Revealed: The evidence which shows we need the sugar tax to fight the obesity epidemic

“A good way to start would be basing tax policy on clear evidence.”

These were the words of Boris Johnson last week when he called for a review of food and drink-related “stealth sin taxes”.

It’s hard to disagree with evidence-based policy-making, so what exactly is the data and science behind the UK soft drink industry levy, the so-called sugar tax?

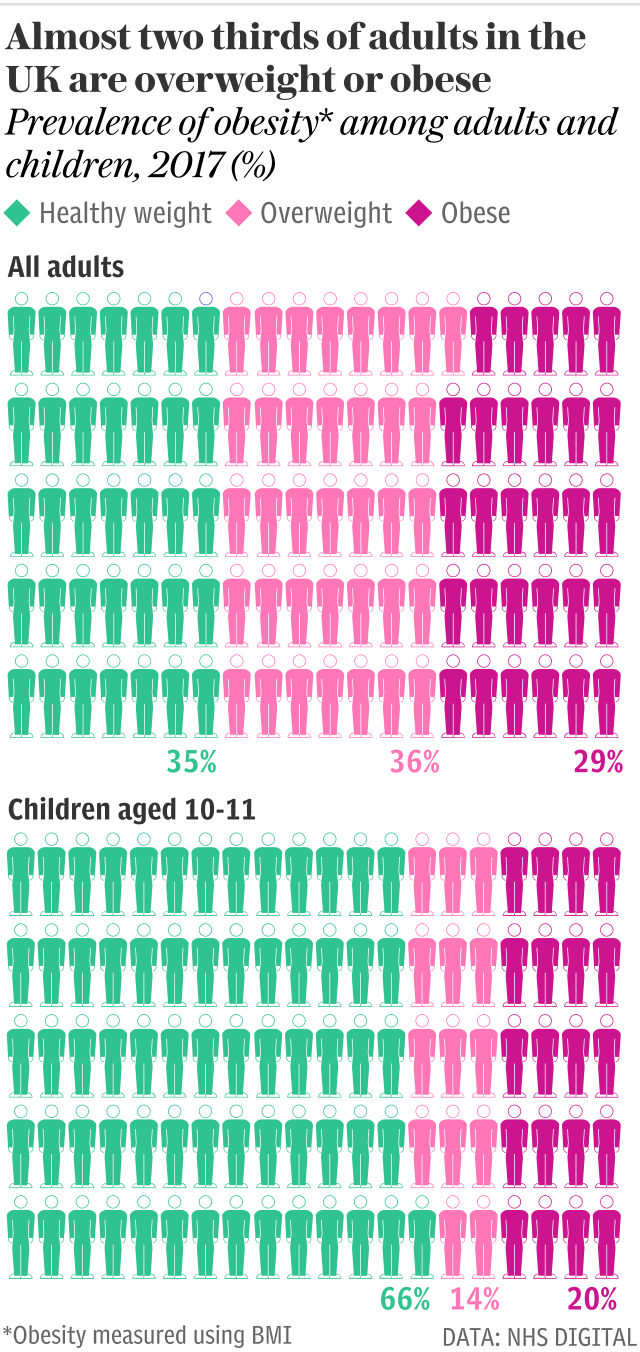

First things first. We all know there’s an obesity crisis in England – more than a third of children aged between 10 and 11 are overweight or obese. In adults it’s more like two in three. And it’s not cheap.

In 2014, the McKinsey Global Institute estimated the UK health costs from obesity to be £6bn a year. That’s almost as much as experts say is needed annually to fix the gap in social care.

Clearly obesity is important, but reversing it has proved difficult. Becoming overweight is linked to behaviours such as diet and activity, which are in turn heavily influenced by our social, environmental, and economic conditions, not to mention the interplay between these and our genetics, physical health, and mental health.

There’s no single overriding cause and by the same token, there’s no one magic bullet. It’s a multifaceted problem that needs a multifaceted solution, of which the evidence suggests a soft drink tax should be a key part.

