How to Read the Closing Disclosure for Your Mortgage

The closing disclosure is a relatively new wrinkle in the homebuying process. And, brace yourself: It's a form loaded with numbers and details, so it can seem like a lot to take in.

But the goal is to be clear and make you -- the buyer-borrower -- better informed. So you'll want to understand it, and read it over. Very. Carefully.

What is the closing disclosure?

A closing disclosure puts all of your important mortgage information into a handy document.

The closing disclosure is a five-page document that explains the final terms of the mortgage loan — and where all of your money will go.

Prior to closing, the numbers you've been getting about your interest rate, monthly mortgage payments, property taxes and more have been mere estimates.

While the estimates should have been as accurate as possible, the closing disclosure gives you a chance to see and challenge any changes that may have come up.

Page 1: Monthly payment breakdown

The first page of the disclosure form is devoted to showing you all of your loan basics: your interest rate, expected monthly payments and closing costs.

This section also gives a breakdown of each payment.

You'll see how one portion will go toward loan principle, and another will go toward interest. Other amounts could go toward private mortgage insurance (PMI) or be placed into escrow to pay property tax.

You're typically required to pay PMI if you're not making a down payment of at least 20%, so you'll want to have some savings so you can make a large enough down payment to avoid PMI.

Page 2: Fees and more fees

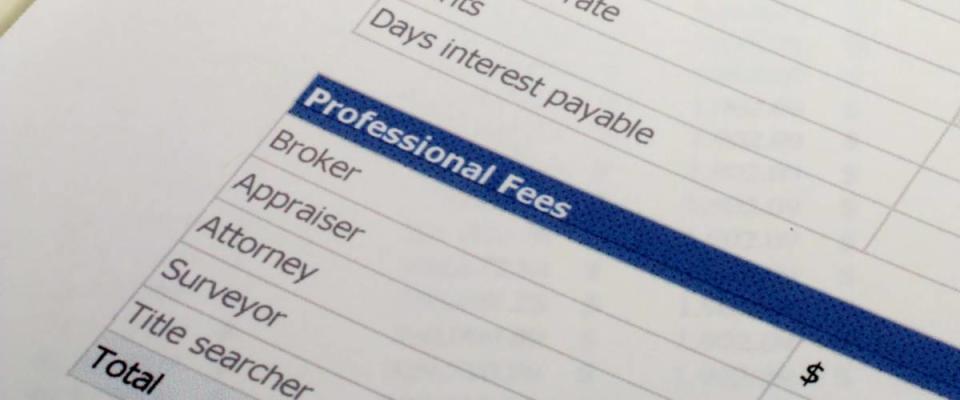

The second page of the form gives a breakdown of closing costs.

The second page of the closing disclosure has all of the nitty-gritty about your closing costs.

Buying a home is complicated and can involve a lot of people, including attorneys, inspectors and government officials.

Their services aren't free. Closing costs are the various fees that these actors in your mortgage production must be paid.

They include lawyer fees, a title search fee, a fee for recording the deed, and maybe even a simple application fee for the mortgage.

Page 3: Have your cash ready

The next page details all of the cash that you're expected to bring with you at closing.

But that may not mean forking over the entire amount required for the closing costs. You should be able to negotiate to have the seller pay some of those charges.

According to Realtor.com, sellers typically wind up paying as much as 10% of a home's sale price, which is taken from their profits.

Use our calculator to determine your monthly mortgage payment.

Pages 4 and 5: Other important stuff

The final pages answer 'What if?' questions, like What if I can't pay my mortgage?

The final two pages of the form are you go-to for answers to lots of important questions that may arise with your mortgage.

Like, what if you fall into financial trouble and can't keep up with your loan? There are disclosures about late payment fees and whether your lender will be willing to accept partial payments.

Or, what if things get really bad and your loan goes into foreclosure? You'll find information about whether you'd still be responsible for the unpaid balance under a foreclosure scenario.

And, the very last page has helpful contact information on how to reach: your lender: your real estate agent or the seller's agent; or the settlement company.

The 3-day rule

Buying a home may be the biggest financial commitment you'll ever make. You want to know exactly what you're getting into before you sign that big stack of papers at settlement.

The Consumer Financial Protection Bureau's Know Before You Owe rule gives you three days to review your closing disclosure and ask questions.

Take the time to go over the form line by line, so you'll protect yourself from any potentially expensive surprises at the closing table.