Ray Dalio's Bridgewater Buys Buffett's Banks in 4th Quarter

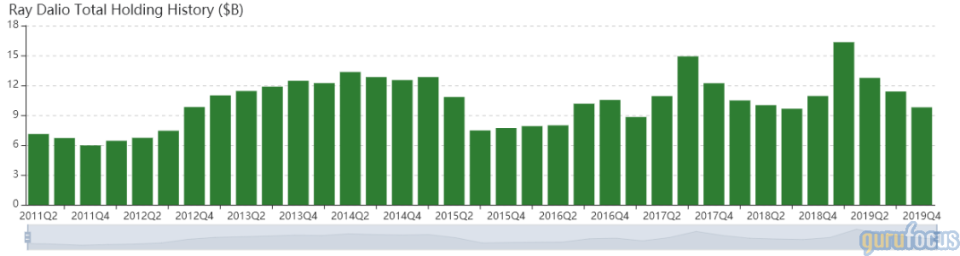

Bridgewater Associates, the $165-billion hedge fund founded by Ray Dalio (Trades, Portfolio), disclosed this week that its top buys for the fourth quarter of 2019 included several major bank holdings of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B).

The Greenwich, Connecticut-based hedge fund seeks long-term capital appreciation through Dalio's principles, which included working for what he wanted, coming up with independent opinions, avoiding overconfidence and wrestling with reality. The Bridgewater co-chief investment officer believes that by following his principles, he has moved faster towards his goals.

In a Jan. 21 CNBC Squawk Box interview at the World Economic Forum in Davos, Switzerland, Dalio said that "cash is trash" and investors should "dump cash for a diversified portfolio."

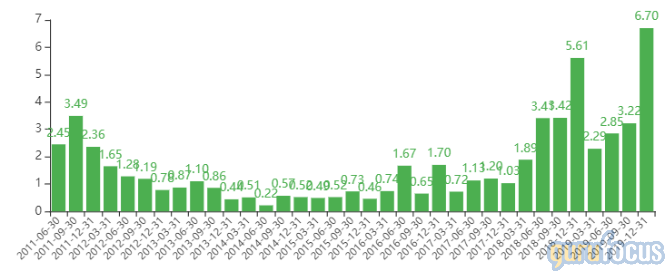

As of the quarter's end, Bridgewater's $11.38 billion equity portfolio contains 333 stocks, of which 110 represent new holdings. While exchange-traded fund holdings occupy over 70% of the equity portfolio, the financial services sector represents 6.70% of the portfolio, up from 3.22% from the September 2019 quarter.

Bridgewater's top six buys for the quarter were in JPMorgan Chase & Co. (NYSE:JPM), Bank of America Corp. (NYSE:BAC), Wells Fargo & Co. (NYSE:WFC), Citigroup Inc. (NYSE:C), U.S. Bancorp (NYSE:USB) and Goldman Sachs Group Inc. (NYSE:GS).

