Prosecutors Played a Stunning Recording at the SBF Trial. It Sure Sounded Bad for Him!

- Oops!Something went wrong.Please try again later.

This is part of Slate’s daily coverage of the intricacies and intrigues of the Sam Bankman-Fried trial from the consequential to the absurd. Sign up for the Slatest to get our latest updates on the trial and the state of the tech industry—and the rest of the day’s top stories—and support our work when you join Slate Plus.

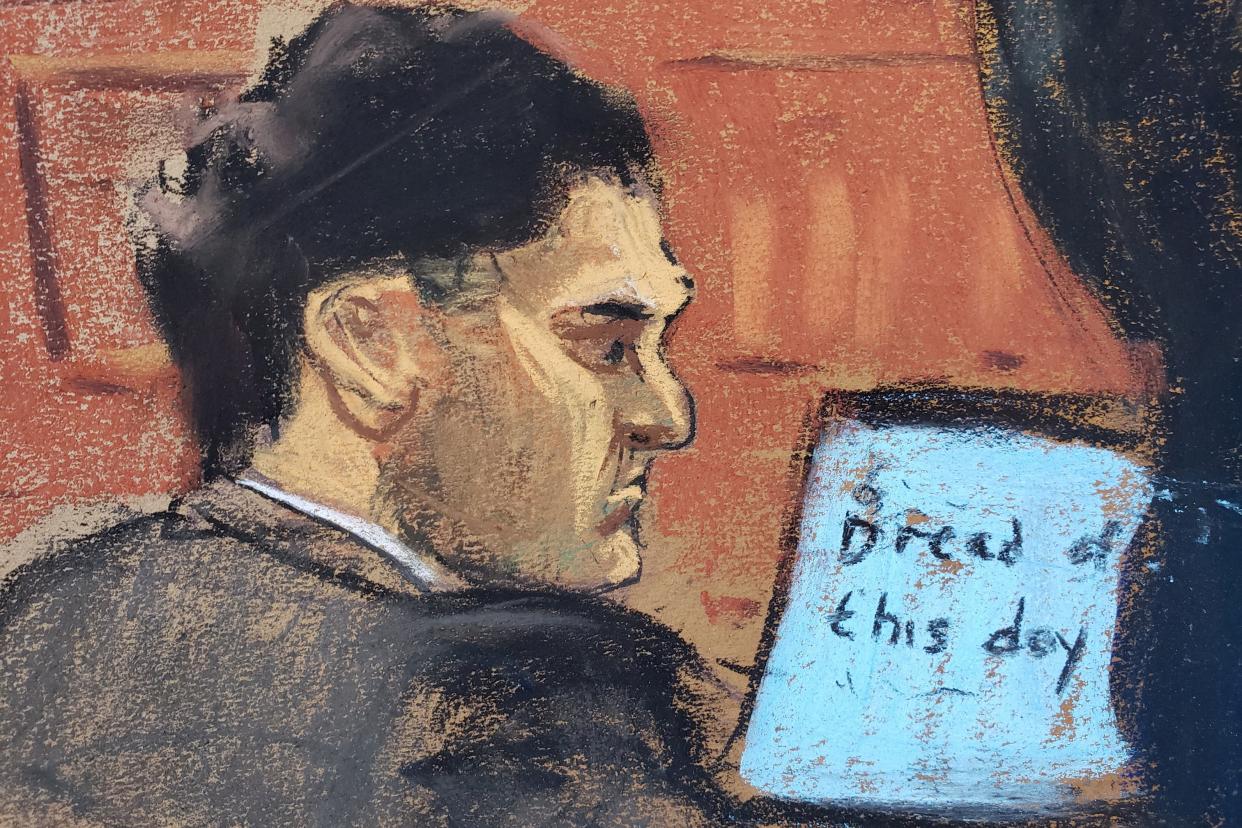

During Thursday’s proceedings in The United States v. Samuel Bankman-Fried, Caroline Ellison finally exited the stand—well, kinda. There was a lengthy cross-examination, a baffling affair in which SBF lawyer Mark Cohen asked plenty of repetitive, circular questions that, again, spurred visible annoyance from Judge Lewis A. Kaplan (and multiple grueling sidebar sessions). But the star of the day wasn’t so much Ellison as it was her recorded voice. The onetime Alameda Research CEO was followed on the stand a former underling: Christian Drappi, a software engineer who started working at Alameda around May 2021 and resigned just before the firm went under. However, unlike prior witnesses Adam Yedidia and Gary Wang, Drappi related no post-collapse drama about fleeing the Bahamas. Instead, he offered the ultimate inside view of the room where it happened, “it” being an infamous all-hands meeting last November where Ellison informed her teams of what had gone down.

The dark-haired Drappi quickly, bluntly explained why he was in court. As an Alameda coder, he interacted with the crypto hedge fund’s traders “every day,” because “they decided what I should be working on” with regard to site functionality. One of those decisionmakers was Sam Bankman-Fried—who is accused of misappropriating his FTX customer funds by funneling them through the very company, Alameda, that remained far more intermingled with the crypto exchange than was publicly disclosed at the time.

SBF’s presence in Alameda business wasn’t so strange at first, since Drappi started there when SBF was still its chief executive. But even after Ellison and Sam Trabucco were deemed the company’s co-CEOs in August 2021, it was “common knowledge” among his colleagues that the other Sam was basically running stuff. How did Drappi know? Well, he often had a firsthand view of Alameda operations, having worked at various points from all its far-flung offices—in San Francisco, the Bahamas, and Hong Kong. At the