Reflecting on PhaseBio Pharmaceuticals' (NASDAQ:PHAS) Share Price Returns Over The Last Year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS) shareholders over the last year, as the share price declined 11%. That's well below the market return of 42%. Because PhaseBio Pharmaceuticals hasn't been listed for many years, the market is still learning about how the business performs. On top of that, the share price is down 11% in the last week.

View our latest analysis for PhaseBio Pharmaceuticals

We don't think PhaseBio Pharmaceuticals' revenue of US$1,084,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that PhaseBio Pharmaceuticals has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

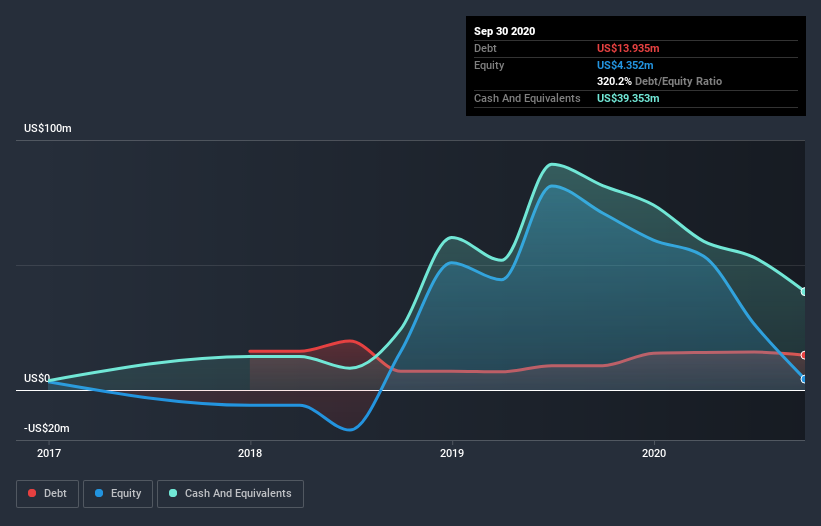

Our data indicates that PhaseBio Pharmaceuticals had US$15m more in total liabilities than it had cash, when it last reported in September 2020. That puts it in the highest risk category, according to our analysis. But since the share price has dived 11% in the last year , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how PhaseBio Pharmaceuticals' cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

While PhaseBio Pharmaceuticals shareholders are down 11% for the year, the market itself is up 42%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 2.9%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand PhaseBio Pharmaceuticals better, we need to consider many other factors. Take risks, for example - PhaseBio Pharmaceuticals has 5 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.