Red flags shouldn’t be ignored – but this French car maker might be an exception

A useful rule of thumb for investors is to avoid companies with shares priced at less than six times earnings. Usually these are value traps.

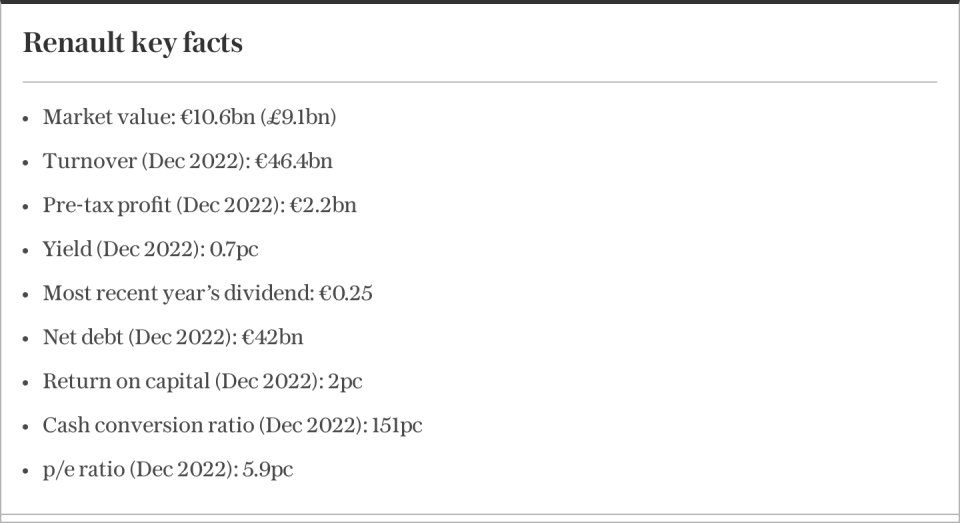

So, a forecast price-to-earnings ratio of less than three, as is the case with French car maker Renault, would normally be a major red flag. But that hasn’t deterred some of the world’s best fund managers, who are enthusiastic backers of the stock.

Thirteen of these investors, each among the top-performing 3pc of the 10,000 equity fund managers tracked by the financial publisher Citywire, own shares in Renault. That results in the car maker’s top AAA rating from Citywire Elite Companies, which rates companies on the basis of their backing by the best-performing fund managers.

Let’s start with the bad news that explains why the shares’ valuation is so low.

Europe’s internal combustion engine (ICE) car industry has long suffered from overcapacity and poor profitability. The phasing out of petrol and diesel vehicles is now forcing car makers into expensive business overhauls. But the electric vehicles (EVs) they expect to replace ICE cars are being manufactured more cheaply in China, by the likes of BYD.

Added to this worrisome long-term trend is a dicey near-term economic outlook in Europe, where Renault makes over three quarters of its sales.

Renault’s ability to adapt is also constrained by politics. Specifically, the French state’s ownership of a 15pc stake in the company, alongside heavy union involvement.

Problems don’t stop there. The company was left reeling by the sensational arrest – then escape – of former chief executive Carlos Ghosn five years ago in Japan. His departure saw a key alliance with Nissan and Mitsubishi turn sour prior to Covid-19, which sent the car industry into disarray.

However, Luca de Meo, Renault’s chief executive since mid-2020, has been working to get the company back on track. His efforts appear to have captured the imagination of top fund managers.

A major step forward last year was a recalibration of the Nissan alliance, which paves the way to unlock value and reclaim an investment-grade credit rating.

To balance both companies’ voting rights in each other at 15pc, a 28pc stake in Nissan, from Renault’s 43pc holding, was put in trust. Already a 5pc stake has been sold, freeing up cash for Renault, with the remaining 23pc in trust worth about €3.1bn (£2.7bn) at Nissan’s current market price.

Meanwhile, Renault has already raced through two phases of a three-step plan to reboot growth and profitability. Operating profit margins are expected to reach nearly 8pc this year compared with a peak of 6.6pc over the past decade.

While some analysts think this is as good as it gets, de Meo believes there’s better to come as he seeks to profit from industry changes.

Renault is often seen as a likely victim of structural change. But by creating a flexible organisation with devolved decision-making, de Meo thinks the company can exploit fast-developing opportunities in EVs, software and the circular economy.

To this end, a near-term opportunity is a plan to spin out Renault’s EV and software division Ampere in the first half of 2024. The company has mooted a flotation value of €10bn, which compares with Renault’s market value of just €10.6bn.

Cynics have suggested a more likely valuation of a couple of billion euros if the division can be floated at all, pointing to the significant cost reductions and volume increases required to make Ampere profitable.

A new joint venture with Chinese car maker Geely could meanwhile help prolong Renault’s ICE business. The partnership, called Horse, is focused on ICE and hybrid engine production, and has lined up Saudi Arabian oil giant Aramco as a potential investor and developer of hydrogen technologies. Ultimately, Horse is aiming to supply engines for ICE cars with a lower cradle-to-grave carbon footprint than today’s EVs.

Then there are Renault’s actual cars. The company’s high-end Alpine performance car division aims to grow sales from less than €1bn this year to over €8bn by 2030, helped by four new launches. Its budget Dacia brand meanwhile makes good money by the industry’s standards and the profitability of Renault’s other vehicle brands has been improving.

There’s also steady income from Renault’s RCI Bank, which finances purchases and provides insurance. As of June 2023, the operation accounted for €52bn of Renault’s total debt of €65bn and €45bn net debt.

While the extreme cheapness of Renault’s shares reflects big risks, the changes afoot at the group and potential for deals to unlock value explains why so many top investors believe it may be worth ignoring a classic rule of thumb.

Questor says: buy

Ticker: EPA:RNO

Share price at close: €34.51

Algy Hall is investment editor of Citywire Elite Companies

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips