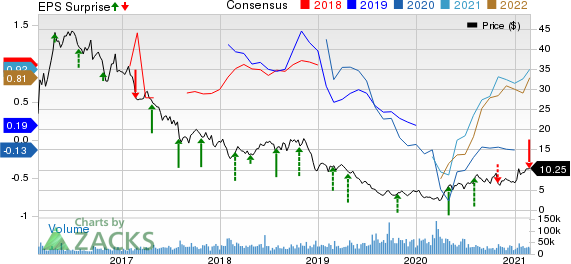

Range Resources (RRC) Q4 Earnings Miss, Revenues Top Estimates

Range Resources Corporation RRC reported fourth-quarter 2020 adjusted earnings of 2 cents per share, which missed the Zacks Consensus Estimate of 6 cents per share. Moreover, the bottom line plunged 75% year over year from 8 cents per share.

Total revenues for the reported quarter were $598.9 million, surpassing the Zacks Consensus Estimate of $511 million. However, the top line deteriorated from the prior-year number of $605.6 million.

The lower-than-expected earnings can be attributed to decreased commodity prices and low overall production volumes. This was partially offset by a decline in direct operating costs.

Range Resources Corporation Price, Consensus and EPS Surprise

Range Resources Corporation price-consensus-eps-surprise-chart | Range Resources Corporation Quote

Operational Performance

For fourth-quarter 2020, the company’s production averaged 2,087.7 million cubic feet equivalent per day, down 11% from the prior-year period. Natural gas contributed 70.2% to total production, while NGLs and oil accounted for the remaining.

Oil and NGL production fell 39% and 9%, respectively, on a year-over-year basis. Moreover, natural gas production decreased 11% from the prior-year quarter.

Its total price realization (including derivative settlements and after third-party transportation costs) averaged $1.07 per thousand cubic feet equivalent (Mcfe), down 22% year over year. Natural gas prices declined 27% on a year-over-year basis to 91 cents per Mcf. Moreover, NGL and oil prices fell 1% and 5%, respectively.

Expenses Decline

Total exploration costs declined to $9.1 million from $9.2 million a year ago. Moreover, on a unit basis, transportation, gathering, processing and compression expenses were recorded at $1.34 per Mcfe, lower than $1.39 in the prior-year quarter. Also, direct operating costs contracted to 8 cents per Mcfe from the year-ago figure of 15 cents.

Capital Expenditure & Balance Sheet

The company’s drilling and completion expenditure totaled $93 million for fourth-quarter 2020. Total capex was recorded at $113 million for the reported quarter.

At the end of the fourth quarter, it had total debt of $3,040.3 million, with a debt-to-capitalization of 65%.

Outlook

For 2021, Range Resources expects total production to average 2.15 Bcfe per day, with 30% allocated to liquids production. Moreover, the company’s overall capital budget is estimated to be $425 million.

Notably, exploration expense for 2021 is estimated to be $24-$30 million. On a per-unit basis, direct operating expenses for the year are expected to be 9-11 cents per Mcfe. Transport, gathering, processing and compression expenses are estimated to be $1.35-$1.40 per Mcfe.

Zacks Rank & Stocks to Consider

The company currently has a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are Altus Midstream Partners LP ALTM, Exxon Mobil Corporation XOM and Franks International N.V. FI, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Altus Midstream’s bottom line for 2021 is expected to surge 380.5% year over year.

Exxon’s bottom line for 2021 is expected to rise 34.4% year over year.

Franks’s bottom line for 2021 is expected to grow 57.5% year over year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Franks International N.V. (FI) : Free Stock Analysis Report

ALTUS MIDSTREAM (ALTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research