Revolve Group: A Debt-Free and Profitable Mid-Cap

- By Robert Abbott

When I'm looking for strong, high-quality companies, I run a screener I created called the "Macpherson Model." It is based loosely on the ideas of Thomas Macpherson, a GuruFocus contributor and the Chief Investment Officer and Managing Director of Nintai Investments LLC.

According to a performance report on the firm's website, Nintai has averaged 20.21% returns per year since inception in 2018 (they also posted above-average returns in previous investing operations).

One of the 25 stocks that makes it through this screener is Revolve Group, Inc. (NYSE:RVLV), an online retailer of fashion and fashion accessories targeted towards Millennials and Generation Z consumers.

What is Revolve Group?

Headquartered in Cerritos, California and founded in 2003, the company became Advance Holdings, LLC in 2012 and registered itself as a Delaware limited liability company. In October 2018, it became Revolve Group, LLC. In June of the following year, it changed its name to Revolve Group, Inc. and transitioned to a Delaware corporation from a limited liability company.

Revolve described itself this way in its 10-K for 2020:

"REVOLVE is the next-generation fashion retailer for Millennial and Generation Z consumers. As a trusted, premium lifestyle brand, and a go-to online source for discovery and inspiration, we deliver an engaging customer experience from a vast yet curated offering totaling over 49,000 apparel, footwear, accessories and beauty styles. Our dynamic platform connects a deeply engaged community of millions of consumers, thousands of global fashion influencers, and more than 1,000 emerging, established and owned brands."

It goes on to say that in its 18 years since 2003, it has continued to invest in technology, data analytics and innovative marketing and merchandising strategies to build a "powerful platform and brand," and one that is connecting with next-generation consumers.

The platform supports two brand segments: "REVOLVE offers constant newness and discovery through a broad yet curated assortment of premium apparel and footwear, accessories and beauty products. FORWARD offers a curated assortment of iconic and emerging luxury brands with a strong and differentiated point of view."

Competition

Revolve competes with both online and offline retailers, including the premium lifestyle and luxury product markets that are "highly competitive and rapidly evolving." It does not specifically name any major competitors. The GuruFocus system produces two weak matches: Chinese ecommerce company Yunji Inc (NASDAQ:YJ) and Overstock (NASDAQ:OSTK). Online fashion retailers that produce similar products include names such as Boohoo Group PLC (BOO), and of course, we can't ignore the elephant in almost every retail room, Amazon.com (NASDAQ:AMZN).

In the 10-K, Revolve said it competes on product selection, differentiation and curation, brand quality, the strength of brand relationships, relevance, convenience, ease of use and customer experience. It believes it competes favorably on those criteria.

That claim is backed up by its return on capital (ROC) of 86.70% and its return on tangible equity (ROTE) of 41.18%. Both are well above the 15% minimum set by the Macpherson Model:

Risks

Investors who put their capital into Revolve face numerous risks, including:

Covid-19, which has had a material effect on the company and is likely to continue affecting its business, financial position, operating results and growth prospects.

As a fashion retailer, it must anticipate which styles will sell well in the future and which will not. It is a very fickle market.

The company has a dual-class share structure that gives its executive officers and directors concentrated voting control.

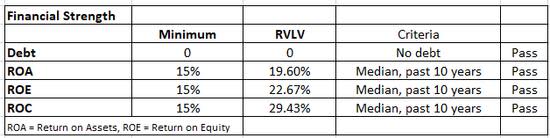

Financial strength

Revolve has no debt and the GuruFocus system gives it an 8 out of 10 score for financial strength.

Here's what we see in the context of the Macpherson Model:

Profitability

Despite all the green on the GuruFocus profitability table, Revolve receives only a 5 out of 10 score for profitability. That seeming discrepancy can be explained by examining the five criteria for the profitability score:

Operating Margin: The quarter ended Dec. 31, 2020 produced an operating margin of 11.80%, which was lower than the margins of the second and third quarters of 2020, but higher than the margins in the fourth quarter of 2019 and the first quarter of 2020.

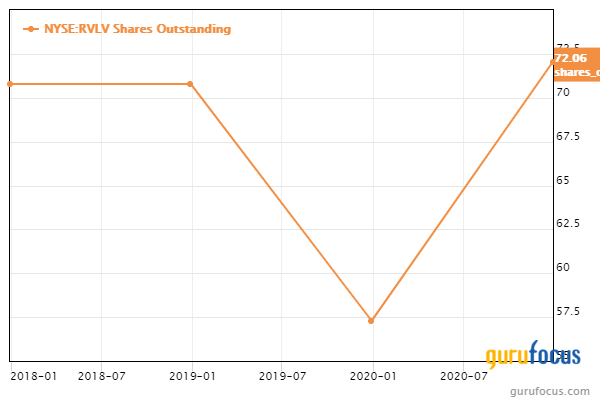

Piotroski F-Score: This score is 6 out of 9, with the company missing marks for a slightly higher number of shares outstanding, a lower gross margin than last year (again, slightly) and a lower asset turnover ratio.

