Regal Beloit (RBC) Tops on Q2 Earnings, Gives Solid '21 View

Regal Beloit Corporation RBC delivered impressive results for the second quarter of 2021. Its earnings surpassed estimates by 11.76% and sales exceeded the same by 7.87%. This was the company’s eighth consecutive quarter of better-than-expected results.

Adjusted earnings in the reported quarter were $2.28 per share, surpassing the Zacks Consensus Estimate of $2.04. The bottom line grew 140% from the year-ago quarter’s 95 cents on sales and margin improvements.

In the first quarter, Regal Beloit announced that it signed an agreement with Rexnord Corporation RXN to combine operations with the latter’s Process and Motion Control segment. The deal will be completed in the second half of 2021. Adjusted earnings before interest, tax, depreciation and amortization are expected to be in excess of $1 billion in 2022.

Revenue Details

In the reported quarter, Regal Beloit’s net sales were $886.9 million, increasing 39.9% year over year. Organic sales in the reported quarter increased 37.2% and movement in foreign currencies benefited the company by 2.7%.

Improvements in industrial markets boosted the quarterly performance. Along with this, strengthening material handling; heating, ventilation and air conditioning; commercial refrigeration; pool pump and others markets were tailwinds.

Also, the top line surpassed the Zacks Consensus Estimate of $822 million.

Regal Beloit reports results under four segments — Climate Solutions, Commercial Systems, Industrial Systems and Power Transmission Solutions. A brief discussion on the segments is provided below:

Revenues from Climate Solutions totaled $257.3 million, rising 44.4% year over year. It represented 29% of net sales. The results benefited from organic sales growth of 43.4% and foreign currency translation had a positive impact of 1%.

Commercial Systems’ revenues, representing 30.4% of net sales, were $269.3 million, up 53.1% year over year. Organic sales in the reported quarter increased 49.6% and movements in foreign currencies benefited the top line by 3.5%.

Industrial Systems generated revenues of $145.2 million, reflecting year-over-year growth of 20.4%. It represented 16.4% of the reported quarter’s net sales. Organic sales increased 15.2% year over year and foreign currency movements benefited the company by 5.2%.

Power Transmission Solutions’ revenues, representing 24.2% of net sales, were $215.1 million, up 34.9% year over year. Organic sales increased 33.1% and foreign currency movements benefited results by 1.8%.

Margin Picture

In the reported quarter, Regal Beloit’s cost of sales increased 37% year over year to $635.4 million. It represented 71.6% of net sales versus 73.1% recorded in the year-ago quarter. Gross profit increased 47.7% year over year to $251.5 million, while margin increased 150 basis points (bps) to 28.4%. Operating expenses of $140.2 million increased 15.3% year over year and represented 15.8% of net sales in the reported quarter.

Adjusted operating profit was $123.8 million, up 108.1% year over year, while margin increased 460 bps to 14%. Interest expenses in the second quarter expanded 8.5% year over year to $11.5 million. Adjusted effective tax rate in the reported quarter was 19.2% versus 22.4% in the year-ago quarter.

Balance Sheet and Cash Flow

Exiting the second quarter of 2021, Regal Beloit had cash and cash equivalents of $618.5 million, reflecting a 9.2% increase from $566.4 million recorded in the last reported quarter. Long-term debt increased 0.3% sequentially to $789 million.

In the second quarter, Regal Beloit generated net cash of $87.1 million from operating activities, reflecting year-over-year growth of 0.2%. The company’s capital investment for purchasing property, plant and equipment increased 43.2% from the year-ago figure to $13.6 million. Free cash flow was $73.5 million, down 5% from $77.4 million in the year-ago quarter.

Free cash flow (as a percentage of adjusted net income) was 90.3% in the second quarter of 2021 versus 255.4% in the year-ago quarter.

In the second quarter, the company paid out dividends totaling $12.2 million to shareholders. Notably, it refrained from repurchasing its shares in the reported quarter.

Recently, the company’s board of directors approved the payment of a quarterly dividend of 33 cents per share to shareholders of record as of Oct 1. The disbursement date has been fixed as Oct 15.

Outlook

The company anticipates gaining from strengthening end markets and margin improvements in 2021. Adjusted earnings per share in the year are expected to be $8.70-$9.00, suggesting year-over-year growth of 53% (at the mid-point). Sales are expected to grow in high-teens from the previous year.

Capital expenditure for 2021 is expected to be $60 million (higher than $57 million stated earlier), the effective tax rate is likely to be 21% (maintained), and net interest expenses are anticipated to be $28 million (maintained). Free cash flow (as a percentage of adjusted net income) will likely be more than 100% (maintained).

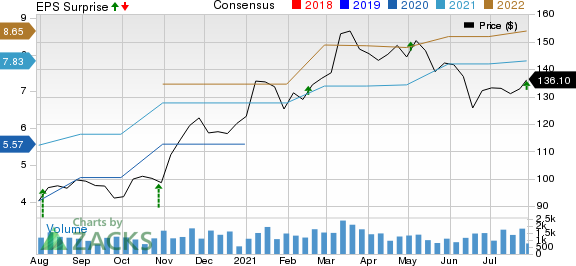

Regal Beloit Corporation Price, Consensus and EPS Surprise

Regal Beloit Corporation price-consensus-eps-surprise-chart | Regal Beloit Corporation Quote

Zacks Rank & Other Stocks to Consider

With a market capitalization of $5.5 billion, Regal Beloit currently carries a Zacks Rank #2 (Buy).

Two other top-ranked stocks in the industry are A. O. Smith Corporation AOS and Eaton Corporation plc ETN. Both companies currently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, bottom-line estimates for both companies have improved for the current year. Further, positive earnings surprise in the last reported quarter was 7.14% for A. O. Smith and 15.20% for Eaton.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Regal Beloit Corporation (RBC) : Free Stock Analysis Report

Rexnord Corporation (RXN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research