Republic Services: Strong Results Don't Come Cheap

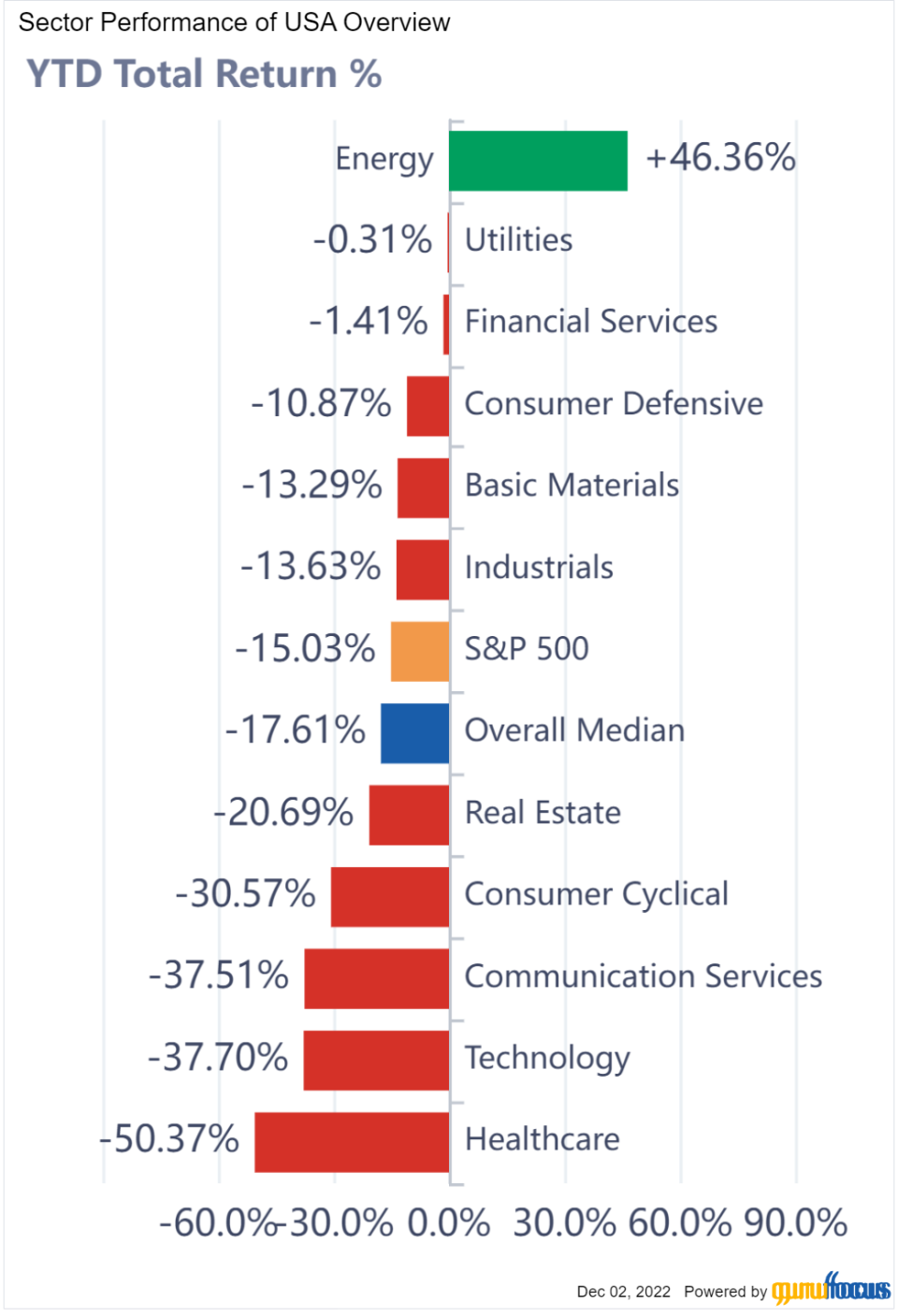

Republic Services Inc. (NYSE:RSG) has gained a little more than 3% year to date, which is well ahead of the double-digit decline in the S&P 500 Index.

There is likely a simple explanation for this as Republic Services provides solid waste disposal and recycling services that customers need regardless of the state of the economy. As such, the companys business is very resilient and has grown under almost every type of conditions.

