Is RaySearch Laboratories (STO:RAY B) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, RaySearch Laboratories AB (publ) (STO:RAY B) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for RaySearch Laboratories

What Is RaySearch Laboratories's Net Debt?

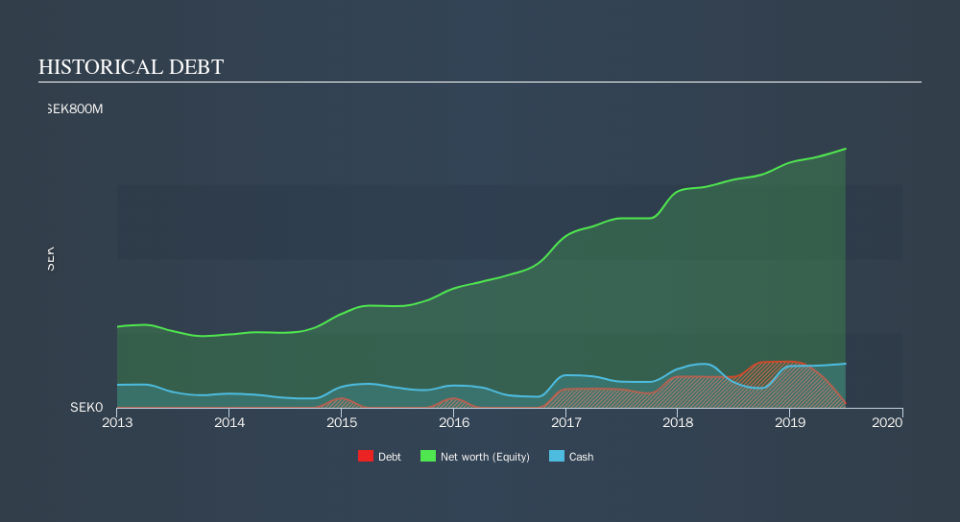

You can click the graphic below for the historical numbers, but it shows that RaySearch Laboratories had kr12.3m of debt in June 2019, down from kr82.7m, one year before. But it also has kr118.1m in cash to offset that, meaning it has kr105.8m net cash.

How Strong Is RaySearch Laboratories's Balance Sheet?

According to the last reported balance sheet, RaySearch Laboratories had liabilities of kr315.4m due within 12 months, and liabilities of kr232.4m due beyond 12 months. On the other hand, it had cash of kr118.1m and kr429.9m worth of receivables due within a year. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that RaySearch Laboratories's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the kr5.55b company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that RaySearch Laboratories has more cash than debt is arguably a good indication that it can manage its debt safely.

It is just as well that RaySearch Laboratories's load is not too heavy, because its EBIT was down 48% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if RaySearch Laboratories can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While RaySearch Laboratories has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, RaySearch Laboratories reported free cash flow worth 16% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that RaySearch Laboratories has net cash of kr105.8m, as well as more liquid assets than liabilities. So we are not troubled with RaySearch Laboratories's debt use. We'd be motivated to research the stock further if we found out that RaySearch Laboratories insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.