Richard Pzena's Firm Buys Westinghouse Air Brake Technologies

Richard Pzena (Trades, Portfolio), leader of Pzena Investment Management LLC, bought shares of the following stocks during the fourth quarter.

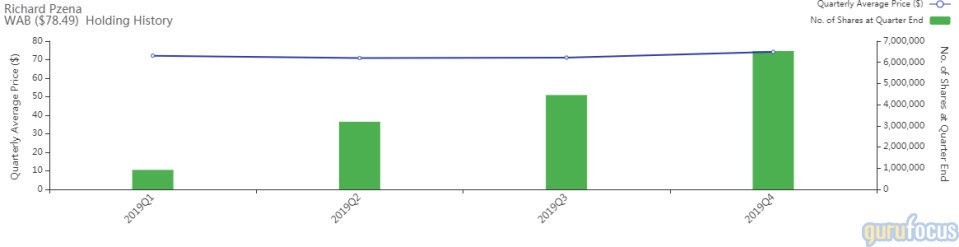

Westinghouse Air Brake Technologies

The firm increased its Westinghouse Air Brake Technologies Corp. (WAB) stake by 46.7%. The portfolio was impacted by 0.75%.

The provider of technology based products for the rail industry has a market cap of $14.70 billion and an enterprise value of $18.89 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 3.21% and return on assets of 1.52% are underperforming 67% of companies in the transportation industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.12 is below the industry median of 0.27.

The largest guru shareholder of the company is Barrow, Hanley, Mewhinney & Strauss with 4.15% of outstanding shares, followed by Pzena with 3.41% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.17%.

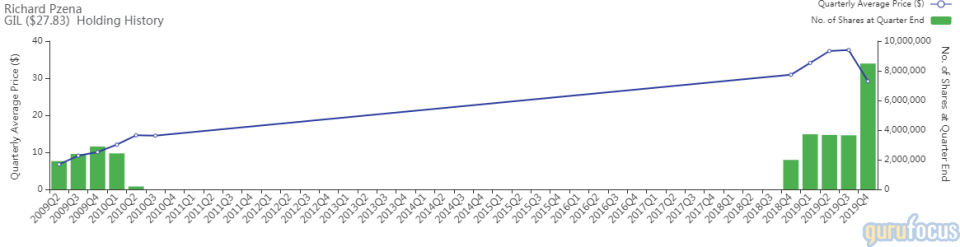

Gildan Activewear

The firm added 132.73% to its Gildan Activewear Inc. (GIL) position. The portfolio was impacted by 0.67%.

The manufacturer of basic apparel has a market cap of $5.69 billion and an enterprise value of $6.62 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 14.91% and return on assets of 8.9% are outperforming 78% of companies in the manufacturing - apparel and accessories industry. Its financial strength is rated 6 out of 10. The company has a cash-debt ratio of 0.06.

The largest guru shareholder of the company is Pzena with 4.17% of outstanding shares, followed by Sarah Ketterer (Trades, Portfolio)'s Causeway Capital Management with 2.57% and PRIMECAP Management (Trades, Portfolio) with 0.56%.

Halliburton

Pzena increased the Halliburton Co. (HAL) holding by 18.24%, impacting the portfolio by 0.56%.

The oilfield services provider has a market cap of $19.14 billion and enterprise value of $28.23 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -12.19% and return on assets of -4.28% are underperforming 62% of companies in the oil and gas industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.2 is below the industry median of 0.35.

The largest guru shareholder of the company is Dodge & Cox with 5.15% of outstanding shares, followed by Pzena with 3.60% and Ketterer with 1.20%.

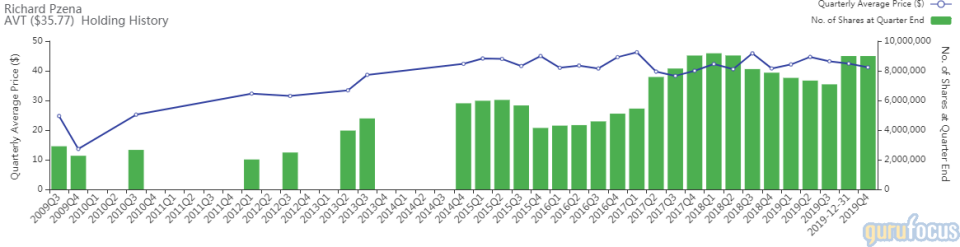

Avnet

The investor increased its Avnet Inc. (AVT) stake by 26.95%. The trade had an impact of 0.44% on the portfolio.

