The Riot Blockchain (NASDAQ:RIOT) Share Price Is Down 84% So Some Shareholders Are Rather Upset

Riot Blockchain, Inc. (NASDAQ:RIOT) shareholders should be happy to see the share price up 15% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 84% lower after that period. The recent bounce might mean the long decline is over, but we are not confident. The real question is whether the business can leave its past behind and improve itself over the years ahead.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Riot Blockchain

Given that Riot Blockchain didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Riot Blockchain grew its revenue at 83% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 30% each year, in the same time period. It could be that the stock was over-hyped before. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

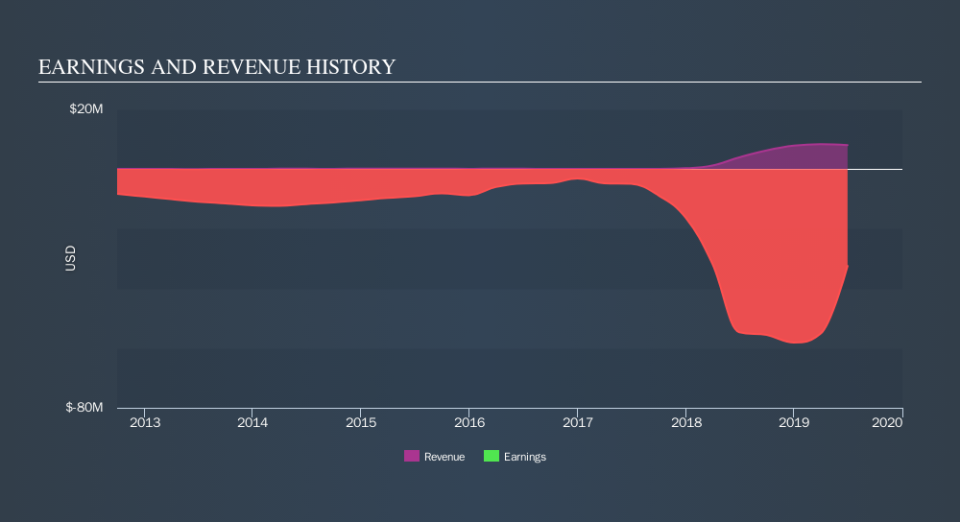

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Riot Blockchain's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Riot Blockchain's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Riot Blockchain's TSR, at -82% is higher than its share price return of -84%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Riot Blockchain shareholders are down 44% for the year, but the market itself is up 4.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 29% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Riot Blockchain's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.