Resale Not So ‘Niche’ at All, Kids the Next Big Opportunity

Japanese resale giant Mercari released its first “reuse report” this week, and it offered insights into how sweeping the resale trend is.

“While resale is sometimes thought of as a niche market, its size indicates it is a mainstream part of the consumer economy. In the past 12 months, 74.9 percent of Americans polled bought at least one secondhand item,” said John Lagerling, chief executive officer of Mercari in the U.S. (Its main headquarters are in Tokyo.) “Three-quarters of adults participating in the reuse ecosystem shows that buying secondhand is now almost as commonplace as going to the grocery store.”

More from WWD

Instead of a strictly fashion slant, the report (done in partnership with retail intelligence firm GlobalData, which also powered analytics for ThredUp) spanned Mercari’s popular categories from household goods to electronics to baby goods.

With 1.6 billion items disposed of by households in 2020, per the report, consumers are now rethinking their wares for resale. Already, 165 million Americans have crossed the fold to be considered “resellers,” selling at least one item secondhand in the last year.

And while many might like to believe those sellers are doing it for the greater good of the environment, most are focused on buying or saving money.

If buying secondhand, consumers expect at least 25 percent off of the retail price. In an online poll of 2,000 consumers from June to September, market research company Zogby Analytics (on behalf of Mercari) found that saving money is still the main reason for shopping resale as cited by 74.6 percent of survey respondents — not sustainability. However, sustainability was cited among other reasons consumers are loving pre-loved, including product discovery, joy and a sense of community.

The report also harped on a discrepancy about younger generations. While Gen Z may be all-in on resale, they’re still heavily editing out their wardrobe pieces. While the majority, or 84.6 percent, of shoppers ages 18 to 24 bought something secondhand over the past 12 months (higher than the 82.1 percent of those aged 25 to 44), the younger cohorts are still holding onto things less.

Resale is quickly outpacing traditional retail — the U.S. resale market is projected to more than double to be worth $353.9 billion by 2030, up from $139.6 billion in 2020 per Mercari’s report. In 2020 alone, the sector grew 153.5 percent or 3.2 times that of the 36.7 percent growth for the retail sector.

Courtesy

With the ongoing maturation of women’s — and men’s — resale, new fashion categories are gaining ground.

Among them are kids’ wear, footwear and accessories, which could each see a more than 400 percent growth rate by 2030 with kids’ wear leading the charge, per Mercari’s report. By 2030, kids’ resale will be worth $6 billion, up from a current roughly $1 billion.

And there’s already movement in the category.

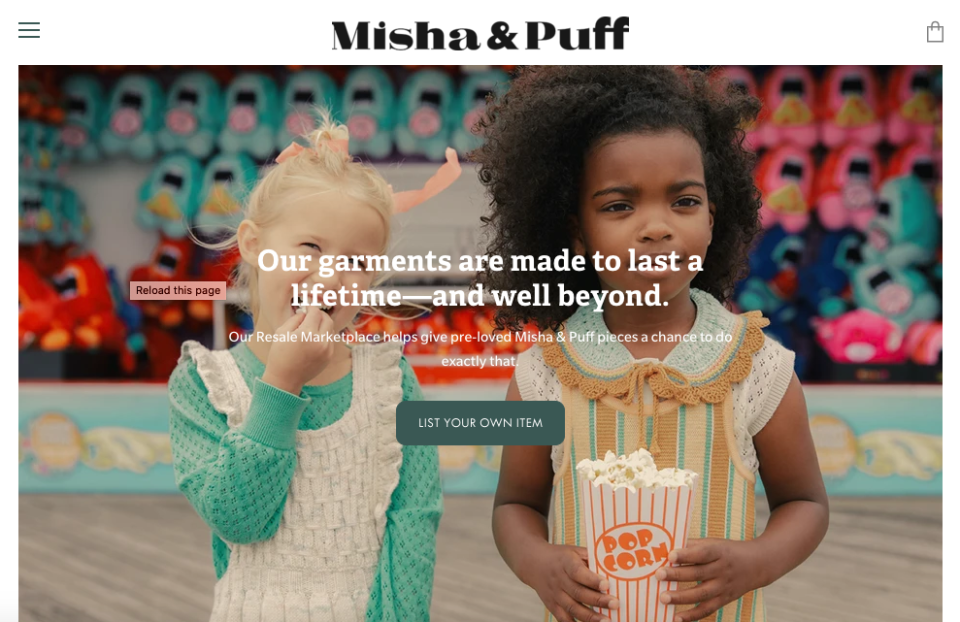

In a separate announcement Wednesday, Recurate, which powers resale for dozens of brands including Mara Hoffman, Re/Done and Outerknown, forged a new pathway into babies and kids with Misha & Puff.

The slow fashion knitwear brand also carries clothing for adults — with all products inspired by Peruvian artistry and New England winters. Its peer-to-peer program called “Loop” offers an owned avenue for resale, unlike marketplaces.

Outside of clothing, home decor, furniture and electronics are other areas of repeat resale interest.

Courtesy

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.