Investor: Coronavirus 'possibly the biggest economic event of all our lifetimes'

A former macro fund manager said on Thursday that the economic impact of the coronavirus — which is shaving trillions off the stock market and exerting a domino effect on the world economy — might be even worse than the 2008 financial crisis.

Raoul Pal, a Goldman Sachs alum, previously co-managed GLG's global macro fund, one of the largest in the world. Since retiring back in 2004, he now authors a research letter, The Global Macro Investor, which is read by some of the most influential hedge fund managers.

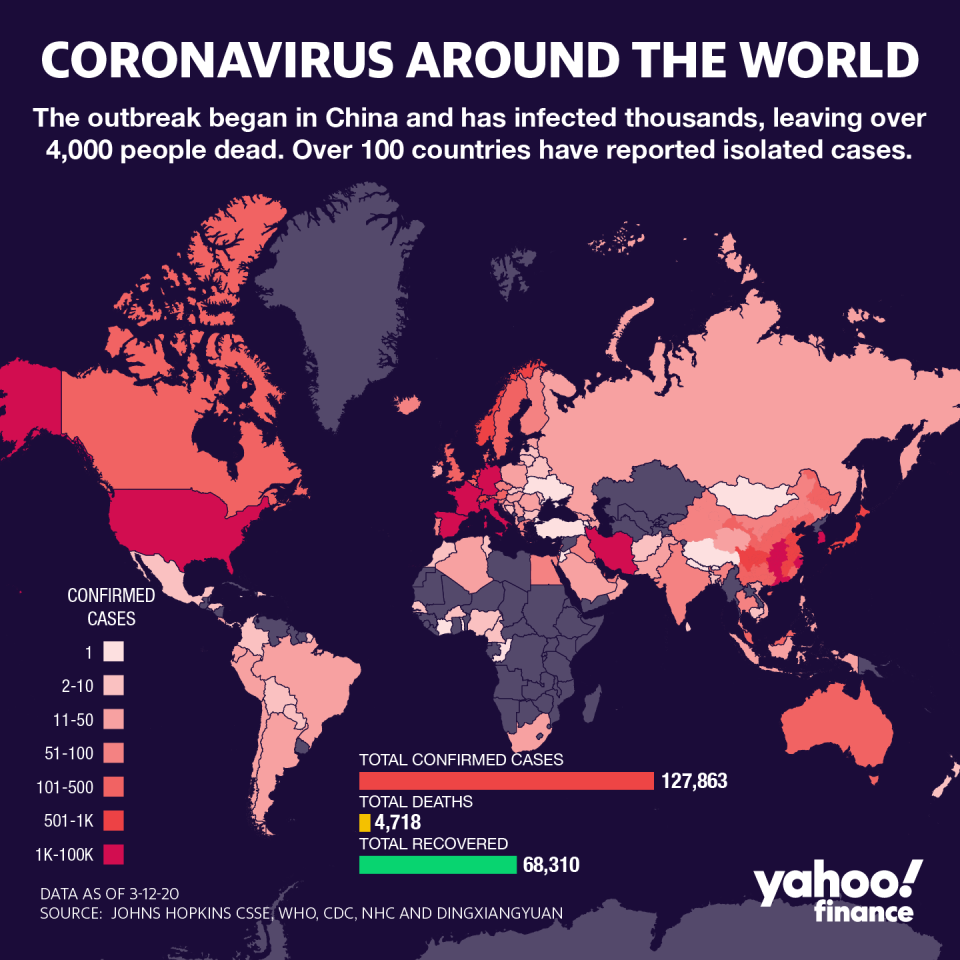

Pal told Yahoo Finance that the rapid spread of COVID-19 — which the World Health Organization declared a pandemic amid soaring new infections and death — is something that “everybody is grappling” to understand. Currently, total confirmed cases around the world climbed past 127,800, while deaths passed 4,700.

"The question is, how big of an event is this? Because if it's as the president suggests, you know, 'It's going to bounce back and everything is fine,’” then investors should just continue to hold the line, Pal told “On the Move” on Thursday.

“However, if the reality is something different, which I think this is, which I believe this is actually possibly the biggest economic event of our all of lifetimes,” he warned. “Then there [are] chances that the market falls further over time," said Pal, who also the co-founder of Real Vision Television, an online subscription financial-news service.

He added that in that latter scenario, there would obviously be periods where the market bounces — but with an unprecedented demand and supply shock, he urges people to "be cautious."

"If you're young, having cheap prices over time means you can average in overtime to your investments, and that's a good thing. It's less good for people who are closer to retirement age," he added.

‘Join the dots’

In his current pursuits, Pal extrapolates probabilities. Right now, there isn't much in the way of economic data that is fully capturing the outbreak’s effects, so investors have to "join the dots," he explained.

He added that the most recent purchasing manager index (PMI) data out of China — the second-largest economy and world's largest exporter — "was probably the weakest piece of economic data" he's ever seen in history.

That may be a taste of what's to come elsewhere, Pal cautioned.

"Now, people initially extrapolated that it was just a China problem. And South Korea then struggled, Singapore, and a few other countries, but they did a great job,” he said.

“What happened was the spread into Italy, and now across Europe and into the U.S., that's something worse,” he added.

Italy is currently under a strict lockdown nationwide with restaurants and retail shops, except for pharmacies and grocery stores, closed as the country aims to minimize social interactions and contain the spread of the virus. Pal thinks the country is in for a period of “zero economic output” where consumers can’t spend, work or otherwise be productive.

Turning to the U.S., Pal sees the probability of further downside in the market and a possible recession on the horizon, especially with stocks selling off so violently.

“So, that makes me think that the potential is much worse because, for me, it already looks like it's going to end up being worse than 2008 in economic terms,” he said. Yet the problem is that there are too many unknowns surrounding the virus’ impact in the U.S.

"The most crucial thing of all is what happens over the summer? The markets have a hope that the virus diminishes over the summer and maybe dies off like SARS did,” Pal said, referencing the severe acute respiratory syndrome outbreak in the early 2000s.

“But studies seem to suggest that's not going to bet the case. We just don't know, so the market has to grapple with the possibility that it comes back later in the summer with a vengeance much like the Spanish Flu did,” he said — making it impossible for the market to price.

"Hence, where the markets are in free-fall trying to find someplace to stop, to say, 'OK, we've now caught up with reality and now need to see what develops,’” the investor said. “I think the reality is lower down in the markets than here still."

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.