Takeaways from recent earnings results

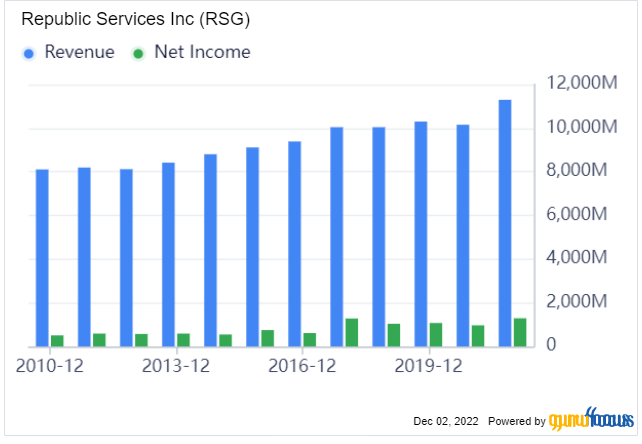

Republic Services has seen steady growth over much of the last decade.

The company has proven to be very successful at outperforming the markets expectations. For example, Republic Services announced third-quarter earnings results on Oct. 27. Revenue grew 23% to $3.6 billion and topped analysts estimates by $67 million. Adjusted earnings per share totaled $1.34, a sizeable improvement from the prior years result of $1.11 and 12 cents ahead of expectations.

Republic Services has beaten revenue estimates in nine out of the past 11 quarters and has not missed earnings estimates since the second quarter of 2018.

Trash and recycling services are basic and essential to everyday life for residential and commercial customers. This provides Republic Services with a wide moat business. Even in the worst of the Covid-19 pandemic, when many businesses were forced to close, trash still needed to be collected. This demand shows up in the companys results. Revenue fell just 6% and 3% in the second and third quarters, respectively, of 2020. Compare these declines to almost any other industry and they are likely to look much more attractive.

Just as important, Republic Services rebounded very quickly and, by the next year, revenue would set new company records.

The same can be said about the Great Recession. Earnings per share fell just 7.3% from 2007 to 2009 before making a new high by 2011.

These results show the stickiness of the companys business even in difficult environments, as well as its ability to grow under improving conditions.

According to Value Line, revenue and earnings per share have a compound annual growth rate of 3.7% and 9.8% over the last decade. The difference in the growth rates has been a reduction in the share count and a 360-basis points expansion in the net profit margin to 11.8%.

The most recent quarter showed exceptional growth, the best in the companys recent history in the case of revenue. A little more than 12% of this revenue growth comes from Republic Services purchase of U.S. Ecology. The deal, which had a total value of $2.2 billion including debt, closed on May 2. The addition of U.S. Ecology will only enhance Republic Services leadership position in the solid waste disposal and recycling market, which is estimated at $91 billion.

The third quarter was the first where U.S. Ecology was included for the entirety of the period and the additional month of inclusion saw revenue grow nearly 6% sequentially. The company should be accretive to earnings as soon as this year.

Republic Services is not just benefiting from a timely acquisition. Organic revenue was higher by 10.2%, while revenue growth from average yield was 5.6% and volume was up 2.2%. Core pricing increased almost 7%. Not only are the companys services seeing strength in its business, customers are willing to pay more for them.

In addition, a tight labor market is acting as a tailwind to Republic Services as competitors are not able to make the companys services due to a lack of workers. This is reflected in open market pricing, which tracks worker expenses and was up 8.7%. Restricted pricing, which use CPI adjustments in contracts, was only up 4%.

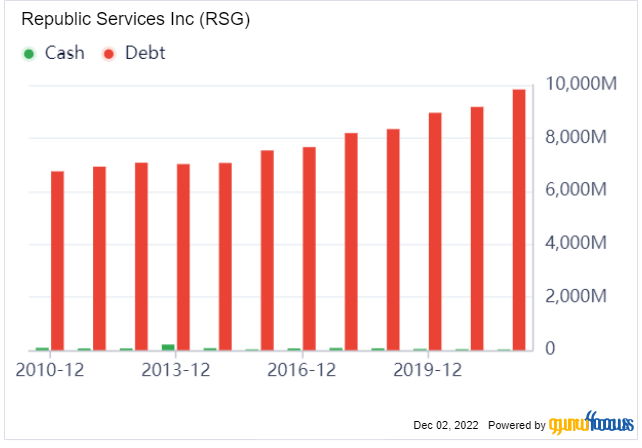

There are some negatives with regards to Republic Services as an investment. First, the companys long-term debt has greatly increased over the last decade.

