Ready for tax season? Here’s the earliest you can expect your refund in Pennsylvania

Given the complex, ever-changing nature of tax season, it’s hard to get too excited about filing your taxes every year. However, receiving a sizable refund can sometimes make the entire process worthwhile.

The federal Internal Revenue Service and the Pennsylvania Department of Revenue will begin accepting 2023 income tax returns starting Monday, Jan. 29. You’ll have plenty of time to get your documents in order before the filing deadline arrives Monday, April 15.

So, when can Pennsylvania taxpayers expect to receive their tax refunds? Here’s what you need to know.

When will my federal tax refund arrive?

The IRS expects to receive more than 128.7 million individual tax returns before April’s tax deadline arrives. According to the agency, most tax refunds are issued in fewer than 21 days.

Filing your tax return electronically and with direct deposit is the fastest and easiest way to receive a refund, the agency says. Some returns may need more time to review, especially if there are any errors.

“Although the IRS issues most refunds in less than 21 days, the IRS cautions taxpayers not to rely on receiving a refund by a certain date, especially when making major purchases or paying bills,” the agency wrote online.

You can find the latest information on your federal taxes by using the IRS’s Where’s My Refund? tool, available online at irs.gov/wheres-my-refund. After entering your filing status, your Social Security or individual taxpayer identification number and the exact refund amount on your return, you can use the system to check your refund’s status. Information in the portal is updated once daily.

What about my Pennsylvania tax refund?

Similar to the federal level, those who file their tax returns electronically in Pennsylvania can expect any potential tax refund to arrive in roughly four weeks. Paper-filed income tax returns can take up to 10 weeks from the date the return was mailed to process through the system.

The Pennsylvania Department of Revenue offers its own tax refund status service, Where’s My PA Personal Income Tax Refund?. Taxpayers can track their state-level refund’s status by entering their tax year, their refund amount and their Social Security number.

Will my local-level tax refund take longer?

As tax season ramps up, it’s important to remember Pennsylvania is one of the few U.S. states that applies local earned income taxes. As such, you need to file on the local level before taxes are due in April.

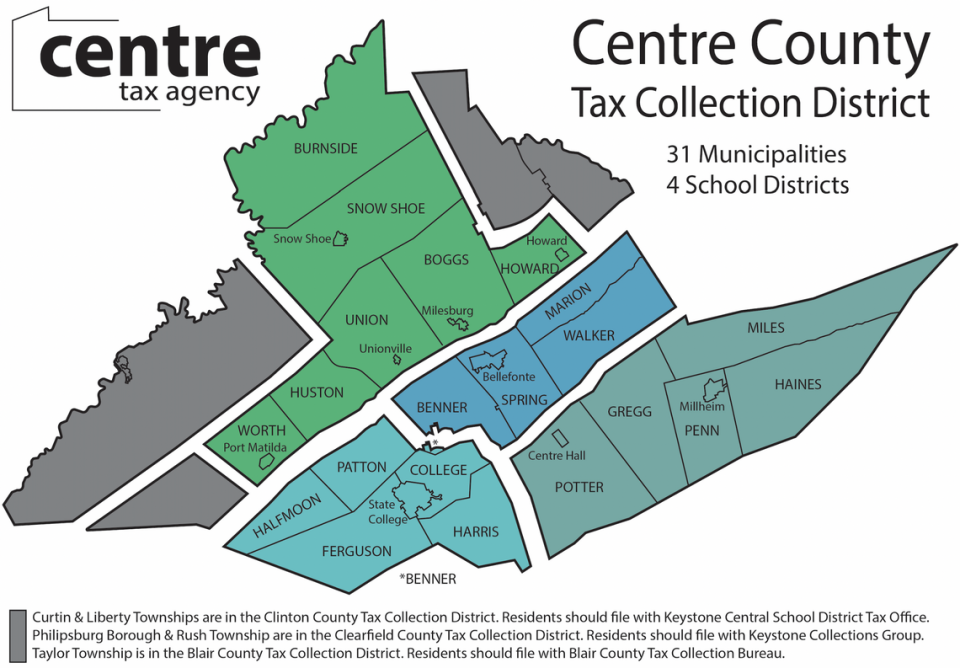

Most taxpayers in Centre County file their local returns through the Centre Tax Agency, which serves as the designated collector of local earned income taxes for 31 Centre County municipalities. Before filing, taxpayers should visit munstats.pa.gov/public/FindMunicipality.aspx to find the correct tax rates for their municipality.

Local-level tax returns take longer to process than their state-level or federal counterparts, Centre Tax Agency officials told the Centre Daily Times in 2023. Most refunds are processed within 75 days of Tax Day, or April 15, following Pennsylvania law. Technically, it is 75 days from the due date or the date a local-level return is filed — whichever is later.