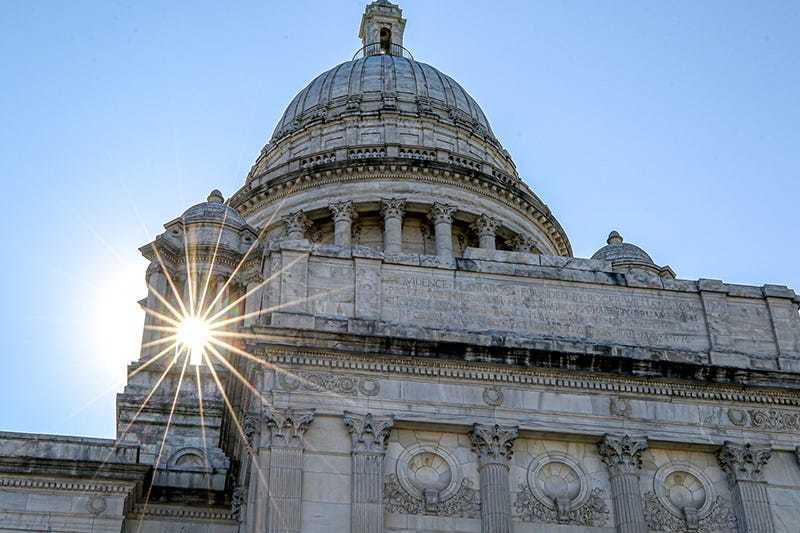

RI House approves $14-billion state budget. Here's what gets a boost and what gets dropped

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

PROVIDENCE – The Rhode Island House of Representatives on Friday approved a $14-billion state budget for next year that would boost public-school funding and cut a tax that annoys business owners, but does not answer the pleas of retirees still smarting over 12-year-old pension cuts.

The final vote was 68 to 4 and sends the tax and spending plan to the Senate, where it is expected to be considered next week.

The budget breaks the $14-billion spending mark for the first time in state history and marks a 2.9% increase from the $13.6-billion budget lawmakers approved a year ago.

Despite the scale of spending, the budget received support from a majority of Republicans. More than a dozen GOP ideas were incorporated into the budget, House Minority Leader Michael Chippendale said, resulting in his support and fewer doomed opposition floor amendments.

"This is a big budget," Chippendale said. "This is a lot of money and with the amount of federal funds being allocated... we are only doing it on one-time expenditures, and that is the responsible thing to do... The challenge we have before us is next year when these federal funds aren't here we drop the size of the budget."

The budget was debated and voted out of the House in around two hours and 45 minutes, a far cry from many previous year budget votes that dragged deep into the night. House Speaker K. Joseph said afterward it the fastest budget vote he could remember.

Opposition did come from former House GOP leader and candidate for governor Patricia Morgan, one of the four "no" votes, who said the safety-net spending in the budget would provide a disincentive to work and would attract migrants to Rhode Island.

The longest and angriest debate was sparked by Rep. Charlene Lima's foiled effort to revive annual COLAs for Rhode Island's retired public employees.

More than two dozen retired public employees had gathered earlier at the State House with signs that said: "No COLA = Teacher shortage," "Retired Teachers/State Workers Matter" and "Who Stole My Pension? Budget Surplus = $600 Million." They chanted: "Restore our COLAs" and stopped lawmakers on their way into the House chamber to make their case.

Lima, D-Cranston, tried twice to give them more than the $14-billion budget provides, and more specifically: a 3% cost of living adjustment on their first $50,000 in benefits that would boost their pensions by $1,500.

And she accused her House colleagues of "screwing over" the retirees – who were "robbed" of their promised benefits as part of the 2011, Raimondo-era pension overhaul – by voting to table both of her proposed amendments.

"They don't want to take a vote on the amendment because they don't want to help you and they don't want you to know that they don't want to help you," she said. "So they're going to hide [behind] a motion to table. You see what they're doing? They're screwing you again."

