I Ran A Stock Scan For Earnings Growth And Arbor Realty Trust (NYSE:ABR) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Arbor Realty Trust (NYSE:ABR), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Arbor Realty Trust

How Quickly Is Arbor Realty Trust Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. We can see that in the last three years Arbor Realty Trust grew its EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

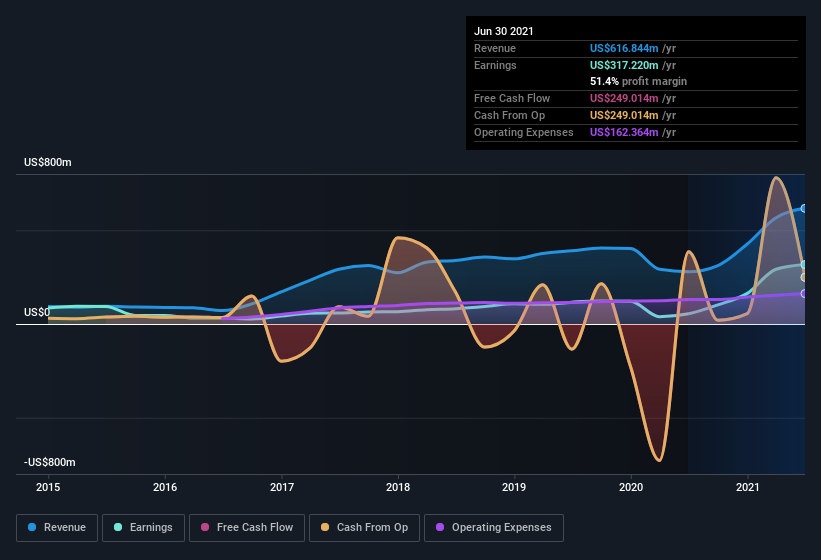

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Arbor Realty Trust's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Arbor Realty Trust's EBIT margins were flat over the last year, revenue grew by a solid 121% to US$617m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Arbor Realty Trust's forecast profits?

Are Arbor Realty Trust Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

For the sake of balance, I do note Arbor Realty Trust insiders sold -US$118k worth of shares last year. But that is far less than the large US$251k share acquisition by Lead Independent Director William Green.

Along with the insider buying, another encouraging sign for Arbor Realty Trust is that insiders, as a group, have a considerable shareholding. With a whopping US$74m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Should You Add Arbor Realty Trust To Your Watchlist?

One important encouraging feature of Arbor Realty Trust is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. What about risks? Every company has them, and we've spotted 3 warning signs for Arbor Realty Trust (of which 1 is a bit concerning!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Arbor Realty Trust, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.