Pound whipsaws after DUP rejects draft Brexit deal

The pound fell sharply before recovering on Thursday morning, after Northern Ireland’s Democratic Unionist Party (DUP) rejected the outline of a draft Brexit deal between the UK and EU.

DUP leader Arlene Foster and her deputy Nigel Dodds said in a joint statement posted on Twitter early Thursday morning: “As things stand, we could not support what is being suggested on customs and consent issues and there is a lack of clarity around VAT.

“We will continue to work with the Government to try and get a sensible deal that works for Northern Ireland and protects the economic and constitutional integrity of the United Kingdom.”

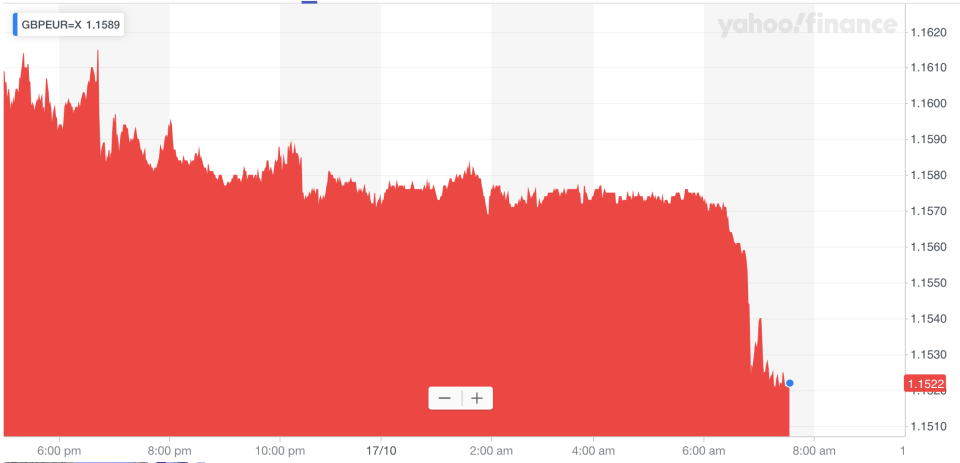

Sterling dropped sharply following the announcement. At 7.30am UK time, the pound was down 0.4% against the dollar to $1.2759 (GBPUSD=X) and down 0.4% against the euro to €1.1525 (GBPEUR=X).

However, sterling had recovered to trade down just 0.2% against the euro and 0.1% against the dollar by 10am. The recovery came after the EU indicated it was still working to get a deal done.

The chief spokesperson of European Commission President Jean-Claude Juncker said at just before 9am on Twitter that the EU and UK were continuing negotiations and Juncker had spoke with UK Prime Minister Boris Johnson this morning.

“Every hour and minute counts before the [European Council meeting],” the spokesperson wrote. “We want a deal.”

European leaders meet in Brussels today for two days of meetings, with Brexit high on the agenda. Negotiations at the summit are seen as a key to deciding whether a deal can be reached before the October 31 Brexit deadline.

“With the EU summit beginning today, the general feeling is that the majority of a new deal has been agreed upon but there are still a couple issues that need to be ironed out before it can be brought back for a vote in the UK parliament,” said David Cheetham, chief market analyst at trading platform XTB.

‘There will be another delay’

The pound’s initial decline came as investors reasoned that the likelihood of reaching a deal had diminished.

The DUP’s support is crucial for any deal to pass through parliament, given the ruling Conservative Party do not have a majority in the House of Commons.

“If the DUP doesn’t go for it, then it's likely that neither will many of the hardline pro-Brexit Conservative MPs who’ve rejected the deal in the past,” wrote James Smith, an economist with Dutch bank ING, on Thursday.

A breakdown in negotiations or a failure to ratify a deal increases the likelihood Prime Minister Boris Johnson will have to ask for a Brexit extension. However, it also raises the odds of a possible no deal Brexit, which is seen as highly damaging to the UK economy and therefore a negative for the pound.

The FTSE 250 (^FTMC) index, which is largely made up of UK-facing companies, fell 0.5% at the open on Thursday due to fears of the possible corporate impact of a no deal Brexit. Like the pound, it had recovered by 10am and was trading flat.

Optimism about Brexit negotiations had built up over the last week, porior to Foster and Dodds’ joint statement. Both sides said they could see a pathway to a potential deal last Friday, prompting the biggest one day gains for the pound against the dollar since January 2017.

UK and EU representatives have been holding intense negotiations all week to try and reach a draft agreement that could be presented to EU leaders at the two-day summit.

“My basic assumption remains that there will be another Brexit delay,” Marc-André Fongern, a foreign exchange and macro strategist at MAF Global Forex, said in an email. “Nevertheless, a last-minute deal that would fuel the UK pound's upside potential cannot be ruled out.”

ING’s Smith said it was “very unlikely the UK will have left the EU at the end of October. Even if a deal is approved this month, the full ratification process in the UK Parliament will take longer.”

The pound has still risen around 3.7% against the dollar so far in October and continues to trade at levels not seen since mid-June. Sterling has gained 2.5% against the euro so far this month and continues to trade at its highest pairing since mid-May.

READ MORE: Organised crime groups ‘would exploit a no-deal Brexit’