'Signs a corner has been turned on inflation', says Andrew Bailey - latest updates

Andrew Bailey has said there will be a "long but-shallow" recession in Britain, hailing “the beginning of a sign that a corner has been turned” on inflation.

The Governor of the Bank of England was optimistic about the cost-of-living crisis, given that a fall in wholesale energy prices "isn't actually yet feeding through" to household bills yet.

However he warned Britain's labour market "remains very competitive and that is influencing pay negotiations" as he visited a family-owned bakery in Blackwood, Wales.

Mr Bailey’s comments come after inflation fell for the second straight month to 10.5pc in December, amid falling petrol and clothing prices.

He said that energy prices have "started to come off and gas prices quite a lot actually" over the last few months.

He told the Western Mail: "That isn't actually yet feeding through, because of the way in which particularly domestic prices are calculated, but it will do.

"And that is encouraging and I think it is a product that Europe has higher stock levels and we had a warmer winter than we might have done.

"It does mean there is more optimism now that we are sort of going to get through the next year with an easier path there."

Read the latest updates below.

01:49 PM

Starmer: 'It's in all of our interest to make sure Putin cannot weaponise energy'

Sir Keir Starmer said it is easy to "retreat and see challenge" over Joe Biden's green subsidies, known as the Inflation Reduction Act.

The Labour leader said it should be seen as "a catalyst for all of us in relation to the climate crisis," adding the Ukraine conflict has "brought that into sharp focus".

He also called for an "active state" to partner with the private sector in developing green energy, saying the "prize here is huge in terms of energy security".

He said: "It's in all of our interest to make sure Putin cannot weaponise energy across the world."

01:30 PM

Oil and gas must be wary that 'future is coming fast,' says Enel boss

Francesco Starace, chief executive of green energy business Enel, appeared to cautiously support Sir Keir Starmer's call for no new oil and gas investment in the North Sea.

Speaking at the same event at the World Economic Forum, Mr Starace said the transition to renewable sources of energy was happening "much faster than originally estimated and it is going to accelerate".

He pointed to the historically slow pace of change in the oil and gas sector. He said:

This is an industry that goes in decades but here we are talking about years.

I would be careful not to make bets that go too long in the future because the future is coming fast.

01:25 PM

Starmer calls for 'inverse Opec' to drive down energy prices

Sir Keir Starmer also called for an "inverse Opec" of leaders in low carbon technology to help the world push towards net zero.

The Labour leader said a "clean power alliance" was needed to help bring down energy prices for the "common benefit", rather than the oil cartel, which keeps prices higher.

Sir Keir told the audience in Davos: "What we need is a strategy for renewables that binds together the challenge of high bills, energy security, the next generation of jobs and our obligations in relation to the climate crisis.

"That is why we set out our green prosperity plan going towards clean power by 2030."

01:16 PM

No new oil fields in the North Sea, says Starmer

Sir Keir Starmer has said there should be no new oil and gas fields in the North Sea to help Britain transition to renewable energy.

The Labour leader said oil and gas should "play a part" but said there should be no new investment "because we need to go towards net zero".

He added that onshore wind farms would also needed to be developed to build on the "huge potential" in the UK, which has become a world leader in offshore wind.

Sir Keir told an audience at the World Economic Forum in Davos: "There does need to be a transition.

"[Oil and gas] will play its part but there should be no new investment - no new fields in the North Sea - because we need to go towards net zero."

Labour leader @Keir_Starmer tells CNBC’s @_hadleygamble he’s proposing an “inverse OPEC” pic.twitter.com/tQa138Y9O6

— CNBC Middle East (@CNBCMiddleEast) January 19, 2023

01:02 PM

Wall Street expected to open lower

US stock market futures declined as growing signs of a global economic slowdown raised concerns from investors that the start-of-the-year rally in equities may have gone too far.

Contracts on the S&P 500 dropped 0.7pc after the benchmark slumped the most in a month on Wednesday following weaker-than-expected economic data.

Nasdaq 100 futures lost 0.8pc.

It comes after JP Morgan Chase chief executive Jamie Dimon told CNBC he expects interest rates to go above 5pc.

