The Public Face of FB’s Libra

Well, it was bound to happen sooner or later, and now it has. Corporate money and Big Data are openly moving into the blockchain space – that’s the prime take-away from Facebook’s June 18 reveal of Libra, its new blockchain-based cryptocurrency initiative. There’s a lot to digest here, with both positive and negative repercussions, so we’ll take it one step at a time.

What is Libra?

Facebook won’t be running the new crypto by itself. Mark Zuckerberg is no fool, and events of the last two years have left him painfully aware of his company’s poor reputation for privacy and data management, so Facebook (FB) has spun off a subsidiary, Calibra, which will handle the day-to-day matters. Per the official white paper, “Facebook created Calibra, a regulated subsidiary, to ensure separation between social and financial data…”

This brings us to the Libra Association. The Association is a consortium of companies, leaning heavily toward tech, venture capital, and financial services. Confirmed members include, in addition to Facebook, Visa, Mastercard, PayPal, Coinbase, Uber, Andreessen Hororwitz, and Union Square Ventures.

It’s important to note here that Libra Association members each get one vote in the management of the Libra token; this is an important nod to early concerns about Facebook’s problematic history with data privacy. Each of the 28 members of the Libra Association paid $10 million toward the common reserve for the Libra crypto token. The Association will be based in Switzerland, due to that country’s “history of global neutrality and openness to blockchain technology.”

Like all cryptocurrencies, Libra will be based on blockchain ledger technology. This is part of Facebook’s ‘sell’ on data privacy, as blockchain has built a reputation for protecting both anonymity and security. Users will access Calibra online, download the wallet app (also called Calibra), and use that app to conduct basic transactions. Again, quoting the white paper, Libra is “built on a secure, scalable, and reliable blockchain; backed by a reserve of assets designed to give it intrinsic value; and is governed by the independent Libra Association tasked with evolving the ecosystem.”

Libra’s Benefits

Asset backing is the chief difference between Libra and most cryptocurrencies: Where Bitcoin (for example) is supported solely by traditional factors of supply and demand (perceptions of its scarcity and what users are willing to pay for it), Libra will be supported by that basket of assets. Again, the white paper: “A basket of bank deposits and short-term government securities will be held in the Libra Reserve for every Libra that is created, building trust in its intrinsic value.” In short, Libra will be a stablecoin, less likely to experience the extreme volatility of the traditional cryptocurrency market, and better suited for use as an everyday currency.

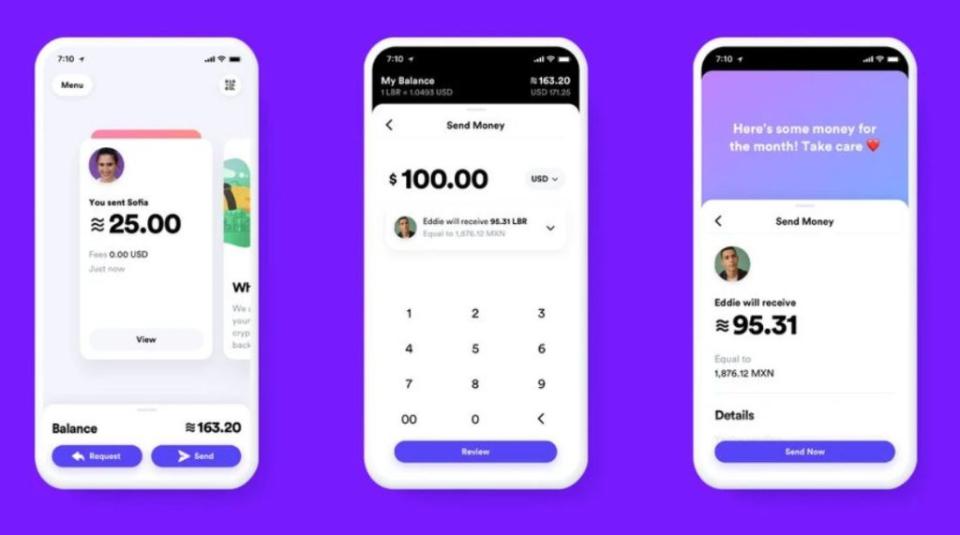

Libra’s users will have access to a variety of services through the Calibra wallet app. Peer-to-peer transfers, currency storage, online purchases, even in-store purchases and cash withdrawals. The Calibra app, according to preliminary image releases, will offer an appearance and user experience similar to existing P2P financial apps.

