Results: Enghouse Systems Limited Beat Earnings Expectations And Analysts Now Have New Forecasts

Shareholders of Enghouse Systems Limited (TSE:ENGH) will be pleased this week, given that the stock price is up 18% to CA$47.90 following its latest annual results. It looks like a credible result overall - although revenues of CA$386m were in line with what analysts predicted, Enghouse Systems surprised by delivering a profit of CA$1.29 per share, a notable 11% above expectations. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest forecasts to see what analysts are expecting for next year.

View our latest analysis for Enghouse Systems

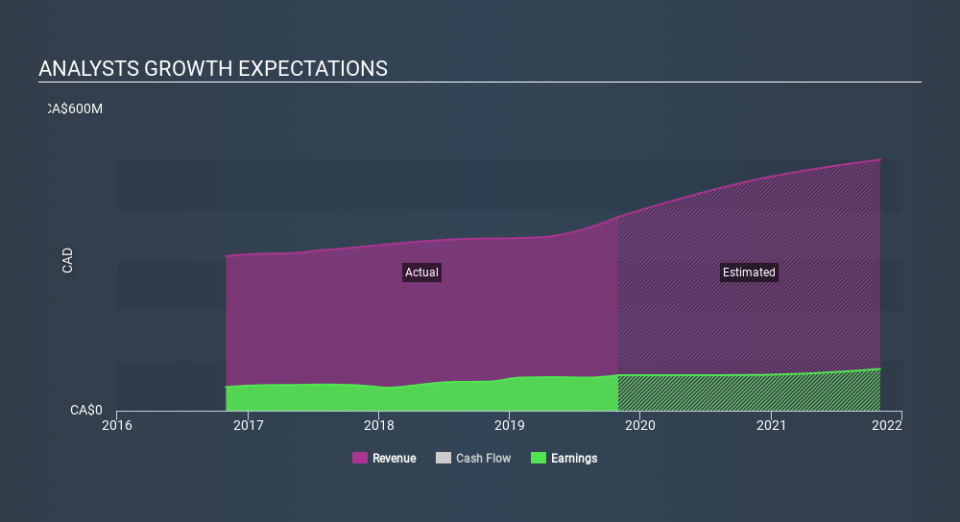

Taking into account the latest results, the most recent consensus for Enghouse Systems from four analysts is for revenues of CA$457.1m in 2020, which is a solid 18% increase on its sales over the past 12 months. Earnings per share are forecast to be CA$1.29, approximately in line with the last 12 months. Before this earnings report, analysts had been forecasting revenues of CA$451.3m and earnings per share (EPS) of CA$1.23 in 2020. Analysts seem to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target rose 15% to CA$51.60, suggesting that higher earnings estimates flow through to the stock's valuation as well. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Enghouse Systems analyst has a price target of CA$50.00 per share, while the most pessimistic values it at CA$43.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that analysts have a clear view on its prospects.

In addition, we can look to Enghouse Systems's past performance and see whether business is expected to improve, and if the company is expected to perform better than wider market. It's clear from the latest estimates that Enghouse Systems's rate of growth is expected to accelerate meaningfully, with forecast 18% revenue growth noticeably faster than its historical growth of 8.4%p.a. over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 16% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Enghouse Systems is expected to grow at about the same rate as the wider market.

The Bottom Line

The most important thing to take away from this is that analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Enghouse Systems following these results. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Enghouse Systems going out to 2021, and you can see them free on our platform here..

You can also see our analysis of Enghouse Systems's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.