Progressives Should Support the GOP’s Social Security Reform Efforts

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

It is usually a sign of desperation when Democratic campaigns trot out the old Social Security scare tactics.

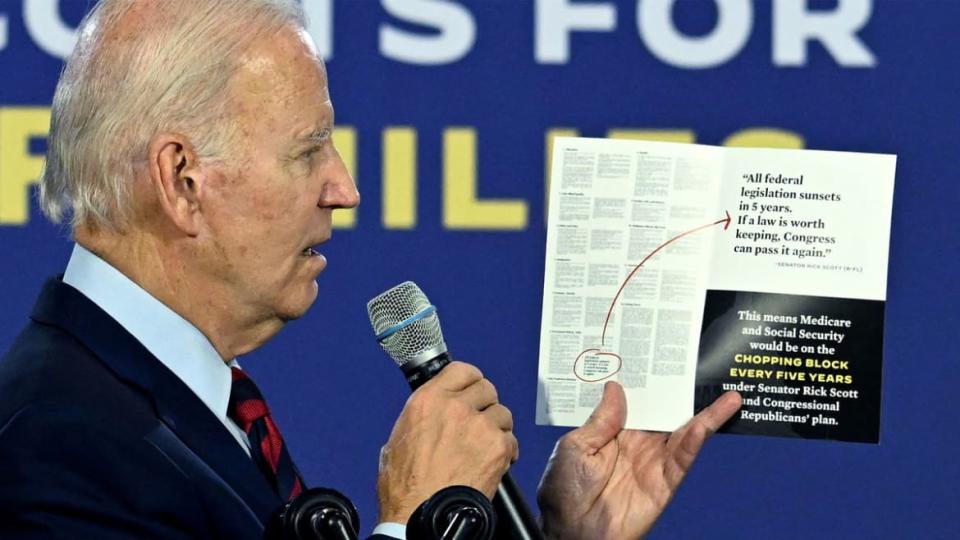

And right on cue, as his party braces for a midterm shellacking, President Joe Biden tweeted that “you’ve been paying into Social Security your whole life. You earned it. Now, Republicans in Congress want to cut it. Who the hell do they think they are?” Former President Barack Obama also recently gave a speech lambasting any reforms to the program. Democratic campaigns, activists, and funders like the Lincoln Project have asserted that “If Republicans win, they can and will eliminate Medicare and Social Security.”

That accusation is absurdly false.

Despite decades of hysterical Democratic warnings, the GOP has brought no legislation to the floor to drastically reduce Social Security and Medicare benefits (much less to “eliminate” the programs). In fact, the largest recent unilateral Medicare expansion was the Republican-created drug benefit in 2003, and the two largest partisan Medicare cuts were enacted by Democrats in 2010 and 2022. Even President George W. Bush’s 2005 Social Security initiative (which was never even drafted into legislation) would have resulted in higher benefits for the vast majority of retirees.

Biden’s Budget Plan Is the Wrong Way To Tax the Rich

So what are these new supposed Republican threats to Social Security?

Essentially, GOP Sens. Rick Scott of Florida and Ron Johnson of Wisconsin have proposed that Social Security and Medicare receive a reauthorization vote every few years in order to provide lawmakers an opportunity to update the programs.

Such program reauthorizations are routine—nearly every federal program is already on a reauthorization schedule simply as a matter of oversight and programmatic updates. It has nothing to do with terminating major programs, which is virtually unheard of during reauthorizations. Indeed—despite scare tactics alleging otherwise—any proposal to simply terminate the Social Security and Medicare systems would be unanimously defeated in the House and Senate. Yes, unanimously.

Sure, lawmakers could use the reauthorization to raise eligibility ages, or trim the growth of benefits. But it is equally possible that benefits could be expanded—which is more typical in reauthorizations. That said, the whole issue is mostly a media and campaign creation. Senate Minority Leader Mitch McConnell has already declared that a new reauthorization requirement “will not be part of a Republican Senate majority agenda,” and there is no indication that a broader GOP Congress will heed the reform calls of a few lawmakers.

Thus, twisting a few lawmaker reauthorization comments into a “Republicans are planning to terminate Social Security” attack is no less of a smear than Republicans using a few out-of-context Democratic police reform comments as proof that Democrats will soon pass sweeping national legislation “defunding the police.”

