I Ran A Stock Scan For Earnings Growth And DMC Global (NASDAQ:BOOM) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like DMC Global (NASDAQ:BOOM). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for DMC Global

How Fast Is DMC Global Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that DMC Global grew its EPS from US$0.89 to US$3.70, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

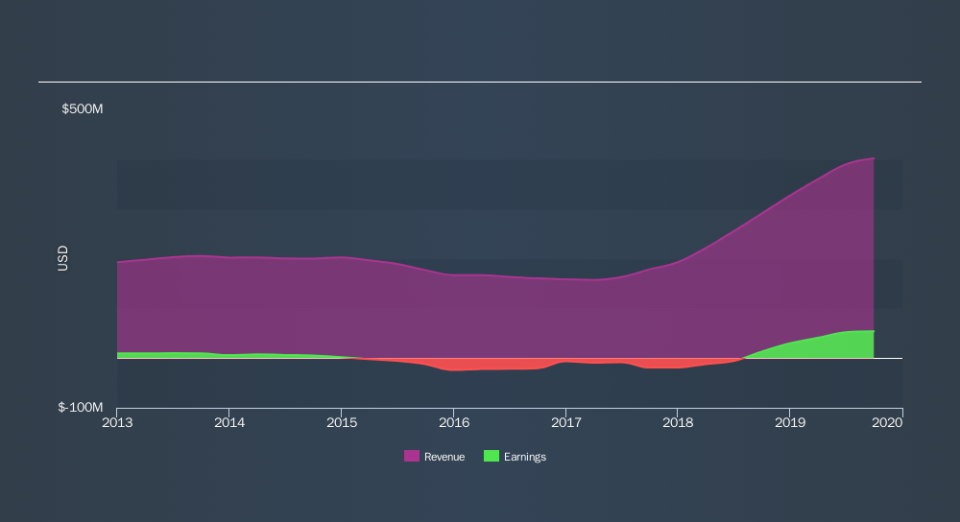

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. DMC Global shareholders can take confidence from the fact that EBIT margins are up from 13% to 20%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for DMC Global?

Are DMC Global Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own DMC Global shares worth a considerable sum. Indeed, they hold US$16m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like DMC Global with market caps between US$400m and US$1.6b is about US$2.6m.

The DMC Global CEO received US$2.1m in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is DMC Global Worth Keeping An Eye On?

DMC Global's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think DMC Global is worth considering carefully. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if DMC Global is trading on a high P/E or a low P/E, relative to its industry.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.