The customer base is the heart of the matter. In its white paper, the Libra Association notes “1.7 billion adults globally remain outside of the financial system with no access to a traditional bank, even though one billion have a mobile phone and nearly half a billion have internet access.” This is hardly an original observation, but Facebook’s proposed solution is unique.

Libra will be available to customers across the Facebook-owned apps. Initial emphasis will be on existing Messenger and WhatsApp users, but Facebook and Instagram will be included. And now we’re starting to move from positive to negative aspects of the Libra initiative.

Facebook has more than 2.7 billion users across its apps (FB, Instagram, Messenger, WhatsApp), and the members of the Libra Association bring their own customer bases along with them. It is safe to assume that total user base available to Libra approaches 3 billion people, and likely includes a fair portion of the ‘unbanked’ adults noted in the white paper.

Is There a Dark Side?

And now we start to get into the negative aspects of Libra. The new crypto comes with a built-in userbase that dwarfs the existing cryptocurrency audience, but more importantly, it comes with enormous financial backing. Facebook alone has a market cap of $535 billion, and as pointed out above, each member of the Libra Association paid $10 million into the common ‘pot’ to back the currency. Facebook’s goal is to expand the Association to 100 members before next launch, giving Libra a $1 billion backing.

Crypto can’t match that. The total market cap in existing cryptocurrencies is just under $290 billion. Bitcoin became famous for introducing open source blockchain to online finance in a way that could bypass corporate and government control, leading to a ‘Wild West’ attitude in the crypto markets. Facebook’s Libra, with its longer reach and deeper pockets, has the potential to tame that for the masses.

And now consider this: when blockchain first hit the scene in 2009, its great advantage was that it could take power away from giant banks, corporations, and governments, and shift it back to individuals. Now one of the least trusted names in high tech – also one of the world’s largest corporations – is moving to co-opt the success that early crypto users built. In the words of Phil Chen, decentralized chief officer of HTC’s Exodus blockchain phone project, “This project is the antithesis of bitcoin and is another step towards total control of data and users. This global coin is the most invasive and dangerous form of surveillance they have devised thus far.”

Facebook counters these fears by pointing out that Libra will be administered solely by Calibra, and that the two entities will not share data. Facebook will continue its focus on social media, while Calibra controls the online wallet platform. At the same time, Facebook is a member of the Libra Association, with a vote on the oversight of Libra, and the company’s recent history of data breaches, privacy violations, and censorship issues all play into libertarian fears. Back to Mr. Chen: “It’s not just access to the information of your transactions, it’s direct access to your wealth and capital… If this is launched and adopted worldwide, we’re bound to see Facebook as the top 10 biggest companies for the next 100 years that have complete ownership of the customer and their data.”

What to Expect

The June 18 reveal did not give a definite launching date for Libra. According to Facebook, the currency can be expected to go public about a year from now, in mid-2020. As noted above, the Libra Association hopes to reach 100 members before that happens, giving the currency a $1 billion backing. Right now, the Association leans heavily toward tech and venture capital firms. The future of Libra may depend on who chooses to join before the launch.

In the meantime, Facebook stock has reacted positively to the Libra announcement, and has risen 1.4% since June 18. Shares are now trading for $191. The average price target of $220 gives FB an upside potential of 15%. Even better, Facebook stock holds a ‘Strong Buy’ from the analyst consensus, with only 3 holds assigned in the last 3 months compared to 35 buy ratings.

Cover Image: Libra