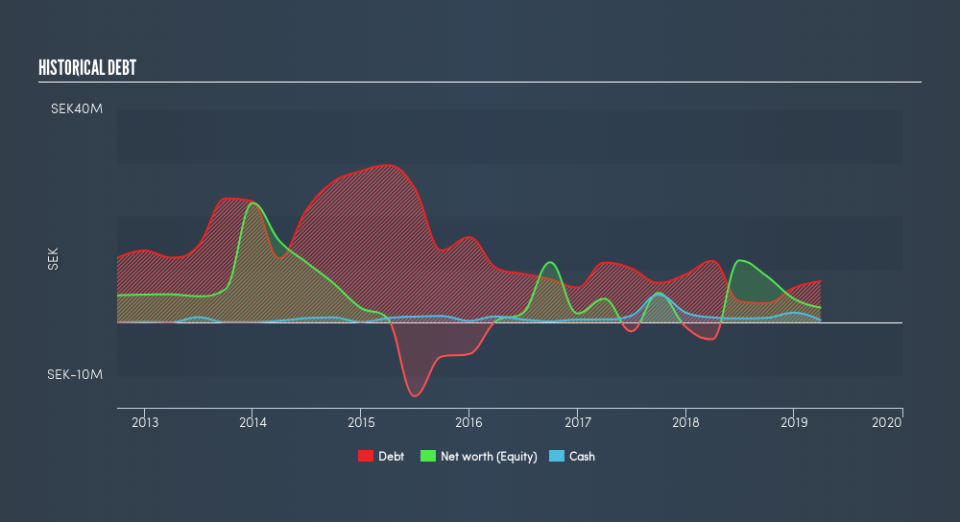

You can click the graphic below for the historical numbers, but it shows that Polyplank had kr7.79m of debt in March 2019, down from kr11.6m, one year before. However, it does have kr459.0k in cash offsetting this, leading to net debt of about kr7.33m.

How Strong Is Polyplank's Balance Sheet?

According to the last reported balance sheet, Polyplank had liabilities of kr17.5m due within 12 months, and liabilities of kr4.66m due beyond 12 months. On the other hand, it had cash of kr459.0k and kr1.10m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr20.6m.

This deficit isn't so bad because Polyplank is worth kr53.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Polyplank's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Polyplank actually shrunk its revenue by 32%, to kr24m. To be frank that doesn't bode well.

Caveat Emptor

Not only did Polyplank's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping kr8.0m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled kr17m in negative free cash flow over the last twelve months. So in short it's a really risky stock. For riskier companies like Polyplank I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.