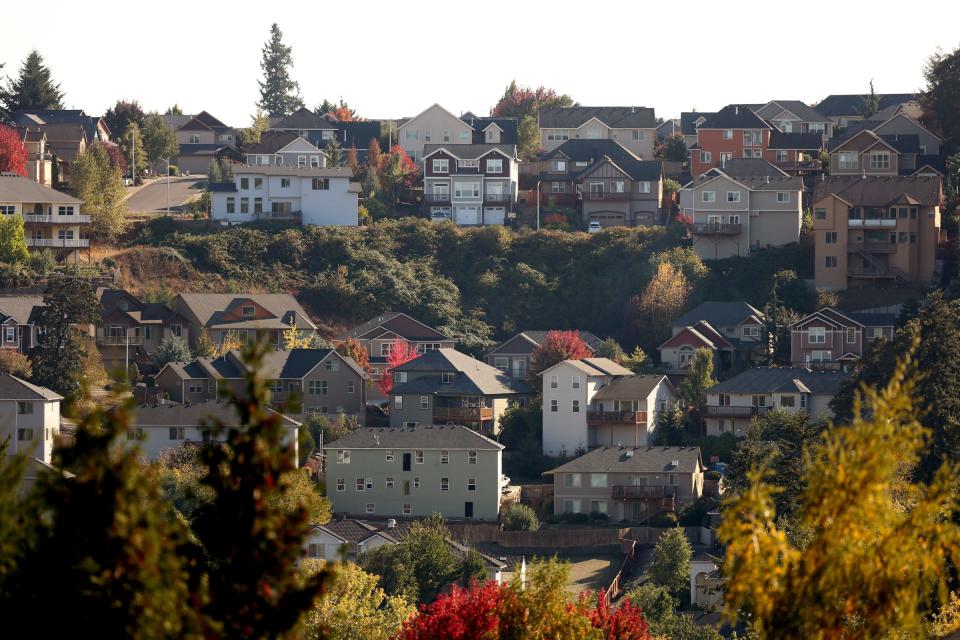

Property taxes rise more than normal in West Salem, Independence, other Polk County cities

Property owners throughout Polk County will see higher-than-normal increases in the amount of property taxes they’ll be paying when they receive their statements for the 2023-2024 tax year.

Between levies and bonds passed in recent elections, people in cities including Monmouth, Independence, Dallas and West Salem will have their taxes rise more than the typical 3%.

Tax statements were mailed Oct. 13 in Marion County and Oct. 20 in Polk County. Property owners receive a 3% discount if they pay by the Nov. 15 due date.

Measure 5 limits tax rates to $10 per $1,000 for general government operations and $5 per $1,000 for schools, while Measure 50 restricts the increase to 3% per year unless a bond or operations levy is passed.

That means property taxes in Oregon are based on the assessed value rather than the real market value.

Polk County Assessor Valerie Patoine said the real market value of all property in the county is $16.9 billion while the assessed value is $7.73 billion. In Marion County, the real market value of all property is $69.7 billion while the assessed value is $31.6 billion.

Meanwhile, the state announced earlier in the week that it had a revenue surplus of $5.61 billion and will be returning that through the state’s “kicker” on people’s income taxes.

Why taxes are going up

Most property owners in Polk County, including West Salem, will see an increase in their taxes since voters in May passed a five-year county public safety levy that increased taxes to 49.5 cents per $1,000 of assessed value, up from $42.5 cents per $1,000.

Taxes on those in and around Monmouth and Independence who live in the Central School District saw their taxes increase to $3.69 per $1,000 from $2.41 per $1,000 as part of a bond that passed in 2008 that paid for major work that was performed on Central High School.

And in Monmouth, residents are also paying for a city hall bond voters passed in the 2021 election that taxes property owners at 19 cents per $1,000.

In Independence, taxes are going up 9.5%, or about $319 per year for an average property owner. And in Monmouth, taxes are going up 12.7%, or about $455 per year.

In Mt. Angel, taxes are increasing 9% due to a voter-approved school bond levy, which is increasing property taxes by $1.12 per $1,000. That’s an increase of about $575 per year.

Those who live in the unincorporated area of Monitor will see an increase after the Monitor Rural Fire District passed a 50 cent per $1,000 levy in the May election, or an increase of about $107 per year.

In Aurora, people will see their taxes decrease by about 3% after the failure of a levy for the Aurora Rural Fire Protection District in May.

Highest and lowest tax bills in the region

City | Average assessed value | Tax rate | Average taxes |

Woodburn | $178,030 | 19.78 | $3,522 |

Salem | $224,430 | 19.62 | $4,404 |

Gervais | $165,660 | 19.17 | $3,176 |

Independence | $192,024 | 19.13 | $3,674 |

West Salem | $258,056 | 18.84 | $4,864 |

Mt. Angel | $216,070 | 18.28 | $3,951 |

Monmouth | $222,080 | 18.21 | $4,046 |

Mill City | $106,960 | 17.00 | $1,818 |

Silverton | $217,540 | 16.63 | $3,617 |

Keizer | $229,570 | 16.58 | $3,891 |

Stayton | $216,810 | 16.38 | $3,552 |

Idanha | $49,270 | 16.08 | $792 |

Aumsville | $166,110 | 15.57 | $2,587 |

Aurora | $255,580 | 15.37 | $3,929 |

Willamina | $131,325 | 15.27 | $2,006 |

Hubbard | $246,800 | 15.22 | $3,757 |

Detroit | $115,780 | 14.73 | $1,720 |

Jefferson | $170,160 | 14.65 | $2,493 |

St. Paul | $211,760 | 14.54 | $3,079 |

Dallas | $215,484 | 13.97 | $3,011 |

Gates | $138,500 | 13.82 | $1,914 |

Scotts Mills | $180,970 | 13.12 | $2,375 |

Falls City | $113,799 | 12.90 | $1,475 |

Sublimity | $294,530 | 12.75 | $3,755 |

Turner | $256,450 | 12.75 | $3,270 |

Donald | $188,680 | 12.20 | $2,302 |

Property owners in Woodburn are paying the highest rates in the area, according to Marion County Property Tax Assessor data, at 19.78. The lowest rate in the area is in Donald, which is 12.20.

People in West Salem are paying the highest average amount in taxes, at $4,864 per year. The lowest average amount of taxes is in Idanha, where owners pay $792.

The highest assessed value in the area is in Sublimity, where the average assessed value is $294,530, but residents there pay at a rate of 12.75, one of the lowest in the county.

The lowest assessed value is in the eastern most city of Idanha, where property has an average assessed value of $49,270.

How to correct a tax rate error in Marion and Polk counties

Property owners in Marion County who feel their tax amount is incorrect can call the Assessor’s Office at 503-588-5144.

In Polk County, they can call the Assessor’s Office at 503-623-8391.

Bill Poehler covers Marion and Polk County for the Statesman Journal. Contact him at bpoehler@StatesmanJournal.com

This article originally appeared on Salem Statesman Journal: Property taxes rise more than normal in some Polk County cities