Both attacks are dishonest exaggerations meant to scare voters away from a needed discussion of legitimate, responsible, and more modest reforms. And that is the real danger.

Social Security is in desperate need of reform because the current system is economically unsustainable. Already in deficit, the Congressional Budget Office (CBO) projects that over the next three decades the Social Security system will collect $65 trillion in payroll taxes and related revenues, and spend $101 trillion on benefits and resulting interest costs. That $36 trillion cash shortfall would merely dip to $33 trillion had the $3 trillion trust fund not been raided (that raid was based on a 1983 law and unrelated to subsequent tax cuts or spending expansions).

US President Joe Biden speaks about protecting Social Security and Medicare, at OB Johnson Park Community Center in Hallandale Beach, Florida, on Nov. 1, 2022.

Medicare is in even worse shape, facing a three-decade projected shortfall of $80 trillion. In fact, virtually the entire $114 trillion 30-year budget deficit projected by the CBO results from the Social Security and Medicare shortfalls. The rest of the federal budget is balanced over three decades.

The worst way to reduce the Social Security shortfall is to do nothing.

The Billionaires Tax Boondoggle Shows the Dems’ Desperation

Current law mandates a 25 percent benefit cut just 12 years from now, when the trust fund is exhausted. Politicians who refuse to take up Social Security reform are essentially endorsing that outcome. The Republicans calling for reform are trying to avoid it. Reform cannot wait, either, because every year of delay brings four million more Boomers into a collapsing benefit system—just as all other retirees get another year older and less able to absorb any reforms.

It’s better to gradually reform the system now, rather than run enormous deficits and have to impose drastic reforms later.

When pressed, many Democrats suggest that Social Security can be saved by lifting the $160,200 wage cap and applying Social Security taxes to all wages. It is not that simple.

A woman walks into a Social Security office in Houston, Texas on July 13, 2022.

First, lifting the cap would raise 0.8 percent of GDP in tax revenues—less than half of the program’s annual shortfall that will level off at 1.8 percent of GDP. Significant additional taxes or spending cuts would still be needed.

Second, applying the 12.4 percent Social Security tax to all wages would raise the total marginal tax rate for upper-income individuals to as high as 62 percent when including federal and state income and payroll taxes. Supporters of 62 percent tax rates should note that even liberal economists generally consider that near the revenue-maximizing tax rate.

This means that any further tax rate hikes on the wealthy would raise little revenue and may even lose money.

Thus, the key question for progressives is whether closing the Social Security gap is the best use of the limited remaining tax-the-rich revenues. Remember that Medicare still faces a massive $80 trillion funding gap. And progressives have wanted to tax the rich to fund new spending on family leave, child credits, Medicare-For-All, free college, more student loan forgiveness, climate, child care, K-12 education, infrastructure, and more anti-poverty benefits.

Virtually none of that will be possible if the largest available tax hike on the rich instead pays for existing Social Security benefits. After all, today’s unified Democratic government could muster only $300 billion over the decade in new taxes on wealthy individuals and corporations. And political limitations aside, passing the entire progressive “tax the rich” wish list of income, investment, corporate, wealth, and estate taxes would raise two or three percent of GDP—barely enough to close the long-term Social Security gap, and far insufficient to close Medicare’s funding gap.

Trump Added More to the National Debt Than Obama and Bush

Social Security is a curious destination for progressives’ largest possible tax on wealthy people. Yes, many seniors still struggle. But overall, they are America’s wealthiest age cohort with incomes rising much faster than working-age families. Millions of seniors are millionaires (even excluding illiquid home values), and millions more have post-retirement household incomes exceeding $100,000 despite fewer mortgage and child care costs than younger families.

A sensible—and progressive—Social Security proposal would gradually trim the growth of benefits for the wealthiest seniors, and gradually raise the eligibility age from 67 to 69 over a few decades to accommodate longer lifespans. It could even strengthen the minimum benefit to aid seniors who are in poverty. Social Security would remain insurance against poverty in old age.

Importantly, this progressive Social Security approach would reserve future “tax-the-rich” revenues for the progressive spending priorities listed above.

But preserving those tax options requires addressing Social Security shortfalls with these alternative reforms. Republicans and Democrats should begin that conversation in the next Congress.

Get the Daily Beast's biggest scoops and scandals delivered right to your inbox. Sign up now.

Stay informed and gain unlimited access to the Daily Beast's unmatched reporting. Subscribe now.