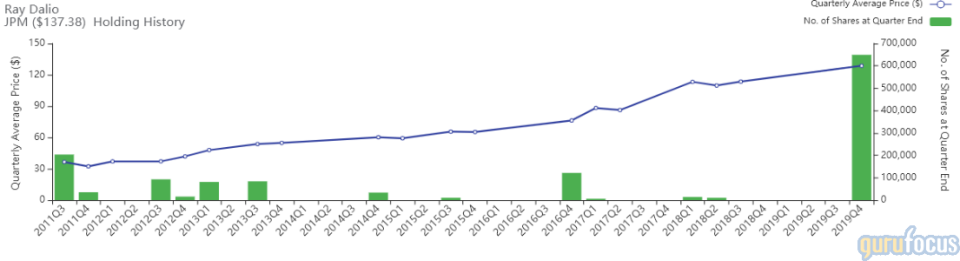

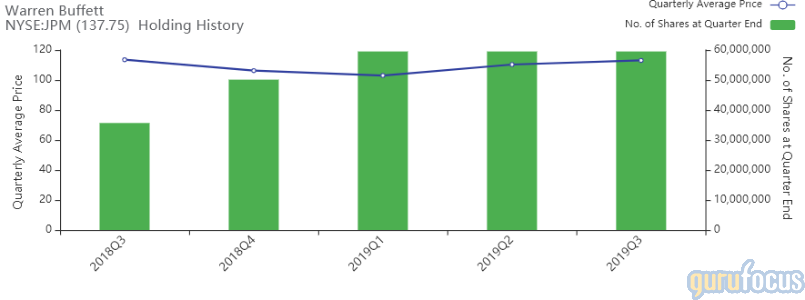

JPMorgan Chase

Bridgewater purchased 649,376 shares of JPMorgan Chase, giving the position 0.92% weight in the equity portfolio. Shares averaged $128.65 during the quarter.

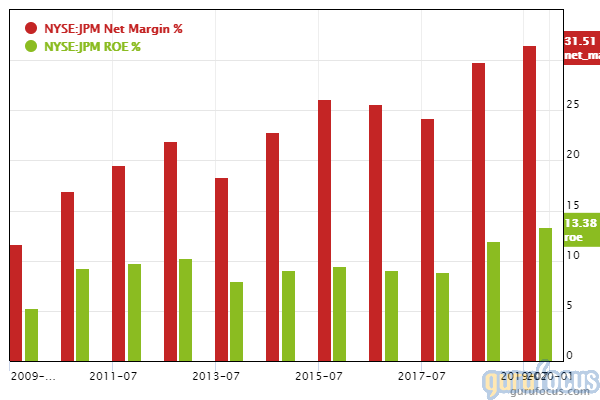

According to GuruFocus, the New York-based bank's net margin outperforms 70.91% of global competitors while the return on equity outperforms 80.11% of global banks.

Gurus with holdings in JPMorgan include Buffett, PRIMECAP Management (Trades, Portfolio) and Dodge & Cox.

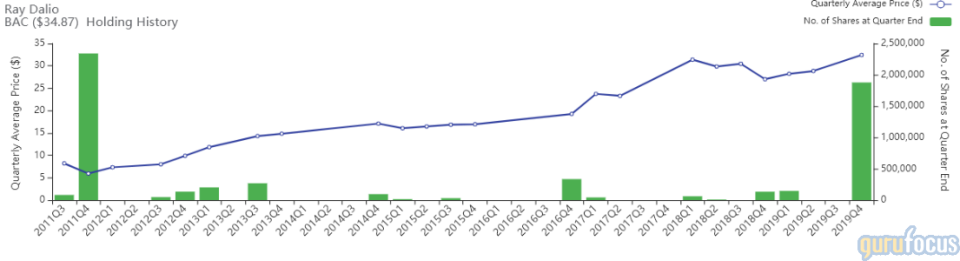

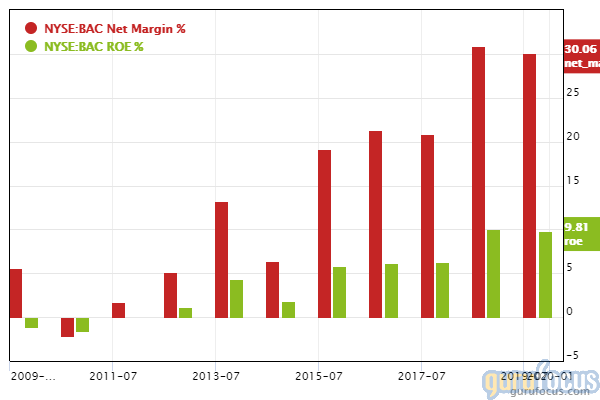

Bank of America

Bridgewater purchased 1,877,448 shares of Bank of America, giving the position 0.68% weight in the equity portfolio. Shares averaged $32.44 during the quarter.

According to GuruFocus, the Charlotte, North Carolina-based bank's equity-to-asset ratio of 0.11 outperforms 58.90% of global competitors, suggesting a relatively-safe leverage ratio. Additionally, Bank of America's net margin and return on assets outperform over 62% of global banks.