The trend of the operating margin (five-year average): Revolve hasn't yet logged five years as a public company. In 2018 the margin averaged 8.38%, in 2019 it averaged 8.00% and in 2020 it averaged 10.52%. So, the trend is upward, even if the history isn't there.

Consistency of profitability: For 2018, it had earnings per share (diluted) of $0.43, then a loss of $0.09 in 2019 and a profit of $0.79 per share in 2020.

Predictability Rank: The company has a publicly-traded history of fewer than five years, so it does not have a predictability rank yet.

Dividends and share buybacks

Revolve does not pay a dividend, and in its 10-K, management states, "We currently intend to retain all available funds and future earnings, if any, to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable future."

The following chart shows the status of its shares outstanding:

As of Feb. 18, there were 33,125,420 Class A common shares and 38,540,095 Class B common shares. The company explained it used most of the proceeds of its IPO to repurchase shares of its Class B common stock, $40.8 million of the $45.8 million.

Class B shares, held by the co-chief executive officers and related entities, have 10 votes per share, while Class A common stock has one vote per share. As of Dec. 31, the co-CEOs owned about 54% of common shares and controlled about 92% of the voting power.

Valuation

The Macpherson Model assesses the intrinsic value of a company by looking at its discounted cash flow (DCF) and/or its discounted earnings.

Discounted earnings and discounted cash flow calculations rely on a consistent or a relatively consistent set of data from the past. As we've noted, Revolve has traded publicly for only three full years; thus, any estimate based on those measures would be unreliable.

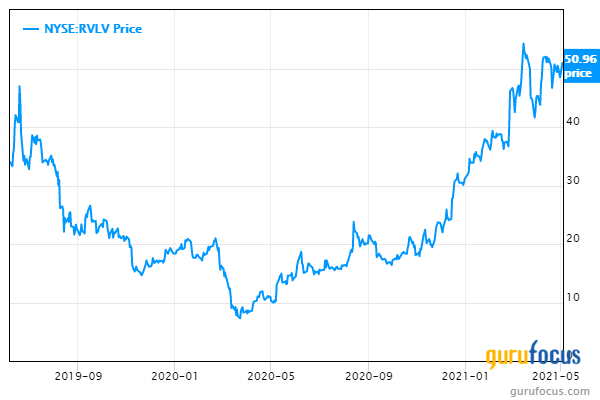

However, we can look at the price chart:

Revolve carries a price-earnings ratio of 64.5 (76.79 on a forward basis). That's higher than 80.49% of the 610 stocks in the industry. The industry median over the past decade was 22.13.

When divided by the three-year Ebitda growth rate of 40.40%, we end up with a reasonable PEG ratio of 1.60 (1.90 on a forward basis). A couple of caveats here: First, a PEG ratio of 1.60 may be reasonable, but it is still above the fair valuation mark of 1.00. Second, the PEG ratio is normally calculated using a five-year average.

Gurus

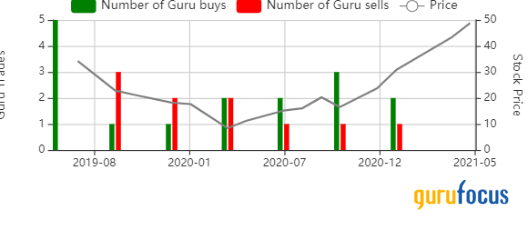

The gurus were big buyers of Revolve at its IPO, then cut back, but many have started becoming net buyers again since the third quarter of 2020:

Three gurus held positions in the stock at the end of December:

Steven Cohen (Trades, Portfolio) of Point72 Asset Management owned 1,646,069 shares, representing 2.34% of Revolve's Class A shares and 0.25% of his firm's assets. He increased his holding by 34.02% in the fourth quarter.

Jim Simons (Trades, Portfolio) of Renaissance Technologies added 43.09% to his stake to finish 2020 with 1,044,300 shares.

Paul Tudor Jones (Trades, Portfolio) of Tudor Investment Management reduced his holding by 87.41% to end 2020 with 44,274 shares.

As previously noted, co-founders and co-CEOs Michael Karanikolas and Michael Mente owned about 54% of the company's shares and controlled 92% of its votes at the end of the year.

Conclusion

Revolve Group, Inc. meets all the available criteria for the Macpherson Model. Despite the middling rating for profitability, the company is doing well. The same is true for its debt-free financial status.

Given its limited history as a public company, it is not easy to value Revolve using traditional measures. When in doubt, assuming overvaluation is the safest route.

Some investors also will be hesitant about the dual-share structure, because this structure is sometimes associated with management taking advantage of shareholders.

Value investors may find this a promising stock if they can buy on a dip and get a margin of safety. Growth investors may see this as a buy-now-and-sell-higher stock if they are comfortable with some speculation.

Disclaimer: I do not own shares in any of the companies named in this article and do not expect to buy any in the next 72 hours.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.