latter, Drappi told the prosecution, he sat pretty close to SBF; in the Bahamas, he played paddle tennis with the FTX mastermind. More to the point, Drappi could see that SBF remained closely involved with the company: The ex–Alameda CEO “maintained direct communication with Alameda employees, weighed in on trading decisions, and still had access to Alameda data” through the internal user interface. SBF was able to gain that interface access because he asked Drappi himself to reauthorize his permission after an IP address change at Alameda locked him out. (Only a “few” other FTX employees had such privileges, Drappi later informed the defense, including Wang, Nishad Singh, and Ryan Salame.)

Furthermore, there were indeed some sketchy moments. Sometime in 2022, Drappi learned of SBF’s influence on Alameda trades after he stumbled upon a stray company Slack message about selling and trading Japanese bonds and yen, not a usual line of business for the hedge fund. When Drappi inquired about this to the company’s head of trading, Ben Xie, he was told that “Sam wanted it.” Later that year, Drappi would also learn from Xie about Alameda’s attempts to sell NASDAQ futures as a hedge against the suffering crypto market … and that it was also an SBF decision.

But the most revealing event occurred on Nov. 8, 2022, when Drappi was working late at the Hong Kong office with Caroline Ellison and two other colleagues, Tony Qian and David Nyeste. “What’s this?” Qian reportedly blurted out at one point. “Are you seeing this?” This was a tweet from Sam Bankman-Fried, announcing that crypto exchange Binance (whose CEO, yes, had just cast some consequential doubts on FTX’s monetary health) was going to acquire FTX.

1) Hey all: I have a few announcements to make.

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).— SBF (@SBF_FTX) November 8, 2022

“I was utterly shocked,” Drappi related on Thursday. He said he wondered why FTX was getting bought at all, much less by such a major competitor—the world’s single largest crypto exchange. Ellison, sitting near him, informed him of another fact that left Drappi “utterly shocked”: that FTX had a major shortfall in user funds thanks to Alameda’s freewheeling use of them. Before that moment, Drappi testified, he’d had no idea that FTX customer assets were so commingled with the very company he worked for. Just because SBF hovered over so many decisions didn’t necessarily mean that he was also directing that kind of decision—did it?

