Is Puhui Wealth Investment Management's (NASDAQ:PHCF) 118% Share Price Increase Well Justified?

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Puhui Wealth Investment Management Co., Ltd. (NASDAQ:PHCF) share price has soared 118% in the last year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 73% over the last quarter. Puhui Wealth Investment Management hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Puhui Wealth Investment Management

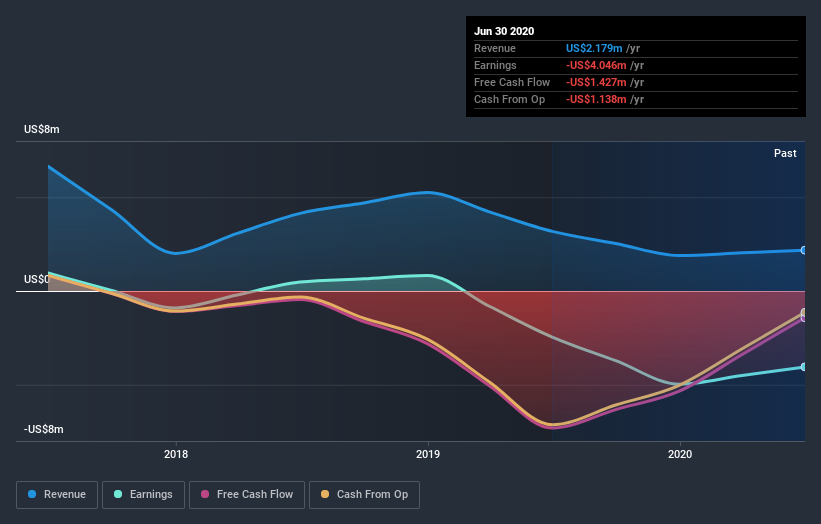

Puhui Wealth Investment Management isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Puhui Wealth Investment Management saw its revenue shrink by 31%. So we would not have expected the share price to rise 118%. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Puhui Wealth Investment Management's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Puhui Wealth Investment Management shareholders have gained 118% over the last year. And the share price momentum remains respectable, with a gain of 73% in the last three months. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 5 warning signs for Puhui Wealth Investment Management you should be aware of, and 2 of them are concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.