Primecap Management Trims Eli Lilly Position

- By Tiziano Frateschi

Investment firm PRIMECAP Management (Trades, Portfolio) sold shares of the following stocks during the fourth quarter.

Warning! GuruFocus has detected 7 Warning Signs with LLY. Click here to check it out.

The intrinsic value of LLY

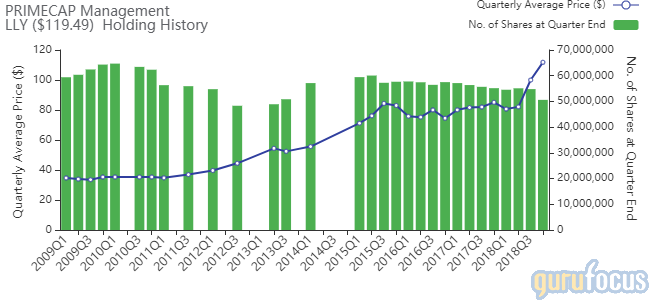

The firm trimmed 7.64% off its Eli Lilly and Co. (LLY) stake. The trade had an impact of -0.30% on the portfolio.

The pharmaceutical company has a market cap of $126.58 billion and an enterprise value of $131.29 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 24.62% and return on assets of 7.37% are underperforming 66% of companies in the Global Drug Manufacturers - Major industry. Its financial strength is rated 5 out of 10. The equity-asset ratio of 0.29 is below the industry median of 0.64.

The largest guru shareholder of the company is Primecap with 4.78% of outstanding shares, followed by Dodge & Cox with 2.74%, the Vanguard Health Care Fund (Trades, Portfolio) with 1.79% and Ken Fisher (Trades, Portfolio) with 0.36%.

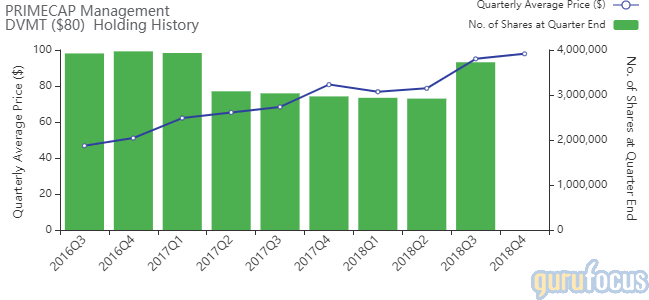

The firm's holding of Dell-VMWare tracking stock (DVMT) was eliminated. The trade had an impact of -0.24% on the portfolio.

In conjunction with becoming a public company once again, Dell Technologies Inc. (DELL) announced in December it was buying back the VMware tracking stock from shareholders for $120 per share. Shareholders could also opt to receive Dell stock in exchange for their shares.

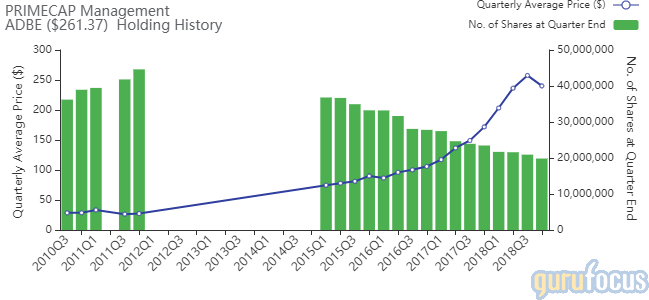

Primecap reduced its Adobe Inc. (ADBE) stake by 5.17%. The trade had an impact of -0.20% on the portfolio.

The company, which provides software and services for content creation, digital advertising and marketing, has a market cap of $127.48 billion and an enterprise value of $128.37 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 29.42% and return on assets of 16.43% are outperforming 89% of companies in the Global Software - Application industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.78 is below the industry median of 4.27.

Another notable guru shareholder of the company is Steve Mandel (Trades, Portfolio) with 4.07% of outstanding shares, followed by Frank Sands (Trades, Portfolio) with 0.86%, Spiros Segalas (Trades, Portfolio) with 0.73% and Fisher with 0.33%.

The NetApp Inc. (NTAP) position was curbed 7.05%, impacting the portfolio by -0.16%.

The company, which designs and manufactures high-performance storage and data management solutions, has a market cap of $16.91 billion and an enterprise value of $14.4 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 58.49% and return on assets of 11.47% are underperforming 70% of companies in the Global Data Storage industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 2.40 is above the industry median of 1.32.

Another notable guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.55% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.19% and Joel Greenblatt (Trades, Portfolio) with 0.13%.

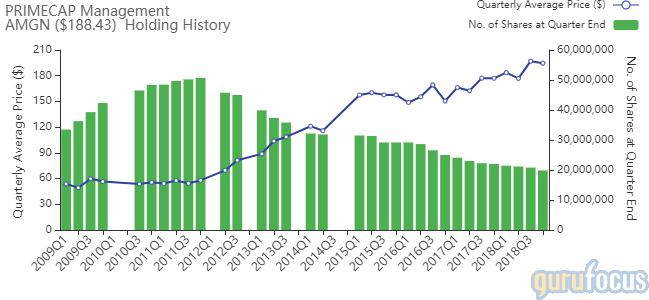

The investment firm reduced its Amgen (AMGN) stake by 4.56%, impacting the portfolio by -0.13%.

The company, which operates in biotechnology-based human therapeutics, has a market cap of $120.07 billion and an enterprise value of $124.7 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 50.80% and return on assets of 11.90% are outperforming 83% of companies in the Global Biotechnology industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.86 is below the industry median of 64.02.

Another notable guru shareholder of the company is Simons' firm with 0.65% of outstanding shares, followed by Pioneer Investments with 0.23%, Richard Pzena (Trades, Portfolio) with 0.19% and the Smead Value Fund (Trades, Portfolio) with 0.06%.

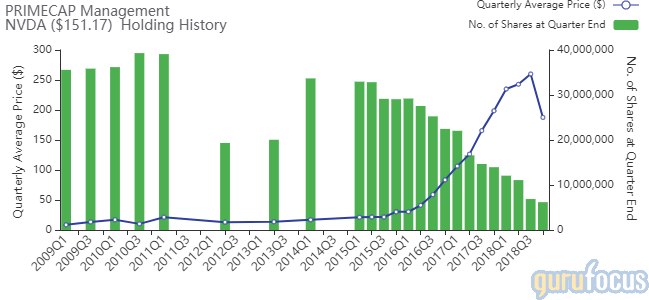

The firm curbed its Nvidia Corp. (NVDA) position by 10.04%. The trade impacted the portfolio by -0.13%.

The company, which develops graphics processing units, has a market cap of $92.21 billion and an enterprise value of $86.61 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 58.96% and return on assets of 39.73% are outperforming 98% of companies in the Global Semiconductors industry. Its financial strength is rated 8 out of 10. The cash-debt ratio of 3.82 is above the industry median of 1.69.

Another notable guru shareholder of the company is Segalas with 0.61% of outstanding shares, followed by Mandel with 0.37%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Diamond Hill Buys AIG, CVS

First Eagle Trims Omnicom, Microsoft Positions

Arnold Schneider Boosts Brighthouse Financial, Transocean

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 7 Warning Signs with LLY. Click here to check it out.

The intrinsic value of LLY