Questions raised over offshore wind cable proposed for Sakonnet River

PROVIDENCE – Rhode Island utilities regulators are considering suspending Mayflower Wind’s application for transmission cables that would run up the Sakonnet River to the former site of the Brayton Point Power Station in Somerset after the developer raised questions about the financial viability of the first phases of the $5-billion offshore wind project it has proposed off Massachusetts.

The state Energy Facility Siting Board has ordered the company to demonstrate why the proceedings shouldn’t be stayed until the questions surrounding financing of the first 1,200 megawatts of the project are resolved.

“It is not reasonable or fair to those governmental agencies, including the EFSB, to spend time and resources evaluating an Application for a project which may only be hypothetical in nature due to an admission by the Applicant that the proposed project is not going to be financially viable,” says the Nov. 10 order signed by board chairman Ronald Gerwatowski.

State law requires a hearing be scheduled within 10 days of a show cause order unless the applicant seeks an extension within five days.

Mayflower Wind said it is reviewing the order and will respond within the required time frame.

“We will share details of our response after we meet our obligation to provide the RI EFSB the response required in the Order,” CEO Francis Slingsby said in an email. “Mayflower Wind remains committed to deliver clean offshore wind energy to the people and businesses of New England.”

The questions about financing were initially raised by Avangrid Renewables, the developer of a second 1,200-megawatt offshore wind project off Massachusetts known as Commonwealth Wind.

In a filing last month with the Massachusetts Department of Public Utilities, the company asserted that the project is “no longer viable and would not be able to move forward” under the terms of the long-term contracts it signed last spring to sell power to utilities in the Bay State. Inflation, shortages of equipment and interest rate hikes, tied to the COVID pandemic and the war in Ukraine, had changed the economics of the project, the company said.

Mayflower Wind, which also has power purchase agreements pending before the DPU, joined with Avangrid in support of a month-long pause in the review of the contracts. In one filing with the agency, Mayflower Wind argued that “the resource may no longer be economic and financeable without adjustments to the PPAs.” In another, the company proposed solutions, including raising the power prices in the contracts and exploring the impact of new federal tax incentives.

The utilities that signed onto the contracts balked at any changes to the agreements. The DPU subsequently denied the offshore wind developers’ request and ordered them to either commit to the contracts or pull out.

While Avangrid asked for more time, Mayflower Wind, a joint venture between fossil fuel company Shell and renewable energy firm Ocean Winds, told regulators last week that it plans to move forward under the current agreements.

But the company added a caveat about what it described as the “current extraordinary global economic conditions,” saying it would provide the DPU with “detailed third-party analysis demonstrating challenges to financeability, with the goal of finding solutions that provide value to ratepayers.”

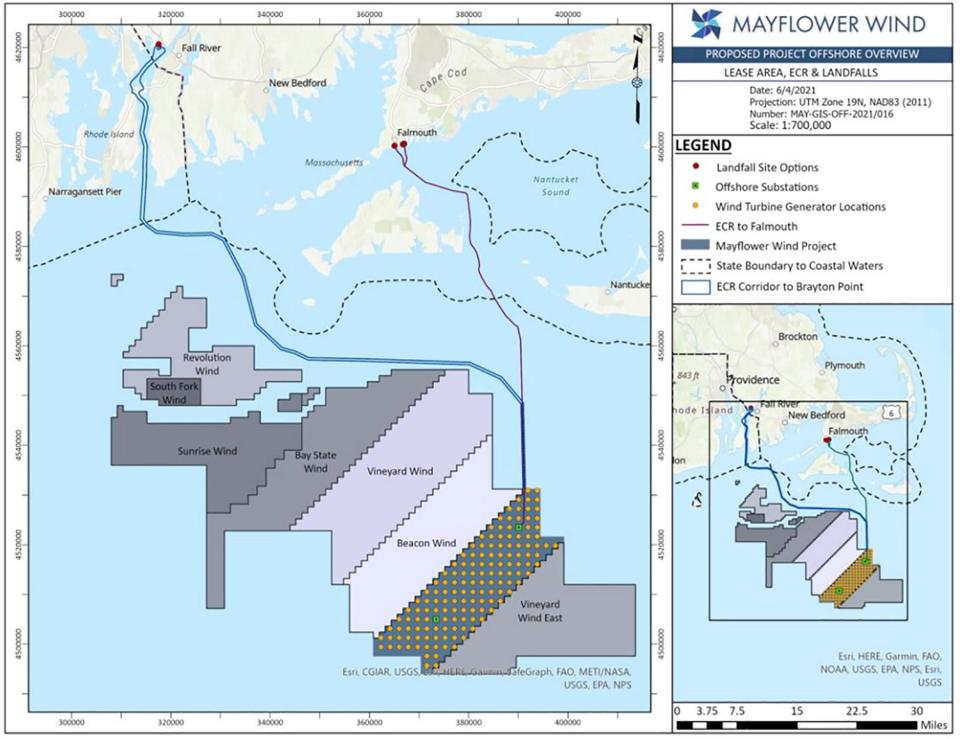

Now, the questions raised in Massachusetts are having repercussions in Rhode Island. Mayflower Wind needs approval from the Rhode Island EFSB in order to deliver at least some of the power from its project that would be built in Atlantic Ocean waters south of Nantucket and Martha’s Vineyard. It’s one of several offshore wind farms, including Revolution Wind, the South Fork Wind Farm and Vineyard Wind, that would be developed in the same general area of the ocean. The projects are seen as essential to meeting climate goals in Rhode Island, Massachusetts and other states in the region.

Vineyard Wind:Work has begun on cable installation in seas off Martha's Vineyard

Vineyard Wind:The offshore wind project is making progress on Cape Cod

Mayflower Wind says its 199-square-mile lease area could generate up to 2,400 megawatts of capacity, or enough power for about one million homes. Half of that power from what could be as many as 149 turbines would flow into the regional power grid through a cable routed into Falmouth.

The other half would be connected through Somerset. Mayflower Wind proposes bringing two export cables from the lease area located about 59 miles southeast of the Rhode Island coast. They would run up the Sakonnet River, through the Island Park neighborhood of Portsmouth, and across Mount Hope Bay before connecting to the substation where New England’s largest coal-burning power plant once stood.

High bills, blackout risks: Grave winter energy forecasts drawing lines across New England

Concerns from fishermen

Local recreational fishermen have raised concerns about electromagnetic fields associated with the cable affecting fish stocks. The Middletown, Little Compton and Portsmouth town councils have intervened in the siting board’s proceedings but have not raised objections.

The EFSB held a hearing in August and a public meeting in October and, according to the order signed by Gerwatowski, was nearing decisions on procedural matters related to the application.

The order chastises Mayflower Wind for not informing the Rhode Island board of the filings in Massachusetts and the company’s representations about financing difficulties.

“The EFSB should not have to rely upon news reports to learn of such material events that could substantially affect the ability of the project to obtain financing which, in turn, is relevant to the issue of need,” the order states.

More importantly, the recent proceedings in Massachusetts raise larger questions about the transmission cables, according to the board.

“As a matter of statutory licensing requirements, all Applicants filing for approval of a license must show that the project is needed,” the order says. “In this case, one cannot logically claim that the transmission facilities that are jurisdictional to the EFSB are needed if it is apparent that the offshore wind generation project to which the transmission facilities would be interconnected will not be economic or financially viable before the licensing proceedings examining need even commence.”

This article originally appeared on The Providence Journal: Regulators consider pausing offshore wind cable request over financing questions