I Ran A Stock Scan For Earnings Growth And Newpark Resources (NYSE:NR) Passed With Ease

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Newpark Resources (NYSE:NR). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Newpark Resources

How Fast Is Newpark Resources Growing Its Earnings Per Share?

Over the last three years, Newpark Resources has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Newpark Resources's EPS soared from US$0.22 to US$0.29, in just one year. That's a impressive gain of 30%.

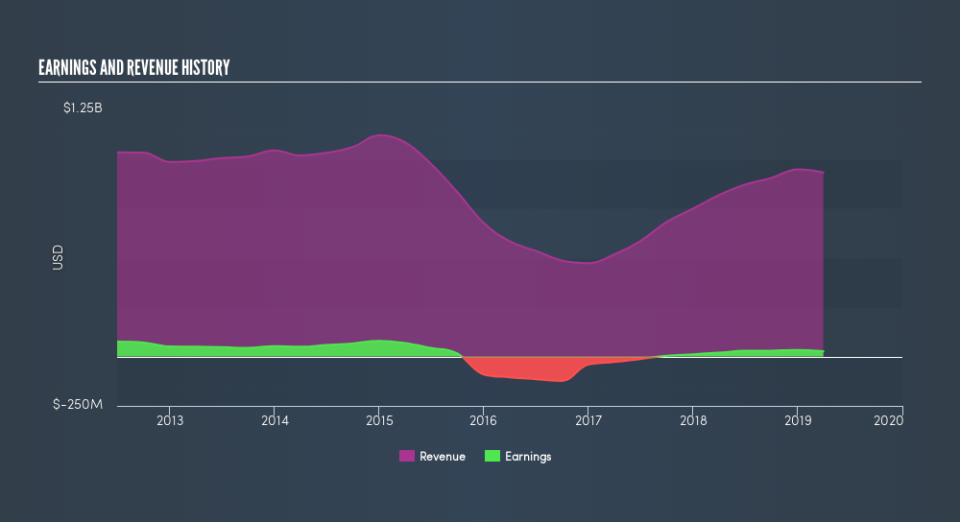

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Newpark Resources maintained stable EBIT margins over the last year, all while growing revenue 14% to US$931m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Newpark Resources's forecast profits?

Are Newpark Resources Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Newpark Resources shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that John Minge, the Director of the company, paid US$10.0k for shares at around US$7.66 each.

On top of the insider buying, it's good to see that Newpark Resources insiders have a valuable investment in the business. Indeed, they hold US$19m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 3.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Newpark Resources To Your Watchlist?

You can't deny that Newpark Resources has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Newpark Resources is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But Newpark Resources isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.