Is Quartiers Properties (STO:QUART) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Quartiers Properties AB (publ) (STO:QUART) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Quartiers Properties

What Is Quartiers Properties's Debt?

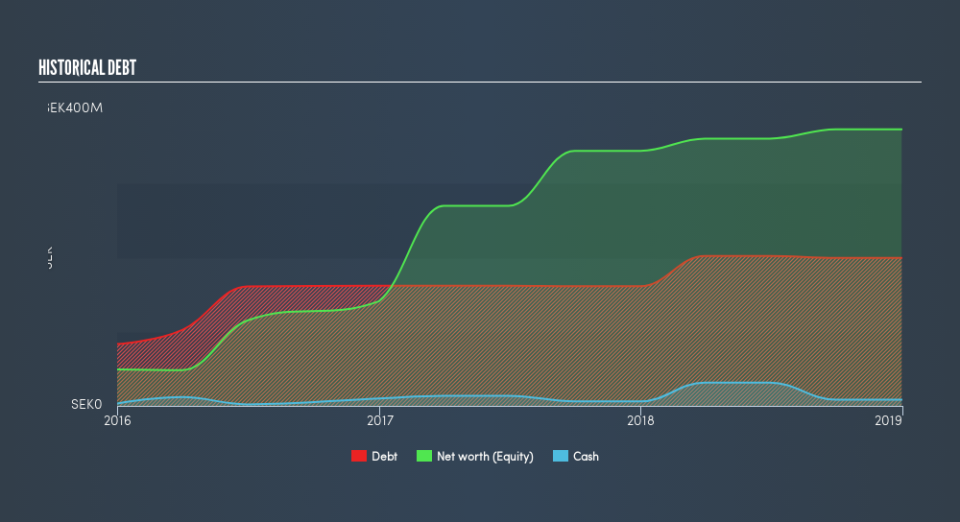

As you can see below, at the end of December 2018, Quartiers Properties had kr201.7m of debt, up from kr163.9m a year ago. Click the image for more detail. However, it also had kr8.42m in cash, and so its net debt is kr193.3m.

A Look At Quartiers Properties's Liabilities

We can see from the most recent balance sheet that Quartiers Properties had liabilities of kr63.2m falling due within a year, and liabilities of kr221.2m due beyond that. On the other hand, it had cash of kr8.42m and kr5.88m worth of receivables due within a year. So its liabilities total kr270.1m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's kr256.9m market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Quartiers Properties's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Quartiers Properties managed to grow its revenue by 181%, to kr28m. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

Despite the top line growth, Quartiers Properties still had negative earnings before interest and tax (EBIT), over the last year. To be specific the EBIT loss came in at kr18m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it had negative free cash flow of kr11m over the last twelve months. That means it's on the risky side of things. For riskier companies like Quartiers Properties I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.