Raymond James (RJF) Q3 Earnings Beat, Revenues & Costs Up Y/Y

Raymond James’ RJF third-quarter fiscal 2021 (ended Jun 30) adjusted earnings of $2.74 per share easily surpassed the Zacks Consensus Estimate of $2.32. The bottom line was up 77% from the prior-year quarter.

Results benefited from impressive Capital Markets and Asset Management segments performance, which majorly drove revenue growth. Rise in assets balance, provision benefit and strong balance sheet position were the other tailwinds. However, higher operating expenses posed an undermining factor.

Net income (GAAP basis) was $307 million, jumping 78% from the prior-year quarter.

Revenues & Costs Rise

Net revenues were $2.47 billion, increasing 35% year over year. The rise was driven by all revenue components except interest income. The top line also beat the Zacks Consensus Estimate of $2.38 billion.

Segment wise in the reported quarter, RJ Bank registered a decline of 5% from the prior year in net revenues. Nonetheless, Private Client Group and Asset Management recorded 36% and 38% growth in revenues, respectively. Capital Markets’ top line surged 38% from the year-ago quarter. Others also recorded solid revenues of $2 million against negative revenues of $20 million in the prior-year quarter.

Non-interest expenses soared 28% to $2.09 billion. The increase was mainly due to higher compensation, commissions and benefits, and business development charges and investment sub-advisory fees, which were partly offset by provision benefit.

As of Jun 30, 2021, client assets under administration were $1.17 trillion, up 39% from the end of the prior-year quarter. Financial assets under management were $191 billion, up 31%.

Strong Balance Sheet & Capital Ratios

As of Jun 30, 2021, Raymond James reported total assets of $57.2 billion, up 2% sequentially. Total equity increased 4% from the fiscal second quarter to $7.9 billion.

Book value per share was $57.44, up from $50.84 as of Jun 30, 2020.

As of Jun 30, 2021, total capital ratio was 25.5% compared with 26.0% as of the Jun 30, 2020. Tier 1 capital ratio was 24.3% compared with 24.8% as of June 2020-end.

Return on equity (annualized basis) was 15.9% at the end of the reported quarter compared with 10.0% in the prior-year period.

Share Repurchase Update

In the reported quarter, Raymond James repurchased approximately 0.4 million shares for $48 million.

Our Take

Raymond James’ global diversification efforts, strategic buyouts and strength in investment banking business are expected to keep supporting top-line growth. However, continuously mounting operating expenses and lower interest rates remain near-term concerns.

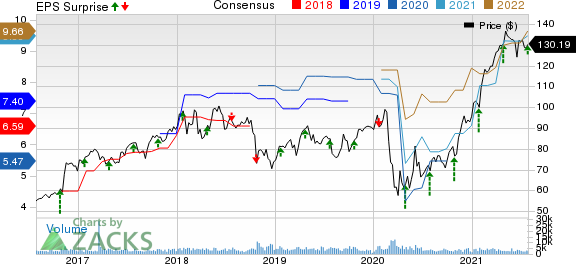

Raymond James Financial, Inc. Price, Consensus and EPS Surprise

Raymond James Financial, Inc. price-consensus-eps-surprise-chart | Raymond James Financial, Inc. Quote

Currently, Raymond James sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance & Earnings Date of Other Brokerage Firms

Charles Schwab’s SCHW second-quarter 2021 adjusted earnings of 70 cents per share beat the Zacks Consensus Estimate by a penny. The bottom line grew 30% from the prior-year quarter.

Interactive Brokers Group’s IBKR second-quarter 2021 adjusted earnings per share of 82 cents lagged the Zacks Consensus Estimate of 83 cents. However, the bottom line reflects growth of 43.9% from the prior-year quarter.

BGC Partners, Inc. BGCP is slated to announce quarterly numbers on Aug 4.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

BGC Partners, Inc. (BGCP) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

To read this article on Zacks.com click here.