Republicans have three tax plans. Now they need to choose one.

Good morning, and happy Friday! We've made it through the Iowa Legislature's third week.

And it was a doozy, with lively debates on child care, ethanol, judges, traffic cameras, experimental treatments — oh, and taxes.

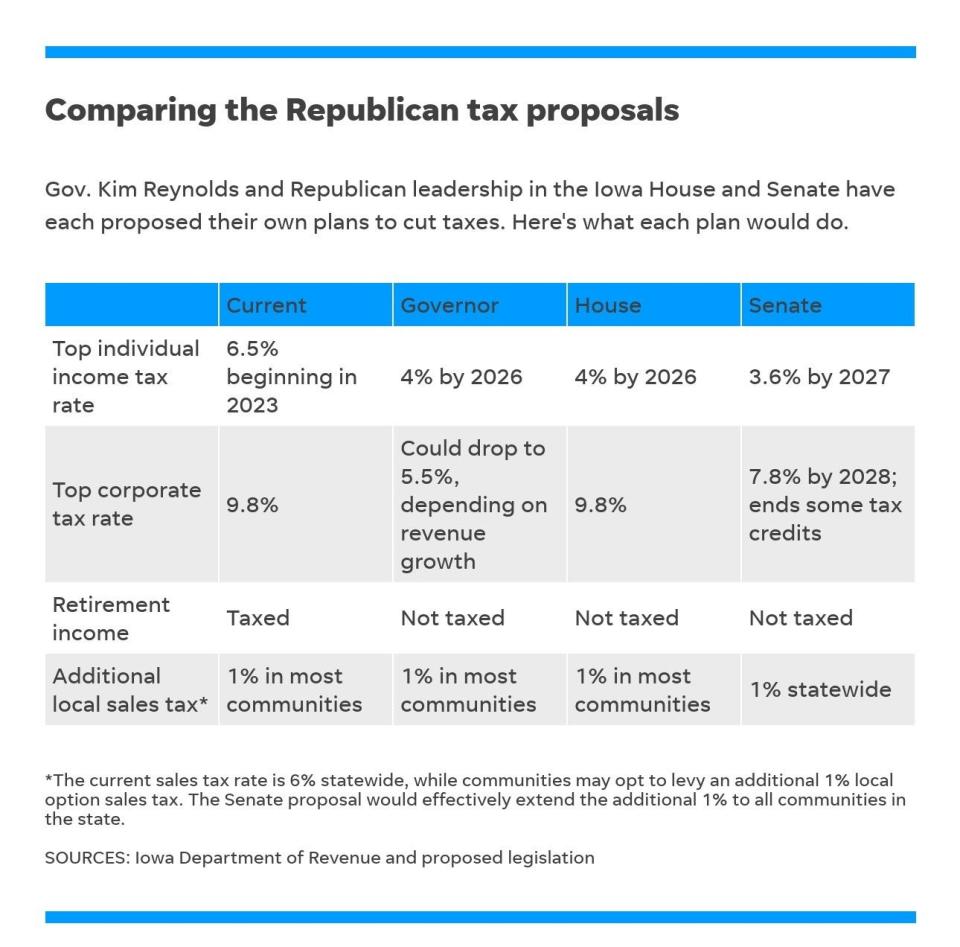

We now have three Republican tax cut plans to compare and contrast: One each from the House, the Senate and Gov. Kim Reynolds.

All three plans would lower the individual income tax rate and exempt retirement income from state taxes. But the Senate also would shift statewide sales tax revenue to fund water quality projects. And the plans differ on how to adjust the tax rates for corporations — or whether to touch them at all.

Republicans will need to negotiate among themselves about how to resolve those disagreements. They're staking out their positions early this year, as opposed to last year when negotiations over tax cuts kept lawmakers in session into May, weeks after they were supposed to home.

“I've said all along that I want to see tax policy move quicker,” said House Speaker Pat Grassley, R-New Hartford. “If It's any indication, I think you’re seeing more conversation earlier in session than we typically have around any tax conversation.”

We've got a full breakdown for you here. And check out this chart as a bonus.

This is Stephen, signing off from the Iowa PBS studio where I'm about to quiz Senate Majority Leader Jack Whitver about his agenda on Iowa Press. If you have thoughts about the tax plans, or suggestions for what my colleagues and I should cover next, send them to me at sgrubermil@registermedia.com. Tell your friends to subscribe to our newsletter here.

Have a good weekend!

This article originally appeared on Des Moines Register: Republicans have three tax plans. Now they need to choose one.