The next day, Nov. 9, Caroline Ellison perched herself atop a beanbag chair to command an already-scheduled all-hands meeting for Alameda staff—this one fated to be far grimmer than the others. The fact this meeting happened, and that Ellison let her employees know there that FTX and Alameda had been inappropriately co-dependent for a long time, has been known for a while; the Wall Street Journal had reported on it just a few days afterward. This trial marked the first time, though, that actual audio from the fateful gathering entered the public record. Apparently, Drappi said, his colleague Rick Best—who’d only “joined three days prior”—secretly recorded the meeting without telling anyone, passing the files along to Drappi after the fact. The software engineer then consulted with an attorney and submitted the recordings to the government, which put some of those files on a CD for the court’s benefit. (A fun note: Before Drappi entered the premises, the prosecution’s mention of the audio fueled a lengthy session of bickering between both sides over whether such evidence, which included voices of people not considered co-conspirators, was appropriate for the trial. Kaplan allowed the recordings and even granted the defense an opportunity to present some meeting audio of its own, despite the government’s own objection. More on that later.)

The first clip solely featured Ellison, who kicked off the meeting by laying out the “basic story here”: “Starting last year, Alameda was kinda borrowing a bunch of money via open-term loans and using that to make various illiquid investments”—referring to the startup investments SBF had purportedly ordered to be carried out with customer money. Between the extant loans, the announcement from Binance (which had dropped its FTX bid earlier in the day), and the still-smarting crypto crash from earlier in the year, FTX was “not going to be able to meet, like, the withdrawal pressure” that it now faced as worried clients begged for their money back. Ellison’s beanbag demeanor, Drappi recalled, was “sunken” and “slouching”: “She did not display confident body language.”

The second clip featured Christian Drappi himself, asking his boss whether FTX/Alameda planned to pay off those obligations. Ellison likewise didn’t sound too confident here, stating that this problem had lingered for a while, thanks to the Alameda lenders who’d begun recalling their loans in the summer. “Our plan to wait for several months and for market environments to improve did not work out,” Ellison responded in part, giggling afterward.

The third clip also featured Drappi, talking through his understanding of the complex situation. “The biggest factor is the loan we have in FTX,” he reasoned, also realizing that, thanks to its special privileges with the sister exchange, Alameda hadn’t put up any substantive collateral, as a typical customer would have to. “That seems pretty bad … ”

The fourth clip consisted of Ellison getting into more nitty-gritty deets. “Our loan from FTX was used to repay” Alameda’s other lenders, she expounded, and was “used mostly to buy illiquid assets.” FTX equity shares made for a significant chunk of these cash-strapped assets, thanks in part to FTX’s buyback of the shares that had belonged to Binance. (As you may remember, this was another action SBF insisted on, per Ellison.) That alone took out $2 billion in liquid funds, adding to sizable investments taken out to sink inside other companies: $1 billion for the mining company Genesis Digital Assets, $500 million for the now-famed A.I. startup Anthropic, about $100 million or $200 million in crypto fund Voyager (but who’s counting?), and $300 million for the investment firm K5 Global (which is currently being sued by FTX’s bankruptcy-era owners, who would like that money bank, thank you much). Ellison giggled while delivering this verbal accounting, which, Drappi clarified, he understood from his personal experience with Ellison to be “nervous laughter.”

Drappi’s voice reappeared in the fifth clip, telling his CEO that “I’m sure this wasn’t a YOLO thing.” (He’d later spell out the acronym for the jury and explain how he used the term in this context, meaning, a pretty hasty and not-well-planned investment). Ellison acknowledged that she had “talked about it with Sam, Nishad, and Gary.” Those three again!

Finally, in the sixth clip, Ellison told another colleague that it’d been “Sam, I guess,” who’d approved all the poor investments. Within 24 hours of the meeting, Drappi then related, he resigned from Alameda.

Oh yeah, the defense did play one clip of its own, arguing that it presented a look into Ellison’s mood and motivations at the time. The audio came from a late moment in the meeting, when an unidentified speaker told Ellison that “I’m sure this is not that fun for you, but I certainly appreciate how open you’ve been.” The CEO, in turn: “Thanks, I mean, it was kinda fun, I don’t know,” a flagging conclusion accompanied by laughs across the meeting room. If the defense was trying to show that Ellison was not, in fact, as sad during that disastrous week as she’d claimed to have been, it didn’t seem very convincing; anyone who’s spent time in this courtroom over the past two weeks knows that in some tense situations, laughing is about the only thing you can do.