In New York premarket trading, Freeport fell as copper resumed its losses. Philip Morris rose after Jefferies upgraded its view of the stock.

12:52 PM

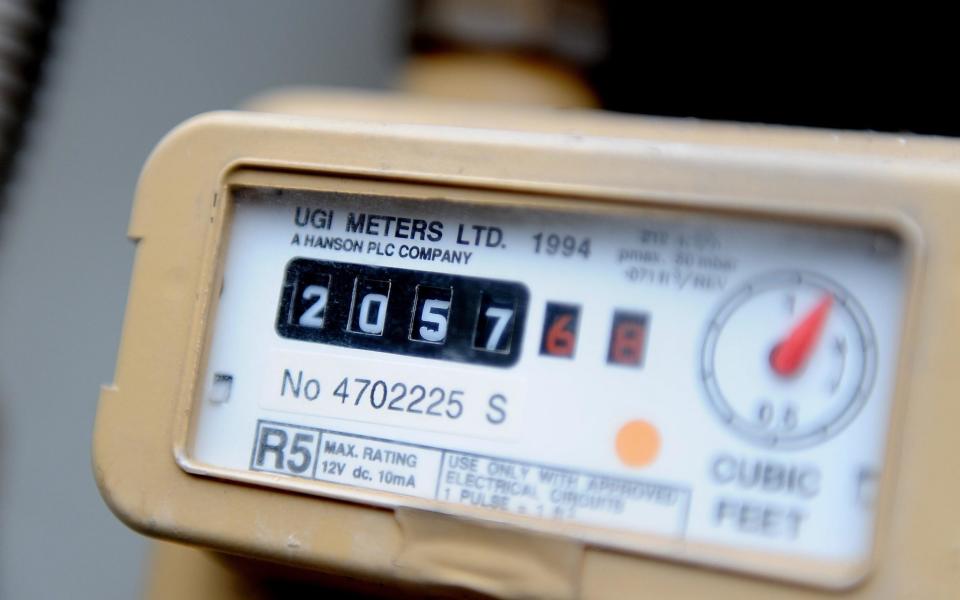

Households get £600 energy bills boost

Energy bills are set to fall by up to £600 more than previously expected this summer due to falling wholesale prices, in a boost for households and the state.

The Ofgem energy price cap will be £3,208 from April, according to analysts at Cornwall Insight.

The consultancy firm said had predicted on January 4 that the cap would be more than £3,500 due to falling wholesale prices.

It said the Ofgem price cap will then fall to £2,200 in July, £600 lower than is previous forecast of more than £2,800. The cap will stay at £2,200 in September, it said.

The cap currently sits at £4,279 but average annual household bills have been limited to £2,500 by the Government's energy price guarantee, which will rise to £3,000 from April.

The changes will cost the Government £208 per household from April to July, but then fall to zero should the cap fall below the value of the guarantee, as expected.

The bills will still be much higher than prices in October 2021, when the cap stood at £1,277.

However, it is well below previous doomsday predictions by Cornwall Insight.

In August, the organisation had predicted energy bills would almost double to more than £6,600 per year by this spring as Vladimir Putin choked off Europe's gas supplies to sent prices to record highs.

12:48 PM

Inflation beginning to 'turn a corner' says Bailey

The Governor of the Bank of England has said that two straight months of falling inflation in Britain indicate that "a corner has been turned" on rising prices.

Andrew Bailey said inflation would fall "quite rapidly this year," most likely from late spring, "and that has a lot to do with energy pricing".

The comments will give hope to homeowners and traders that the Bank will not continue its run of 10 consecutive interest rate rises for too much longer, although a 50 basis point rise next month is widely expected.

Inflation fell back to 10.5pc in December, down from a 41-year high of 11.1pc in November.

Mr Bailey told the Western Mail: "There was a sort of locked in level of energy prices over the winter, but we expect it to fall quite rapidly after that."

12:41 PM

Thunberg accuses energy firms of throwing people 'under the bus'

The world's most powerful activist confronted the man in charge of regulating global energy in Davos on Thursday, demanding an end to fossil fuel investments.

Greta Thunberg urged IEA Executive Director Fatih Birol to stop the global energy industry and the financiers who support them from fuelling carbon investments.