The distributor of electronic components has a market cap of $3.56 billion and an enterprise value of $5.05 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 2.44% and return on assets of 1.15% are underperforming 60% of companies in the hardware industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.25.

The company's largest guru shareholders are Pzena with 9.01% of outstanding shares, Simons with 1.11% and HOTCHKIS & WILEY with 1.09%.

TechnipFMC

The investor increased its TechnipFMC PLC (FTI) stake to 11.2 million shares, adding 44.31%. The portfolio was impacted by 0.34%.

The company has a market cap of $7.62 billion and an enterprise value of $8.03 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -20.92% and return on assets of -8.85% are underperforming 77% of companies in the oil and gas industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.92 is above the industry median of 0.35.

The largest guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 7.22% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 3.88% and Pzena with 2.51%.

Axis Capital Holdings

Pzena increased his Axis Capital Holdings Ltd. (AXS) holding by 22.22%. The portfolio was impacted by 0.32%.

The casual insurance company has a market cap of $5.34 billion and an enterprise value of $6.85 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 5.22% and return on assets of 1.28% are underperforming 68% of companies in the insurance industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.65 is below the industry median of 3.13.

The largest guru shareholder of the company is Pzena with 6.41%, followed by Simons with 3.05% and NWQ Managers (Trades, Portfolio) with 0.91%.

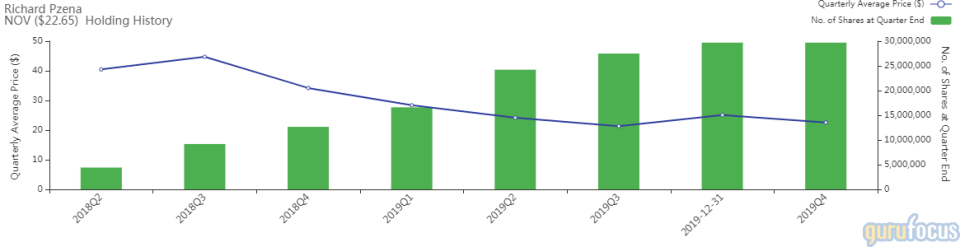

National Oilwell Varco

The investor added 8.04% to his National Oilwell Varco Inc. (NOV) stake. The portfolio was impacted by 0.30%.

The company supplies oil and gas drilling rig equipment. It has a market cap of $8.73 billion and an enterprise value of $10.4 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -58.8% and return on assets of -37.48% are underperforming 88% of companies in the oil and gas industry. Its financial strength is rated 5 out of 10, with a cash-debt ratio of 0.42 that is outperforming 52% of competitors.

Pzena is the largest guru shareholder of the company with 7.75% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 6.17% and Dodge & Cox with 5.90%.

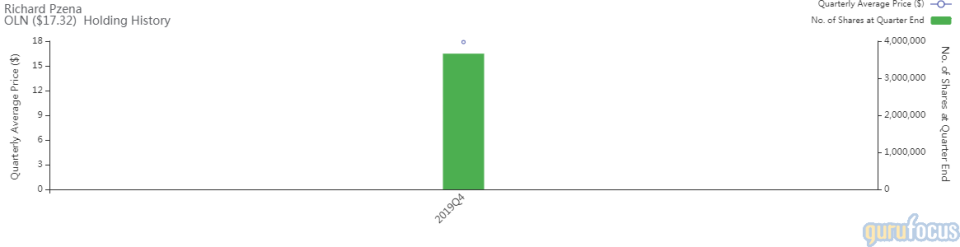

Olin

The guru bought 3.6 million shares of Olin Corp. (OLN), starting a new position. The trade had an impact of 0.30% on the portfolio.

The manufacturer of chemical products has a market cap of $2.77 billion and an enterprise value of $6.27 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -0.42% and return on assets of -0.12% are underperforming 81% of companies in the chemicals industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.06 is below the industry median of 0.61.

The largest guru shareholder of the company is Pzena with 2.32% of outstanding shares, followed by Arnold Schneider (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) with 0.31%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Pioneer Investments Buys Microsoft, Amazon, Apple

Lee Ainslie Buys Crown Holdings, Monster Beverage

Richard Pzena Trims Walmart, Merck Positions

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.