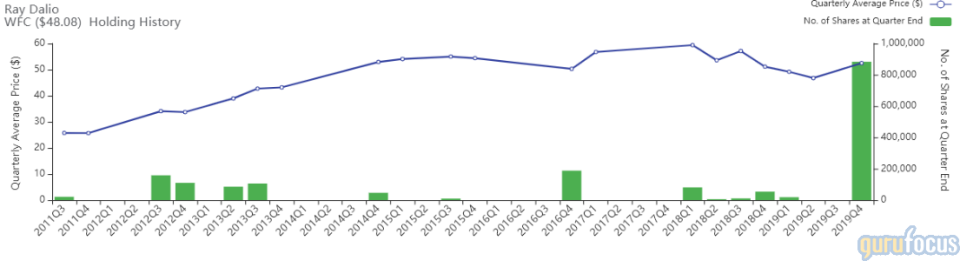

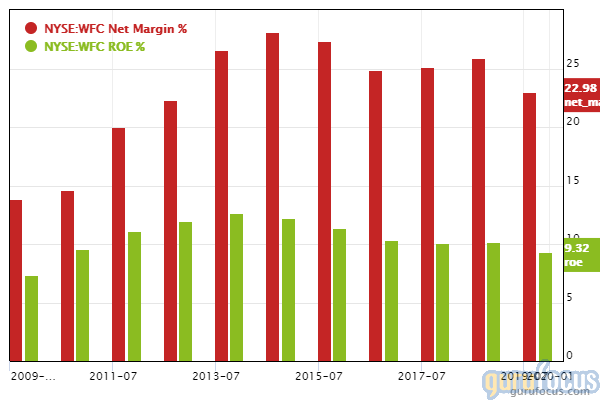

Wells Fargo

Bridgewater purchased 883,420 shares of Wells Fargo, giving the position 0.49% weight in the equity portfolio. Shares averaged $52.48 during the quarter.

According to GuruFocus, the San Francisco-based bank's margins and returns underperform slightly more than half of global competitors, suggesting moderately-low profitability.

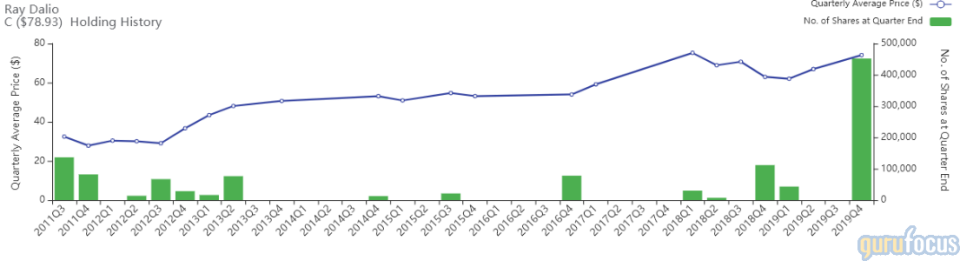

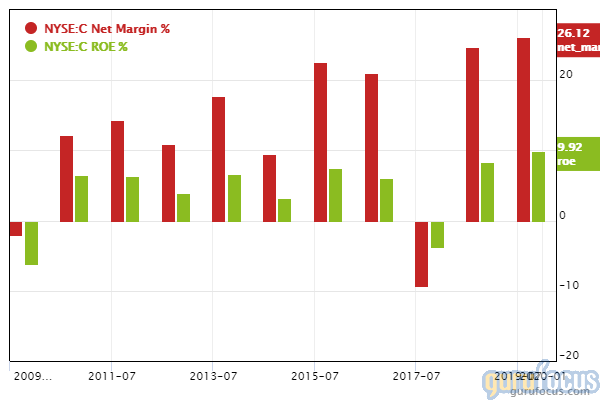

Citigroup

Bridgewater purchased 452,049 shares of Citigroup, giving the position 0.37% weight in the equity portfolio. Shares averaged $74.07 during the quarter.

According to GuruFocus, Citigroup's net margin and returns are outperforming more than half of global competitors, suggesting moderately-strong profitability.

