Prepped for hurricane season? Think family, home and your financial house, too

As we work our way toward the end of May, I hope you enjoyed the wonderful mid-month weather while we had it.

Keep in mind that hurricane season starts in less than two weeks. Although if you have lived here for at least three to four years, you know that it really does not start rolling until mid-July to mid-September for us Floridians.

I highly recommend that you take hurricane preparedness seriously, especially if you are new to Florida. Having been through the 2004 hurricanes, I know what it is like to not have power for over a week, and limited access to gas and food due to those power outages. Stock up on batteries and anything that is battery-powered. Heck, even look at getting a house generator. If you need help with that, I know a guy.

Why do I say all of this and what does this have to do with taxes? That is a great question. Most people know how to board up their house or even spend good money to upgrade their doors and windows to the impact rated, energy efficient variety (which by the way are potentially eligible for a small energy credit if you get the kind that qualifies, check with the vendor).

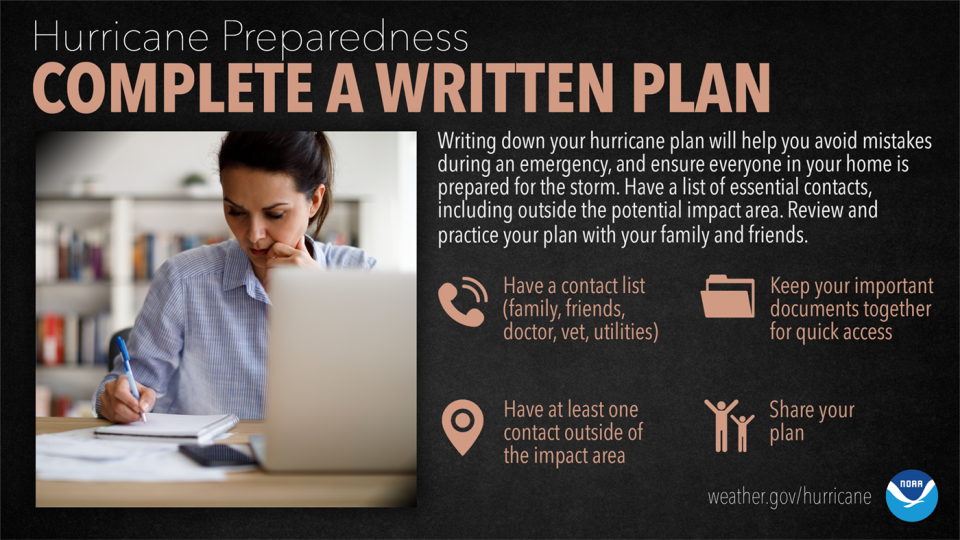

But most people don’t think about protecting their most important things. No, not their family (but that is also very important). I am talking about their documents and records.

More: Money matters: Get tax cash out of your real estate

Whether you are still a paper dinosaur or you keep everything electronically, please be sure to keep those documents safe. Back in 2004, I had one client who kept his historical business cash register receipts in the attic. Now, probably not my first choice of where to store them, but that is where he kept them. Well, one of the storms blew off a portion of his roof and these records got all wet. Not sure if you know what these types of cash register tapes look like after getting wet, but I can tell you, they stick together as if they were one big piece of papier-mâché and nearly impossible to separate.

Of course, as luck would have it, he got selected for a state sales tax audit. Since this was in the days where electronic records weren’t as common yet, it was very difficult to deal with, but we got him through it. But trust me, it would have been a ton easier if the records were in a good condition to provide to the state.

More: In a jam over taxes? Tackle dealings with IRS head-on to avoid bigger problems

Another client was trying to get his records to me to prepare some delinquent tax returns. He had everything electronically, but then one day, his hard drive crashed. No more data. Bye-bye! Then he had to painfully recreate everything he had.

The moral to the story is to protect your documents! Use a waterproof (maybe even fireproof) container or safe. Keep your birth certificates, passports, wills and other estate planning documents, life insurance, health insurance and any other important piece of paper.

For businesses, save your receipts, invoices and mileage records in a safe place as well. Make scans, pictures and upload to a backup storage place online. Do not trust your computer or phone to retain these documents. If you do not have power, you cannot open these things on a dead phone or computer. Plus they are susceptible to something that could wipe out the memory.

Now, I hope and pray we don’t have to worry about a hurricane this year, but if you prepare your house and your financial house and keep it in order, it won’t matter if we do get another hurricane. You will be better prepared to weather the storm.

Until next month, please consult a tax professional if you have questions.

Dan Henn, CPA, is a local certified public accountant. His firm specializes in IRS audit and collections representation, real estate and medical taxation, year-round tax planning and tax preparation in Rockledge. You can contact his office at 321-684-7800 or at danthetaxman@danhenncpa.com.

This article originally appeared on Florida Today: Prepped for hurricane season? Think family, home and documents, too