When are property taxes due in Franklin County and Central Ohio? What to know

It's tax season.

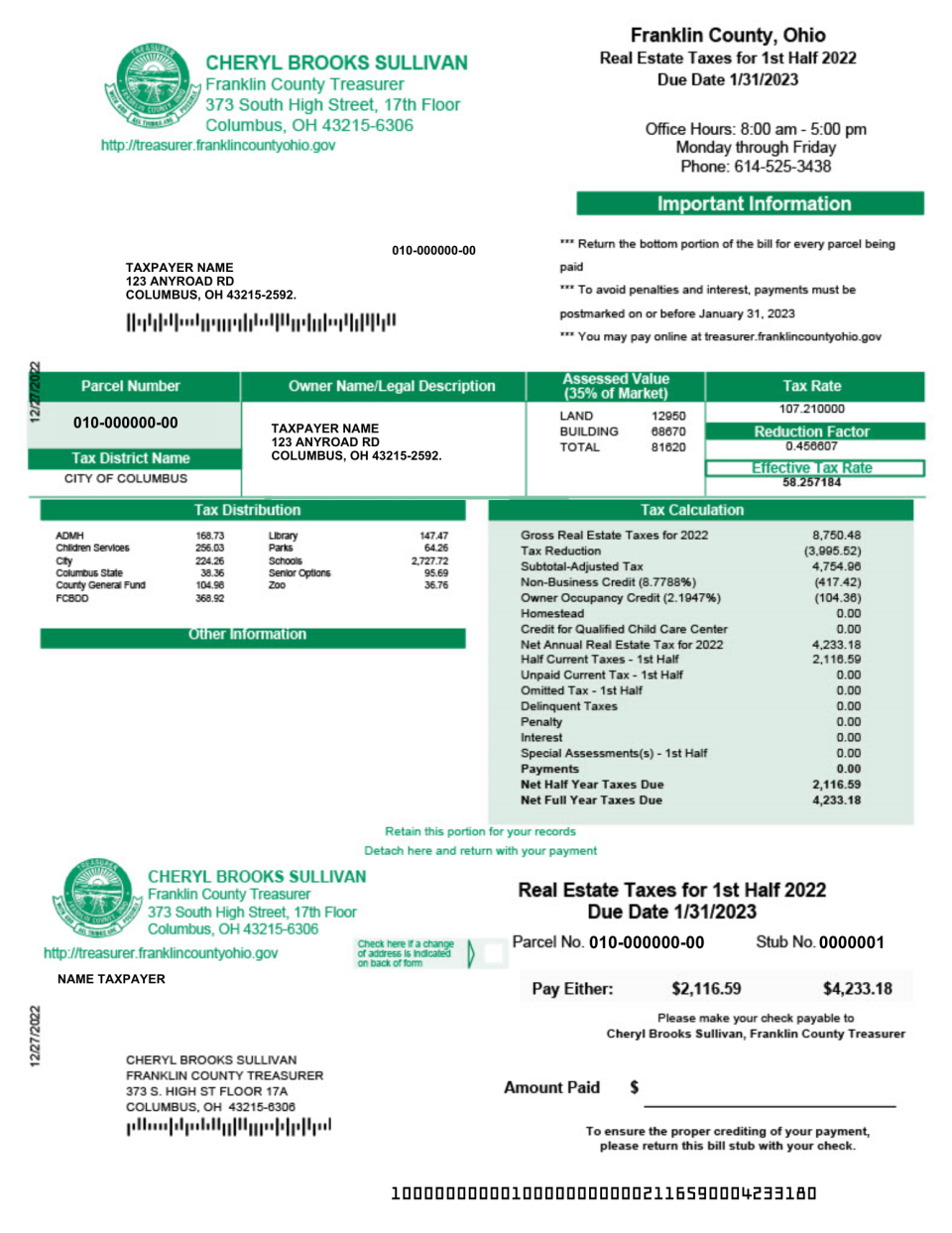

And if you're a homeowner, it's almost time to pay the first half of your property taxes. Especially if you live in Franklin County, which just had a property reappraisal in 2023, you may have already received your tax bill in the mail (the due date for Franklin County is at the end of January and bills were mailed Jan. 8).

Here's what you need to know about property taxes and how to estimate your taxes.

When are the first half of property taxes due in Greater Columbus?

The first half of property taxes for the year are due:

Delaware County: Feb. 21.

Fairfield County: Feb. 15.

Franklin County: Jan. 31.

Licking County: Feb. 21.

Madison County: Feb. 12.

Pickaway County: March 1.

Union County: Feb. 14.

How can I check my tax bill?

For most counties in Central Ohio, your best bet for finding your tax bill is to check your mail. In Ohio, county treasurers are required to mail tax bills out 20 days before the due date, according to the Ohio Revised Code.

However, Franklin and Delaware counties both have services on their website that allow you to view and print your tax bill online.

How do I pay my property tax bill in Franklin County?

The office accepts online payments through its secure portal, which can post immediately, on its website: https://treasurer.franklincountyohio.gov/Payments/Online-Payment

Property owners can settle their bill at the treasurer’s office on the 17th floor of the Franklin County office tower, located at the corner of High and Mound streets. Those paying with cash must do it there.

Checks can be deposited into a drop box in the lobby of 373 S. High St. in Columbus. Checks can be mailed, too.

What happens if I miss the due date to pay my property taxes?

Counties in the Columbus area have escalating penalties if you continue to fail to pay your property taxes after the due date has passed. For example, any taxes paid after the deadline in Franklin County will accrue a penalty and interest.

In several counties in Central Ohio, the penalty raises from 5% to 10% the longer the bill goes unpaid.

Many counties offer payment programs or monthly payments, and the Franklin County Treasurer's Office even offers penalty forgiveness if taxpayers meet certain conditions or if there was an error on the county administration's end.

Can I dispute my property taxes?

Unfortunately, the review process for the 2023 property values used used to calculate your taxes concluded before the tax bills were mailed out, so final assessed values have been determined. If you would like to contest your final assessed value, you may file a Board of Revision complaint on the Franklin County Auditor website until April 1, 2024.

The Franklin County Auditor's Office is also holding in-person filing events where office employees will answer questions and assist with filing a complaint. A list of locations and times is available on the auditor's website.

@Colebehr_report

Cbehrens@dispatch.com

This article originally appeared on The Columbus Dispatch: When are property taxes due? Can they be disputed? What to know