Read This Before You Buy Dovre Group Plc (HEL:DOV1V) Because Of Its P/E Ratio

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). To keep it practical, we'll show how Dovre Group Plc's (HEL:DOV1V) P/E ratio could help you assess the value on offer. Based on the last twelve months, Dovre Group's P/E ratio is 15.76. In other words, at today's prices, investors are paying €15.76 for every €1 in prior year profit.

See our latest analysis for Dovre Group

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Dovre Group:

P/E of 15.76 = EUR0.33 ÷ EUR0.02 (Based on the trailing twelve months to December 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each EUR1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Does Dovre Group's P/E Ratio Compare To Its Peers?

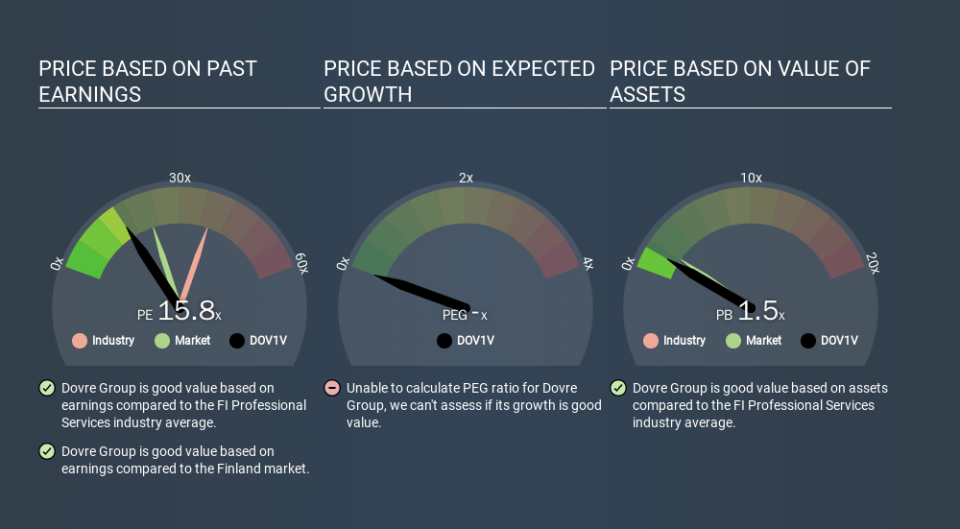

We can get an indication of market expectations by looking at the P/E ratio. If you look at the image below, you can see Dovre Group has a lower P/E than the average (38.2) in the professional services industry classification.

Dovre Group's P/E tells us that market participants think it will not fare as well as its peers in the same industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

In the last year, Dovre Group grew EPS like Taylor Swift grew her fan base back in 2010; the 149% gain was both fast and well deserved. The cherry on top is that the five year growth rate was an impressive 38% per year. So I'd be surprised if the P/E ratio was not above average.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Is Debt Impacting Dovre Group's P/E?

Dovre Group's net debt is 6.2% of its market cap. The market might award it a higher P/E ratio if it had net cash, but its unlikely this low level of net borrowing is having a big impact on the P/E multiple.

The Verdict On Dovre Group's P/E Ratio

Dovre Group's P/E is 15.8 which is below average (22.1) in the FI market. The EPS growth last year was strong, and debt levels are quite reasonable. If it continues to grow, then the current low P/E may prove to be unjustified.

When the market is wrong about a stock, it gives savvy investors an opportunity. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Dovre Group may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.