And she was not alone. Rep. Patricia Serpa, the retired teacher who chairs the House Oversight Committee, said: "I am one of those – like the folks in the gallery – who was one of those who was robbed ... We were cheated. We were lied to, and it's disgusting. I am disgusted with my [2011] vote, but I did it on half-truths."

"And I would never, ever, ever do it again," she said of her 2011 vote for the "pension reform" package shepherded to passage by then-Treasurer Gina Raimondo, the current U.S. commerce secretary.

The budget bill provides a much-reduced annual COLA that will give them one-quarter of the COLAs awarded to retirees in the state's best-funded municipal pension plans.

Getting a quarter of the 3.11% increase given retirees this year in the 70 or so municipal-pension units that have already reached 80% funding of their current and future pension obligations means a COLA of up to $269 for retired state and municipal employees and teachers who retired before July 1, 2015, and $225 for those who retired more recently.

Before budget debate began, House Speaker K. Joseph Shekarchi announced that an additional $7 million would be added for early-childhood programs. The money includes $3 million to prevent the loss of Head Start and Early Head Start seats, and $4 million to provide child care to child-care workers.

The child-care money was the subject of a major organizing push by progressive groups and child-welfare advocates.

“Quality child care is very important to the House and Senate leadership and membership, and many members encouraged me to help find resources to help preserve these vital programs," Shekarchi said in a news release. "It is critical that we continue to address staffing shortages within both programs in a sustainable way."

Around $1 billion of the budget goes to K-12 school aid. Lawmakers added $25 million for local schools to the budget Gov. Dan McKee proposed in January. It's $56.6 million more for schools than they approved last year.

The education money includes $20 million in funding to local districts to compensate them for the state aid losses that normally come with enrollment drops. School districts have been financially "held harmless" against the impacts of lost students since the start of the pandemic.

Shekarchi said the House plans to help districts that have lost students "transition" to less state aid over two years. McKee's proposal had proposed compensating districts that had lost students to charter schools.

The House budget tweaks the school aid formula to provide more money to districts with high areas of high concentrations of poverty, large numbers of students whose first language is not English and high-cost special education students.

Morgan, R-West Warwick, took aim at state subsidies for the film industry and the governor's Diversity, Equity and Inclusion office in two tax cutting amendments.

One amendment would have made one of the major tax items in the budget -- a four-month suspension of taxes on gas and electric utility bills -- permanent by axing $30 million in film tax credits, $2 million in DEI and $3 million from the General Assembly's own coffers.

Another would have eliminated the 1% meal and beverage tax and offset the lost revenue from those same areas.

"We have done studies for many years on the movie tax credit and it gives almost no value to Rhode Islanders," Morgan said. "They pay big stars. They bring in big trucks from out of state. They bring in people from New York and all over, but they don't employ Rhode Island. The most we get is catering."

"We either stand with the middle class or we stand with Hollywood," Morgan said.

But Woonsocket Reps. Jon Brien and Robert Phillips, both of Woonsocket, defended the film productions lured to their city with film tax credits, particularly the Hachi: A Dog's Tale, a Richard Gere remake of a Japanese film about a loyal Akita.

"We have more Japanese people coming to our city to take pictures of the statue in front of the train station because that dog is revered in Japan," Phillips said.

The amendment was defeated 5-63.

First proposed by McKee, the four-month pause in taxes on utility bills is expected to cost $36 million.

Other items in the budget include:

A $50,000 exemption to the tangible-property tax that businesses pay on equipment. The budget includes $28 million to reimburse the cities and towns that collect tangible tax for their lost revenue. Senate President Dominick Ruggerio, who sought the exemption, argued that the time and energy of complying with the tangible tax made it a major annoyance for small businesses in addition to the expense.

$28 million for a new low-income housing tax credit.

$10.4 million to fund tuition-free junior and senior years for in-state students at Rhode Island College.

Rhode Island Island College would also receive money to create a new cybersecurity institute.

A $1.1-million increase in the Earned Income Tax Credit.

$45 million to start a quasi-state biotech hub in Providence.

This article originally appeared on The Providence Journal: Bid to boost pension COLAs loses, schools win as RI House OKs $14B budget