RaySearch Laboratories (STO:RAY B) Shareholders Have Enjoyed A Whopping 338% Share Price Gain

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. To wit, the RaySearch Laboratories AB (publ) (STO:RAY B) share price has soared 338% over five years. And this is just one example of the epic gains achieved by some long term investors. It's even up 42% in the last week. This could be related to the recent financial results, released less than a week ago -- you can catch up on the most recent data by reading our company report.

View our latest analysis for RaySearch Laboratories

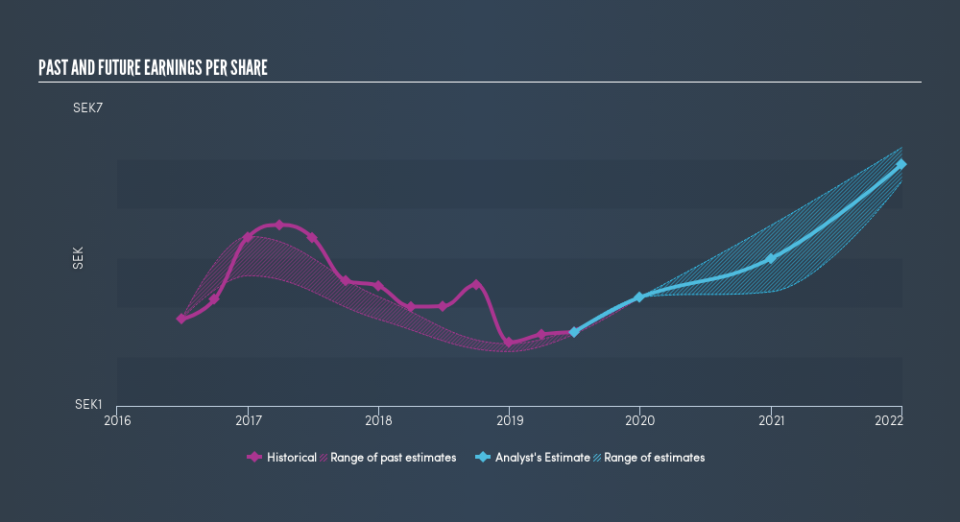

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, RaySearch Laboratories moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on RaySearch Laboratories's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that RaySearch Laboratories shareholders have received a total shareholder return of 32% over one year. However, that falls short of the 34% TSR per annum it has made for shareholders, each year, over five years. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: RaySearch Laboratories may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.