Ms Thunberg warned: "As long as they can get away with it they will continue to invest in fossil fuels, they will continue to throw people under the bus."

During a round-table discussion with Birol on the sidelines of the World Economic Forum annual meeting, activists said they had presented a "cease and desist" letter to chief executives calling on them to stop opening new oil, gas and coal extraction sites.

12:11 PM

French strike halts fuel deliveries from Total refineries

French strikes are disrupting the delivery of fuels from three oil refineries operated by Total, just months after a previous round of industrial action left filling stations running dry.

The disruption comes two and a half weeks before a European Union embargo on fuel imports from Russia that will deprive the bloc of its biggest external diesel supplier.

Together with Exxon Mobil, Total accounts for a huge share of French fuel production and the unions, protesting about pensions, are threatening to ratchet up their actions. The strikes go beyond oil refining. The actions of Exxon workers today appeared less disruptive.

Total confirmed that its sites were disrupted but said it would continue to supply its clients and filling stations.

The one-day action is the first step in a set of planned measures that get progressively more serious. On January 26 there is due to be a 48-hour stoppage and then on February 6, that will be followed up by a three-day strike, according to the CGT union.

11:45 AM

Oil extends decline amid rising stockpiles

Oil has fallen for a second day on signs of rising US inventories and economic growth concerns.

Brent crude, the international benchmark, fell 0.6pc towards $84 a barrel, while West Texas Intermediate dropped below $79 after declining 0.9pc.

The American Petroleum Institute reported a 7.6 million-barrel gain in commercial stockpiles, reflecting the lingering impact of a December cold snap which shut down refineries.

Thursday also marks the first day of a series of strikes in France, including at the nation's refineries.

While the first walkout will only last 24 hours, industrial action late last year shuttered much of the country’s crude processing, damping European demand and boosting fuel prices.

11:10 AM

Christine Lagarde says ECB fighting to avoid 'de-anchoring'

Christine Lagarde has warned about the risks that inflation could become entrenched, suggesting instead that in fact the 2023 economy will be "a lot better than feared".

The President of the European Central Bank said that she was fighting to avoid so called "de-anchoring", where the shocks seen in the world economy in the short term could affect long-term economic expectations for leaders and businesses around the world.

She told at audience at the World Economic Forum in Davos: "We look very carefully at inflation expectations.

"We are not seeing inflation expectations de-anchoring in any significant way.

"We have to avoid that they be at risk of de-anchoring."

10:48 AM

Grant Shapps takes aim at Joe Biden's green subsidies over 'protectionism'

Joe Biden's laws to reduce inflation could lead to a global wave of protectionism, the Business Secretary has warned.

Grant Shapps said there was a risk that the President’s Inflation Reduction Act could see a return to protectionism.

He told an audience at the World Economic Forum in Davos that Vladimir Putin's war in Ukraine had shown that countries "need to be a little more self-reliant".

However, he warned "it is very important that we don’t slip into protectionism" pointing to the risk that could happen with the Inflation Reduction Act in the US.

The sweeping legislation, which was approved in August and includes a record $369bn in spending on climate and energy policies, has received some angry responses, particularly among the 27 EU nations.

EU countries are worried their companies will suffer because of US tax breaks for components used in renewable energy technologies like electric cars on condition they are made in North America.

10:36 AM

Coffee culture at risk from home working as price of a latte breaches £3

Home working has put Britain’s coffee shops at risk forcing retailers to push up the price of a latte to more than £3.

Britons drank more coffee last year but demand is yet to recover to pre-pandemic levels, according to market researcher Allegra Group.

Sales grew nearly 12pc in 2022 but cafes and restaurants grappled with inflation and high energy costs, according to the report.

Half of operators surveyed said consumer footfall was yet to fully recover, particularly in city centres, while larger branded chains recouped some ground last year.

They also responded to shifting consumption patterns by investing in drive-thrus — which grew 18pc — as well as delivery, self-serve, and smaller format stores.

The cost of a latte — the most popular coffee drink in the UK — rose 11% to £3.25 ($4) over the last 12 months, Allegra said in a report.

10:20 AM

Shell shifts towards electric charging with Volta takeover

Electric charging points could be swiftly rolled out at petrol stations across the country after Shell agreed to buy US company Volta.

