QEP Resources (QEP) Incurs Q4 Loss Due to Soft Oil Realization

QEP Resources, Inc. QEP recently reported fourth-quarter 2020 adjusted loss of 4 cents a share. The Zacks Consensus Estimate was a profit of 6 cents per share. This underperformance can be attributed to weak oil price realizations and lower production volumes.

Meanwhile, the company’s loss per share was narrower than the year-ago quarter’s loss of 10 cents. This outperformance is attributable to increased natural gas and NGL price realizations and lower operating expenses.

Quarterly revenues of $200 million lagged the Zacks Consensus Estimate of $231 million. Also, the top line deteriorated 37.9% from the year-ago quarter’s sales of $322 million.

Volume Analysis

Production of crude and natural gas summed 7,364.1 thousand barrels of oil equivalent (MBoe) (62.4% oil and condensate), down 13% from the year-ago quarter’s figure of 8,465.3 Mboe, primarily reflecting lower drilling activity in the Permian Basin.

Natural gas volumes were in line with the year-ago quarter’s 8.5 billion cubic feet (Bcf) while natural gas liquids output dropped 2% to 1,364.3 thousand barrels (Mbbl). Oil volumes declined from 5,653.9 Mbbl in fourth-quarter 2019 to 4,596.7 Mbbl in the quarter under review.

Moreover, the company’s Permian Basin production fell 17% year over year to 4,247.7 Mboe, contributing to 57.7% of its total output.

Realized Prices (Excluding Derivative Impact)

QEP Resources’ net realized natural gas price in the quarter was $1.79 per thousand cubic feet, up 17% from the year-ago quarter’s level of $1.53. Further, net NGL price realization increased 19.1% from the fourth quarter of 2019 to $12.17 per barrel. However, net oil price realization decreased 27.8% year over year to $40.02 per barrel.

Costs, Capex and Balance Sheet

Total operating expenses in the quarter declined considerably to $259.5 million from $274.4 million in the prior-year quarter. Moreover, QEP Resources’ fourth-quarter lease operating expenses came in at $37.1 million, down 21.7% year over year. General and administrative costs fell 4.8% year over year. Capital investment excluding acquisitions was down 29.5% year over year to $74.4 million in the fourth quarter, mainly due to reduction in QEP Resources’ drilling and completion expenses in the Permian Basin and the company’s decision to halt completion activity in the said basin until the fourth quarter of 2020.

As of Dec 31, 2020, QEP Resources had $60.4 million in cash and cash equivalents. The company’s long-term debt was $1,591.3 million, representing a debt-to-capitalization of 37.3%.

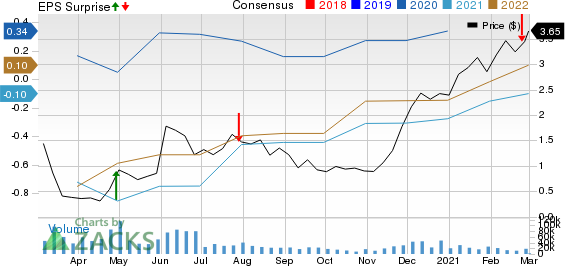

QEP Resources, Inc. Price, Consensus and EPS Surprise

QEP Resources, Inc. price-consensus-eps-surprise-chart | QEP Resources, Inc. Quote

Acquisition Update

Last December, QEP Resources entered into an agreement with Diamondback Energy, Inc. FANG wherein the latter will acquire the former in an all-stock deal worth $2.2 billion. This move will provide QEP Resources shareholders with 0.05 shares of Diamondback common stock for each share held, accounting for an implied value to each QEP Resources stockholder of $2.29 per share as of the closing price on Dec 18, 2020.

The transaction is expected to close by the first quarter of 2021 and is contingent on pending approvals and customary conditions. Upon the closure of this deal, Diamondback stakeholders will possess 92.8% of the consolidated company while the rest will be held by QEP Resources stockholders. On account id this merger, QEP Resources stopped providing guidance for the ongoing year.

Zacks Rank & Key Picks

QEP Resources has a Zacks Rank #3 (Hold), currently. Some better-ranked stocks in the energy space are Matador Resources Company MTDR and Denbury Inc. DEN, each presently flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

AccessZacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QEP Resources, Inc. (QEP) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Denbury Inc. (DEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research