In total, long-term debt has increased more than 62% over the last 10 years. Approximately a quarter of this debt matures within the next five years.

The good news is this debt has been used to fuel growth to such levels that adjusted earnings per share and adjusted free cash flow have 11% and 10% compound annual growth rates over the last three years. These rates should accelerate with U.S. Ecology now a part of the company. For example, third-quarter free cash flow improved 23% year over year to almost $1.7 billion. Equipped with this type of cash flow, debt levels should be more manageable, though this is an area shareholders will want to monitor.

The second issue is the price of recycling prices. The average recycled commodity price per ton sold during the quarter was $162, which was $56 lower sequentially and down $68 year over year. Pricing is expected to be in the low-$90 range for the fourth quarter. Inflationary pressures are one reason that pricing has fallen as higher energy costs have led to weaker demand for recycled material.

Another reason for the decline in pricing includes the strong U.S. dollar. A strengthening dollar caused exports to international markets, such as India and Southeast Asia, to become significantly more expensive. Demand in these regions is key as the U.S. does not trade much material with Europe. Without demand from these markets, pricing will face further pressure.

If expected fourth-quarter pricing were to remain constant for 2023, then adjusted earnings per share could be reduced by as much as 15 to 18 cents, not an immaterial amount.

Even here there is sliver of good news as the dollar has begun to weaken slightly, but a further weakening would be needed to help increase demand.

Despite this, Republic Services expects adjusted earnings per share in a range of $4.77 to $4.80 for 2022, which would be a 15% increase at the midpoint.

The company has an excellent GF Score of 91 out of 100, implying outperformance in the stock could be had going forward. This score is driven by perfect or near-perfect scores for growth, profitability and momentum, offset by weaker showings on financial strength and value.

Valuation analysis

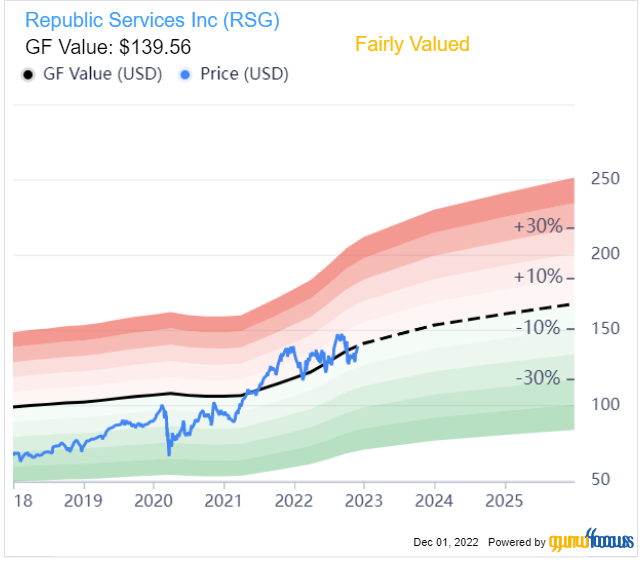

Based on managements guidance for the year, Republic Services is trading at 29 times forward estimates. This is a premium multiple, but investors have shown a willingness to pay up for stable growth and solid performance under adverse conditions. Shares have a price-earnings ratio of more than 25 over the last five years, so the stock is overvalued in comparison to its medium-term average.

The GF Value chart shows the stock to be trading right at fair value.

Republic Services has a price-to-GF Value ratio of exactly 1.

Final thoughts

Republic Services has used its positioning as a leader in its industry to produce solid results over the long term. A recent acquisition has caused growth rates to spike, but the company is also seeing high rates of organic growth. Income investors will note the company has raised its dividend for 18 consecutive years.

Shares are not cheap as investors have pushed the multiple to the high 20 range. Using intrinsic value, shares are much more fairly valued.

Value investors might be turned off by the multiple, but others might find Republic Services' ability to navigate difficult periods of time, as well as the its sticky business model, as attractive.

And while trash and recycling services may not be the most exciting industry, Republic Services ability to outperform the broader market should stand out.

Even with these tailwinds, Republic Services has a fairly valued rating from GuruFocus, which some investors might find appealing given the steadiness of the business.

This article first appeared on GuruFocus.