RBNZ Seen Delivering Hawkish Hold Ahead of New Zealand Election

(Bloomberg) -- New Zealand’s central bank is expected to keep interest rates on hold 10 days out from a general election, but policymakers may leave the door open to another increase if needed to tame inflation.

Most Read from Bloomberg

Airbnb Is Fundamentally Broken, Its CEO Says. He Plans to Fix It.

Stocks, Treasuries Pummeled by Too Hot Jobs Data: Markets Wrap

JPMorgan’s Dimon Predicts 3.5-Day Work Week for Next Generation Thanks to AI

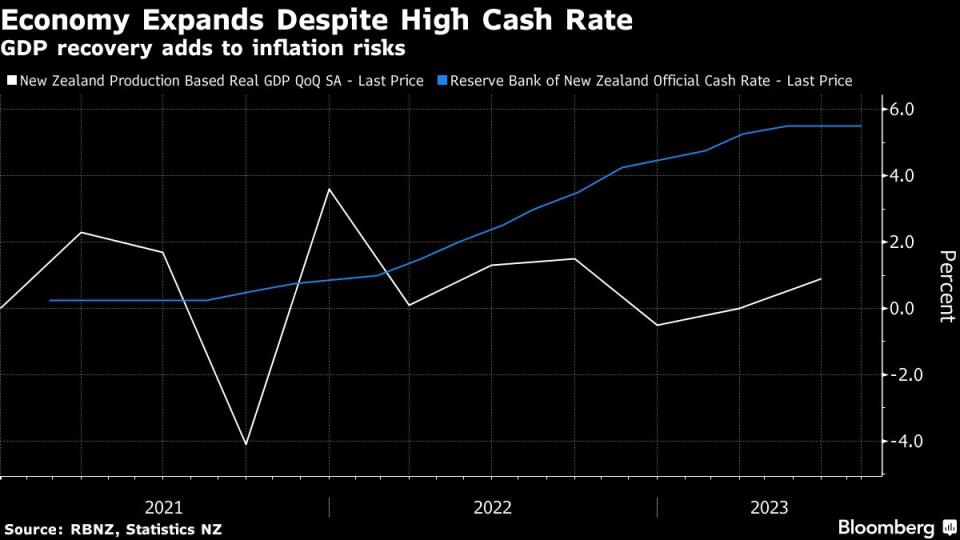

The Reserve Bank will keep the Official Cash Rate at 5.5% Wednesday in Wellington, according to all 22 economists in a Bloomberg survey. However, the RBNZ is expected to maintain a hawkish tone and reiterate the need for policy to remain restrictive for a prolonged period.

“There is still the risk that the OCR could move higher from here if inflation does not look like it will be coming down fast enough for the RBNZ’s comfort,” said Mark Smith, senior economist at ASB Bank in Auckland. “With an election looming, the RBNZ will want to keep a low profile and make policy adjustments — if need be — post-election.”

The economy grew more strongly than expected in the second quarter, oil prices are rising and inflation expectations remain elevated. While China’s economic slowdown is adding to concerns about New Zealand’s growth outlook, investors are still pricing about a 50% chance that the RBNZ will raise the cash rate to 5.75% at its final meeting of the year in November.

The RBNZ will release Wednesday’s decision at 2pm local time. It is a policy review rather than a full Monetary Policy Statement, so the bank won’t publish fresh economic forecasts or hold a news conference with Governor Adrian Orr.

At its last policy decision in August, the RBNZ raised its forecast track for the cash rate, implying a small chance of an increase, and pushed rate cuts from next year into 2025.

November Hike?

“Data since the August Monetary Policy Statement has overall been stronger than anticipated,” ANZ Bank New Zealand economists said in a research note. “We continue to expect a hike at the November meeting and risks are tilting toward even more being required in 2024.”

The economy grew 0.9% in the second quarter, more than twice as much as economists expected, while a revision to the previous quarter showed the nation hasn’t been in recession. House prices have been rising since June, according to the Real Estate Institute.

At the same time, the full impact of the RBNZ’s tightening to date has still to be felt as households gradually roll onto higher mortgage rates. Global concerns that central banks will need to work harder to curb inflation have also driven lending rates higher, tightening monetary conditions.

Furthermore, while opinion polls indicate the Labour government will be ousted at the Oct. 14 vote, there’s uncertainty over the shape of the next government, with the main opposition National Party possibly needing the support of two smaller parties to achieve a majority in parliament.

“Life is getting no less complicated for the Reserve Bank,” said Stephen Toplis, head of research at Bank of New Zealand in Wellington. “With such competing tensions, and the uncertainties surrounding the upcoming election, we think the bank would be best advised to play a straight bat, acknowledge the risks that pervade but produce a steady as you go conclusion.”

Most Read from Bloomberg Businessweek

With Banks Offering 5% Returns, Financial Advisers Fight Irrelevance

Hacking the Help Desk: How Attackers Talk Their Way Into Company Networks

Tech IPOs Could Burn Firms Who Bought Into Hot Startups Too Late

©2023 Bloomberg L.P.