Record Mexico Bond Sales Set to Spill Into 2024, Santander Says

(Bloomberg) -- A record year for Mexico’s bond market will spill over into 2024 as companies ramp up spending ahead of the nation’s presidential election, according to the head of one of the nation’s top underwriters.

Most Read from Bloomberg

Sam Altman, OpenAI Board Open Talks to Negotiate His Possible Return

McKinsey and Its Peers Are Facing the Wildest Headwinds in Years

Nvidia Fails to Satisfy Lofty Investor Expectations for AI Boom

Hulu for $1, Max for $3: Streaming Services Slash Prices This Black Friday

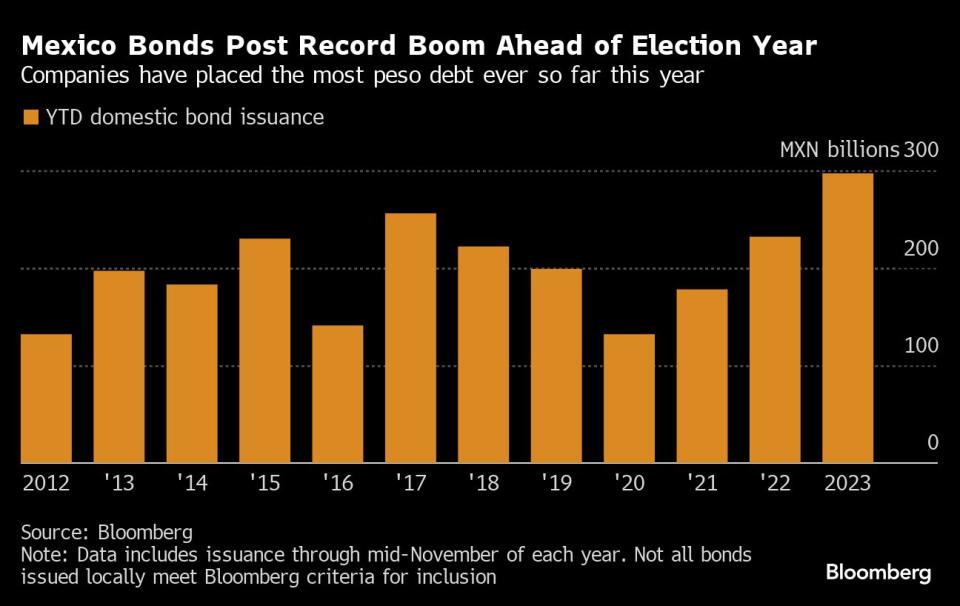

Mexican corporations sold around 300 billion pesos ($17 billion) of debt in local markets through mid-November. That’s the most for the time period since at least 2012 when Bloomberg began tracking the data.

Felipe Garcia Ascencio, chief executive officer of Banco Santander SA’s Mexico unit, said companies are using the market to finance growth plans and they’re finding willing buyers for their debt in local pension funds that are flush with cash.

“We have a large number of assets under management that are quite keen to buy these credits. It’s a market that works very well,” Garcia said in an interview in the bank’s corporate offices in Mexico City.

Santander, last year’s biggest underwriter for local bonds, is competing with Banco Bilbao Vizcaya Argentaria SA’s local unit for the top spot this year, preliminary data compiled by Bloomberg show.

The blockbuster year has been led by big issuance from some of the nation’s largest companies, like billionaire Carlos Slim’s America Movil SA and food maker Grupo Bimbo, owner of Sara Lee-brand breads.

The momentum is set to continue at least through the first half of 2024, Garcia said, as government spending boosts economic growth ahead of the June presidential vote. The market may slow slightly in the second half as investors turn more cautious following the election.

“It’s going to remain relatively strong,” Garcia said. “We will probably start to see a few indices deteriorate slightly in terms of credit worthiness, but very, very slightly.”

Garcia, previously the bank’s head of capital markets, took the job last year, replacing Hector Grisi, who became CEO of the Spanish parent company. Santander Mexico is the country’s second-largest bank by total assets with the third biggest loan portfolio.

Equity Outlook

The landscape for equity issuance is also improving as the economy, expected to expand above 3% this year, feeds the growth of consumer-focused companies, he said.

Mexico hasn’t seen a large company make an initial public offering in the last six years. Secondary offerings recovered this year as industrial property real estate trusts and companies with ties to manufacturing moved to raise cash amid the buzz around the relocation of supply chains to be closer to the US, or nearshoring.

Mexico’s Congress approved last week a bill designed to spur more debt and stock listings. While Garcia said the regulations could help the IPO market, it will largely depend on the “macro situation,” including growth of the economy in the US, Mexico’s largest trading partner.

Read More: Mexico’s Congress Approves Key Bill to Boost Company Listings

Garcia also cautioned that the nearshoring boom faces hurdles, including a lack of space for new industrial parks in major hubs, insufficient roads and water and power supply issues.

“If we do not work, private sector and public sector, together to ensure that we’re investing in infrastructure, in energy, in water, in ports, in health, education and so forth, I’m not sure how far this Mexican moment is going to run,” he said.

Citigroup Inc. analysts last month said that it’s unclear how much of Mexico’s economic growth is due to nearshoring, even if it is picking up.

“Nearshoring is a net win for Mexico but will not be immediately transformative,” they wrote in a note to clients. “Concerns about near-term bottlenecks are increasing, and the outcome of the biggest catalyst — the 2024 election — remains uncertain in its implications for policy change.”

‘Huge’ Opportunity

For now, Garcia is bullish. Santander plans to invest $1.5 billion over the next three years as it looks to beef up its technology to compete with fintech companies including Warren Buffett-backed Nu Holdings Ltd.

Santander is noticing the interest in nearshoring in its own business too, seeing activity spring up across the country, not just in the north. It’s shifting its branch strategy, shutting down offices in dense urban areas where users are going digital, and opening them in the outskirts near industrial parks and other new business.

The country’s banking sector got a boost last week from JPMorgan Chase & Co. Chair and CEO Jamie Dimon, who said he saw a ”huge” opportunity in Mexico.

Garcia said that momentum could translate into larger equity offerings next year and not necessarily limited to the shifts in global trade.

“There’s going to be money invested in Mexico for quite some time,” he said. “That means employment is going to remain healthy and Mexicans are going to be doing well.”

Most Read from Bloomberg Businessweek

How Elon Musk Spent Three Years Falling Down a Red-Pilled Rabbit Hole

More Americans on Ozempic Means Smaller Plates at Thanksgiving

Guatemalan Town Invests Remittance Dollars to Deter Migration

©2023 Bloomberg L.P.