Is a Positive Earnings Surprise Likely for Zions (ZION) in Q4?

Zions Bancorporation ZION is scheduled to report fourth-quarter and 2021 results on Jan 24, after market close. The overall loan demand was impressive in the to-be-reported quarter. Specifically, growth in commercial and industrial loan balances (which constitute a large part of Zions’ loan portfolio) was decent.

The Zacks Consensus Estimate for the company’s average interest-earning assets for the fourth quarter is pegged at $84.1 billion, which indicates a rise of 1.1% from the previous quarter’s reported number.

Thus, while a rise in loan balances is expected to have aided Zions’ net interest income (NII) (its main revenue component) in the quarter, continued low interest rates are likely to have offset growth in NII. The consensus estimate for NII of $555 million indicates no change sequentially.

Other Key Factors and Estimates for Q4

Fee Revenues: Mortgage loan originations as well as refinancing normalized in the fourth quarter. The origination boom in 2020, propelled by the ultra-low rates, makes comparison difficult for the quarter. Mortgage rates rose in the quarter under review, which resulted in a drastic decline in mortgage origination activities, with steadily rising rates hurting refinancing.

Thus, due to the not-so-impressive mortgage-banking business performance, Zions’ loan sales and servicing income is not expected to have improved in the fourth quarter. The Zacks Consensus Estimate for the same is pegged at $24.66 million, suggesting an 8.7% decline from the previous quarter’s reported number.

The consensus estimate for commercial account fees of $34.24 million indicates a marginal rise sequentially. Similarly, the consensus estimate for card fees of $25.40 million suggests a 1.6% rise from the prior quarter’s reported figure.

The consensus estimate for retail and business banking fees is pegged at $20.48 million, suggesting a 2.4% rise sequentially. The estimate for capital markets and foreign exchange fees of $18.18 million indicates a rise of 6.9% sequentially.

Despite the expected rise in most components, customer-related fee (accounting for more than 85% of Zions’ total non-interest income) is not anticipated to have improved in the quarter. The consensus estimate for the same is pegged at $151 million, which indicates no change from the previous quarter’s reported figure.

The consensus estimate for dividends and other income is pegged at $8.67 million, indicating a decline of 3.7% from the previous quarter’s reported number.

The consensus estimate for total non-interest income indicates that the component will increase in the quarter. The estimate is pegged at $158 million, suggesting a rise of 13.7% from the previous quarter’s reported number.

Expenses: Zions has been witnessing a persistent rise in operating expenses over the past few years. As the company continues to invest in franchise, overall costs are expected to have been elevated in the fourth quarter.

Asset Quality: The Zacks Consensus Estimate for total non-performing loans is pegged at $303 million, suggesting a 6.2% decline from the prior quarter’s reported figure.

What Our Quantitative Model Predicts

According to our quantitative model, the chances of Zions beating the Zacks Consensus Estimate this time are high. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Zions is +1.30%.

Zacks Rank: The company currently carries a Zacks Rank #3.

Q4 Earnings & Sales Growth Expectations

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.33 per share, which suggests a decline of 19.9% from the year-ago quarter’s reported number. The estimate has been unchanged over the past 30 days.

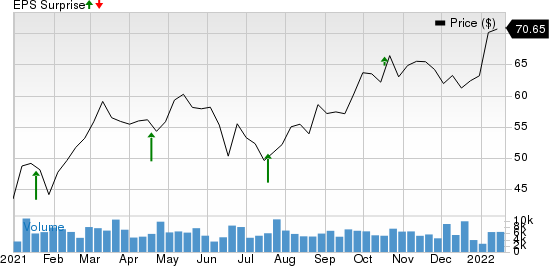

Zions Bancorporation, N.A. Price and EPS Surprise

Zions Bancorporation, N.A. price-eps-surprise | Zions Bancorporation, N.A. Quote

The consensus estimate for sales is pegged at $714.6 million, which indicates a decline of 1.2% from the prior-year reported figure.

Other Stocks That Warrant a Look

A few other finance stocks, which you may want to consider as these too have the right combination of elements to post an earnings beat in their upcoming releases per our model, are Huntington Bancshares Incorporated HBAN, Ameriprise Financial AMP and Prosperity Bancshares PB.

The Earnings ESP for Huntington Bancshares is +1.46% and it carries a Zacks Rank of 3 at present. HBAN is scheduled to report quarterly numbers on Jan 21.

Ameriprise Financial is slated to report quarterly results on Jan 26. AMP currently has an Earnings ESP of +0.69% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Prosperity Bancshares is slated to report quarterly earnings on Jan 26. PB, which carries a Zacks Rank of 3 at present, has an Earnings ESP of +0.55%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research