The oil giant will pay $169m (£137m) for Volta, which installs chargers with large video advertising screens at grocery stores, office buildings and elsewhere.

Shell USA will purchase Volta for 86 cents a share in cash, the San Francisco-based charging firm said. The transaction is expected to close in the first half of this year.

Volta has set up more than 3,000 charging points with partners including supermarket Kroger, the Oracle Arena in San Francisco and Six Flags Theme Parks.

However, Volta, which went public in 2021 through a merger with a special purpose acquisition company, has struggled in the past year, with its two top executives abruptly exiting last March.

The firm issued a going-concern warning in May as cash reserves dwindled and fired more than half its workforce to stabilise its finances.

10:03 AM

Dr Martens warehouse issues wipe £392m off value of the company

Shares in Dr Martens plummeted in value by a quarter as the business said that unseasonably warm weather last autumn and problems at a warehouse have eaten into its performance in the US.

The company downgraded its outlook for the financial year after what boss Kenny Wilson said had been a "challenging" period.

The shoe brand said that it has recently found "significant operational issues" at its new Los Angeles distribution centre.

The problems saw its share price collapse by 25pc, wiping more than £390m off the value of the company.

The business said that problems had arisen as its stock had moved from a distribution centre in Portland to the new third-party site in LA faster than had been planned.

The business had also told some of its US wholesalers that they could use the distribution centre to store some of their shipments, while the shipping times from factories to the warehouse dropped, adding more stock to the already overloaded site.

All this came together to create serious bottlenecks at the warehouse, which has created problems getting shoes to wholesale customers.

09:53 AM

Tesco Bank announces 'cost of living' pay increase for 90pc of staff

Tesco Bank will give 3,400 of its staff a £1,250 pay rise to help with the cost of living.

The payment, which will go to more than 90pc of its workforce, is backdated to January 8 this year and is in addition to the bank's annual pay review due in May.

The uplift to salaries followed discussions between Tesco Bank and both USDAW and Unite trade unions.

Tesco Bank chief executive Gerry Mallon said:

The rising cost of living is having an impact on households across the country, and we've been listening to colleagues about how this is affecting them.

That's why we've taken action and awarded a permanent increase to base pay for the majority of our colleagues.

The salary increase aims to provide sustainable, long-term support to colleagues, including our contact centre colleagues who show great commitment to helping our customers in the current economic climate.

09:44 AM

Orders fall on Deliveroo as customers charged more

Takeaway delivery group Deliveroo said efforts to cut costs boosted its profitability, despite revealing a drop in order numbers amid a slowdown in demand after years of pandemic-boosted trading.

Total order numbers fell 2pc across the group to 75.1m in the final three months of the year, the company said.

In the UK and Ireland, order numbers remained flat at 40.6m.

Deliveroo saw this offset as its restaurant and grocery partners raised prices per item, with gross transaction value (GTV) lifting 6pc on a constant currency basis, leaving it with growth of 7pc for the full year - but this was far lower than its previous guidance for up to 12pc.

However, the firm said underlying earnings were around breakeven for the second half, with its margin performance better than feared thanks in part to moves to rein in costs.

Underlying earnings are expected to improve throughout 2023, it added.

09:31 AM

Badenoch holds meeting with US trade ambassador

Kemi Badenoch will "stay in close touch" with US trade representative Katherine Tai following a meeting between the pair on the sidelines of the World Economic Forum in Davos.

The International Trade Secretary and Ms Tai discussed the two countries' "shared commitment to strengthening the bilateral relationship".

They also discussed the importance of investing in clean energy technology and Ambassador Tai acknowledged the UK's concerns with the Inflation Reduction Act, echoed by Grant Shapps at an event in Davos this morning.

It comes after Ms Badenoch met with major UK investors such as Merck (MSD), who reaffirmed their £1bn investment in a discovery research centre in London's Knowledge Quarter.

She also spoke to Fujitsu who emphasised that the UK was their biggest market outside Japan and they were excited about the £22m they are investing in a Centre for Cognitive and Advanced Technology in the UK.

09:13 AM

Sophos to axe 10pc of staff

Cyber security provider Sophos will reportedly lay off about 10pc of its global workforce.