Nearly all of us eat too much sugar, and drinks play a massive role in this – particularly among children. Teenagers consume nearly three times their recommended amount of free sugar – that is, any added sugar, plus sugar in juice or syrup – of which over a fifth comes from soft drinks.

And soft drinks don’t only lead to weight gain (there are randomised control trials in both children and adults demonstrating this), they are also associated with tooth decay, heart disease, and high blood pressure. Then there’s diabetes, where soft drinks are estimated to cause around 5 per cent of all type two diabetes cases in the UK, over 12,000 a year.

But why target this one factor among the many reasons that people are obese? Well, soft drinks are different to most other things we eat or drink – they have no nutritional benefit beyond their calories; the drinks people switch to are generally healthier; and from a Treasury point of view, they can be easily defined.

One of the main economic reasons to implement taxes is because of ‘negative externalities’ – costly unwanted outcomes that aren’t accounted for in the original price of a product and which the tax then ‘internalises’ into the price.

An example is smoking and cancer, an outcome that both harms the consumer and is expensive to society due to health care and lost productivity. The same is true of alcohol and liver disease, and of soft drinks and obesity.

And we know from taxes on tobacco and alcohol that they change people’s behaviour.

Ten years’ ago, evidence for the impact of soft drink taxes on behaviour was all based on mathematical modelling (hypothetical projections) but now there are over 30 countries with such taxes and the ‘real-world’ data are filtering through.

Perhaps the most well-studied country is Mexico, where a soft drink tax of a peso per litre (around a 10 per cent price increase) led to an average 8 per cent reduction in purchases over the first two years. More recent data from Philadelphia in the US has shown a 40 per cent fall in sales following a 1.5c per ounce tax.

A systematic analysis of all such real-world evaluations published last month concluded that a 10 per cent price rise in soft drinks leads to – on average – a 10 per cent fall in purchases.

Now, one of Boris Johnson’s key concerns is that these types of tax “clobber those who can least afford it”. On this he’s right. Soft drink taxes – like VAT, like tobacco tax, like excise taxes, like National Insurance – are regressive. That is, those with less money pay a higher proportion of their income.

A 2016 systematic review concluded that soft drink taxes generally affect household bills by less than $5 per year, and account for between 0.1 per cent and 1 per cent of income in low income households compared with 0.03-0.6 per cent in high income households.

But research tells us that interventions affecting the whole population, like taxes, compared with those requiring individuals to choose to take part – like gym classes or cooking lessons – are both more effective and more equitable for improving health. And when it comes to taxes, those with lower incomes are more likely to change their behaviour and more likely to have health benefits.

A better way for Boris Johnson to deal with any potentially regressive tax concerns would be to simply ensure that the rest of the tax system is made proportionately more progressive.

Obesity is a massively complex problem and no single solution is going to solve the current crisis – hence the need for a wide-ranging government strategy. But, as single interventions go, sugary drink taxes are right up there. They’ve been looked into, and supported, by Public Health England, the Health Select Committee, the British Medical Association, and numerous medical Royal Colleges.

Some fear, however, that this issue is as much about ideology as it is about evidence – minds are made up and producing yet more “real-world” data (of which plenty on the UK sugar tax is forthcoming from a formal evaluation) probably isn’t going to change things. But then again, maybe for this particular issue it doesn’t need to.

A YouGov poll last week showed a 55 per cent overall approval rating for taxes on unhealthy food and drink, including 54 per cent among Conservatives. And just a side note, the poll refers to taxes on unhealthy food and drink, not “sin taxes”.

There is nothing immoral about consuming soft drinks or eating chips. What might be immoral is stigmatising and blaming people who are overweight as sinners whilst not supporting us all to stay healthy against a tide of environmental triggers for over-consumption.

So, in a week when it’s been widely reported that obesity is now causing more cancers than smoking for four subtypes, suggesting that we should throw out such an important piece of genuine evidence-based public health policy does seem particularly short sighted.

Adam Briggs is a public health doctor and an academic visitor at the Nuffield Department of Population Health, University of Oxford.

Protect yourself and your family by learning more about Global Health Security