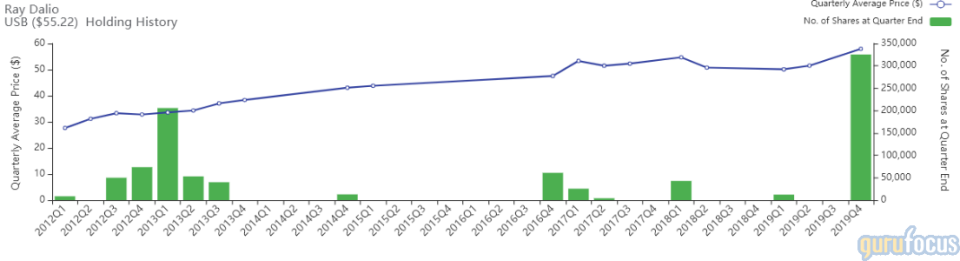

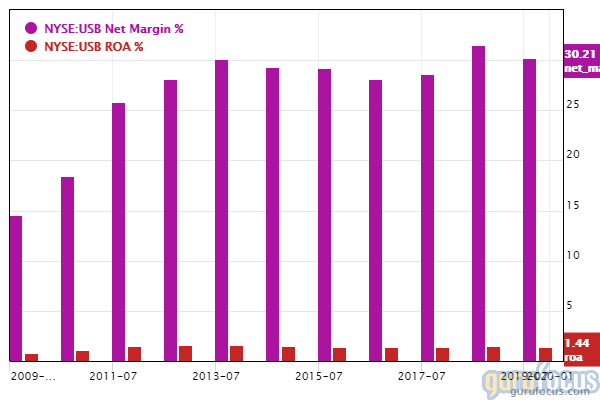

U.S. Bancorp

Bridgewater purchased 325,383 shares of U.S. Bancorp, giving the position 0.20% weight in the equity portfolio. Shares averaged $57.94 during the quarter.

According to GuruFocus, the Minneapolis-based regional bank's net margin outperforms 66% of global competitors, with returns on assets outperforming over 77% of global regional banks.

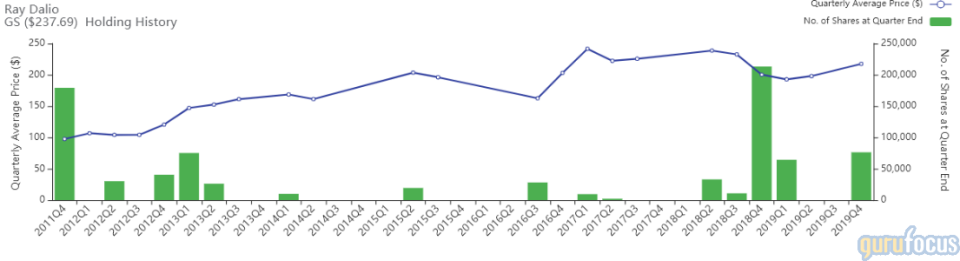

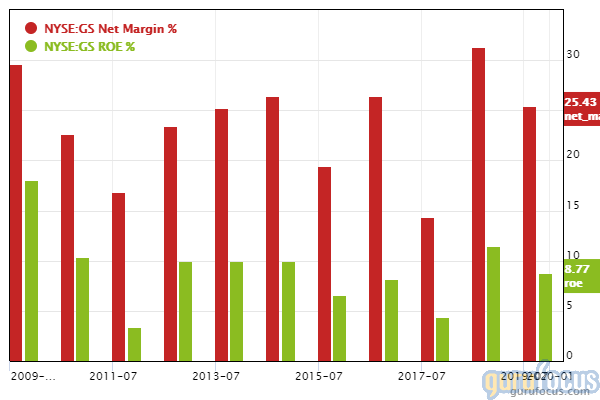

Goldman Sachs

Bridgewater purchased 76,326 shares of Goldman Sachs, giving the position 0.18% weight in the equity portfolio. Shares averaged $217.51 during the quarter.

According to GuruFocus, the New York-based investment bank's net margin and return on equity are outperforming over 67% of global competitors, suggesting good profitability.

Disclosure: No positions.

Read more here:

Top 5 Buys of Charles Brandes' Firm

Jeremy Grantham's Top 5 Buys of the 4th Quarter

First Eagle Buys Buffett's DaVita in the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here

This article first appeared on GuruFocus.