The Oxford-headquartered company will let go of about 450 staff, according to TechCrunch.

More than half a million companies use Sophos technology around the world, which generated more than $1bn (£810m) in revenue.

Private equity firm Thoma Bravo bought the company in a $3.9bn (£3.2bn) deal in March 2020.

09:03 AM

Starmer and Reeves arrive at Davos

Sir Keir Starmer has arrived at the World Economic Forum in Davos where he is expected to tell business leaders later that he wants to improve Britain's relationship with the EU.

The Labour leader arrived alongside shadow chancellor Rachel Reeves prior to a meeting with chief executives at the business summit.

08:57 AM

Boohoo shares fall amid disappointing sales

Shares in Boohoo have tumbled by 5pc after the fashion retailer insisted it would still hit expectations during the financial year despite a massive drop in sales during the last few months of 2022.

The business said that its UK and US units had driven an 11pc fall in sales across the group in the four months to the end of December.

The decline did not come as a surprise to either Boohoo or its shareholders, who had been warned that sales were set to drop over the period.

As a result, Boohoo was able to say on today that it expects earnings before interest, tax, depreciation and amortisation to measure up to market expectations.

Revenue is set to drop by around 12pc over the financial year, the business said.

So far, in the 10 months to the end of December, revenue dipped from a little under £1.7bn to just over £1.5bn, a 10pc fall.

So far this year, the US has been by far the worst-performing market for Boohoo. In the 10 months to the end of December revenue dropped 23pc to £306.3m when compared to the same period a year earlier.

08:45 AM

Markets fall with Dr Martens suffering biggest drop

The commodity-heavy FTSE 100 fell today, with energy firms and material stocks hauling the benchmark index lower, while bootmaker Dr Martens slumped to a record low after it gave a profit warning.

The FTSE 100 slid 0.5pc, while the domestically-oriented FTSE 250 shed 0.6pc.

Energy heavyweight Shell fell more than 2pc, while industrial miners shed 1.6pc as crude and copper prices fell after disappointing US economic data and on worries about a hawkish Federal Reserve.

Dr Martens sank as much as 21.4pc after it warned of a lower annual profit and revenue due to operational issues at its new US distribution centre.

The stock's slump dragged the personal goods sector down 3.1pc.

Adding to the sombre mood, data showed UK house prices fell more than expected in December and hit their lowest since October 2010 as inflation and rising interest rates squeezed home-buyers.

08:40 AM

Rebuilding Ukraine to cost more than double World Bank estimate, says BlackRock boss

More than $750bn (£608bn) will be needed to rebuild Ukraine, the head of the world's largest money manager has said at an event in Davos attended virtually by the country's president Volodymyr Zelensky.

The figure outlined by BlackRock chief executive Larry Fink is more than the World Bank's most-recent estimate of $350bn made in June 2022.

He told a breakfast on the sidelines of the World Economic Forum: "The need is likely to be closer to $750bn [to support the] economic recovery and aid according to conversations with the economic team and President Zelensky."

Mr Fink said this will require the private and public sector to work together "whether it is any of the intergovernmental agencies (such as the IMF and World Bank) or the Europeans plus attraction of private capital".

He added: "The way we're going to have to be doing this is constructing a true foundation where we can identify the needs of the country."

Ukraine's prime minister suggested yesterday that the final reconstruction bill could top $1 trillion. The UK's annual economic output is just under $3 trillion.

Mr Fink's comments came after Boris Johnson likened Vladimir Putin to "the fat boy in Dickens" who wants to make our flesh creep with the threat of nuclear war.

Ukraine's economy was projected to contract by 35pc last year, according to the World Bank, although economic activity has been scarred by the destruction of productive capacity, damage to agricultural land, and reduced labour supply as more than 14 million people are estimated to have been displaced by the war.

Mr Zelensky told the meeting that a slowdown in the war was mainly due to winter, adding that “motivation and morale” is not enough to win.

08:24 AM

Mr Kipling maker to close factory, putting 300 jobs at risk

Mr Kipling cake firm Premier Foods has revealed plans to close one of its manufacturing sites in a move impacting around 300 jobs.

The group is proposing to close its Knighton manufacturing site in Staffordshire, which it said was loss-making.

It is launching a consultation with the 300 workers at the site under a process that will run to the middle of 2023, although the site - which largely makes unbranded powdered drinks for the group - is likely to continue operating into 2024 before finally shutting.

Premier Foods said: "It is recognised that this will be an unsettling time for those circa 300 colleagues who are potentially affected by these proposals and they will be fully supported and consulted with throughout the process."

It also reported third quarter sales up 12pc, which was branded "impressive" by analysts at Peel Hunt.

08:05 AM

Markets fall at the open

Stock markets fell again at the open as concerns linger about persistent inflation in Britain.

The blue-chip FTSE 100 index and the domestically-focused FTSE 250 both fell 0.4pc to 7,801 and 19,811 respectively.

07:24 AM

Boohoo revenues tumble as UK and US businesses suffer

Online fashion business Boohoo has confirmed that it saw a big drop in sales in the last four months of 2022 as its US and UK businesses suffered.

The company said revenue had dropped by 11pc compared to the same period a year earlier.

The slowdown on the international market happened as the company's delivery times were starting to lengthen.

Boohoo shares fell 71pc last year.

07:21 AM

Putin is 'not going to use nuclear weapons' insists Johnson

Boris Johnson likened Vladimir Putin to "the fat boy in Dickens" who wants to make our flesh creep as he attended an event alongside Volodymyr Zelensky.

The former prime minister made the reference at a breakfast meeting at the World Economic Forum in Davos as he insisted Russia’s leader would not use nuclear weapons .

Economics editor Szu Ping Chan is in the room:

It was standing room only at the event involving Mr Johnson and the president of Ukraine, who was attending virtually.

Mr Johnson said the focus must totally be on helping Ukraine and not trying to second guess Russia's next move.

He said: "We should not get into this whole business of presenting the war as a nuclear standoff between NATO and Russia."

He described this narrative as "nonsense", adding: "He's not going to use nuclear weapons."

Lifting a line from the Pickwick Papers, Mr Johnson said: "He wants to make our flesh creep. He wants us to think about it. He's never going to do it."

He says that following through would put the world into complete paralysis.

He added: "The Chinese would turn massively against him, and he would terrify the Russians. He's not going to do it so don't go down that rabbit hole."

07:17 AM

Good morning

It was standing room only as Boris Johnson spoke at a breakfast meeting at the World Economic Forum in Davos this morning.

The former prime minister insisted Vladimir Putin was not serious about the threat of nuclear war at the session attended virtually by Ukrainian president Volodymyr Zelensky.

Mr Johnson said that going nuclear would turn the Chinese and Russian population against him.

5 things to start your day

1) Ex-Barclays boss saw young women being abused on trips to Epstein’s townhouse, lawsuit alleges | Jes Staley accused of helping to cover up the disgraced financier’s sex-trafficking ring while at JP Morgan

2) The world is giving up on Britain, warns CBI chief | Lack of economic leadership means investors are pulling money out of UK, says Tony Danker

3) Microsoft to cut 10,000 jobs as chief executive Satya Nadella says ‘no one can defy gravity’ | Company makes ‘difficult but necessary’ layoffs as economic downturn looms

4) Royal Mail restarts international deliveries for first time since cyber attack | Postal service trials 'workarounds' to shift backlog

5) Netflix offers up to £300,000 for flight attendant on its private jet | Job listing comes despite the streamer battling a slowdown

What happened overnight

Asian stocks opened lower on Thursday as concern over economic growth overshadowed optimism that central banks will slow policy tightening.

Hong Kong equities led declines, with notable weakness in tech companies, and Japanese shares were also decisively lower. Futures for the S&P 500 dropped after the benchmark closed down 1.6pc on Wednesday, the biggest decline in a month.

Tokyo shares also declined, with the Nikkei 225 index falling 1.10pc to 26,495.26 in early trade and the broader Topix index losing 0.90pc to 1,917.52.

The dollar stood at 128.41 yen, slipping from 128.80 yen in New York overnight.

Meanwhile, New Zealand stocks largely shook off news that Prime Minister Jacinda Ardern will step down next month, falling just 0.1pc.