Rishi Sunak earned more than £2.2m last year but paid effective 23pc tax rate

- Oops!Something went wrong.Please try again later.

Rishi Sunak earned more than £2.2 million last year, paying an effective tax rate of 23 per cent, according to official accounts released on Friday.

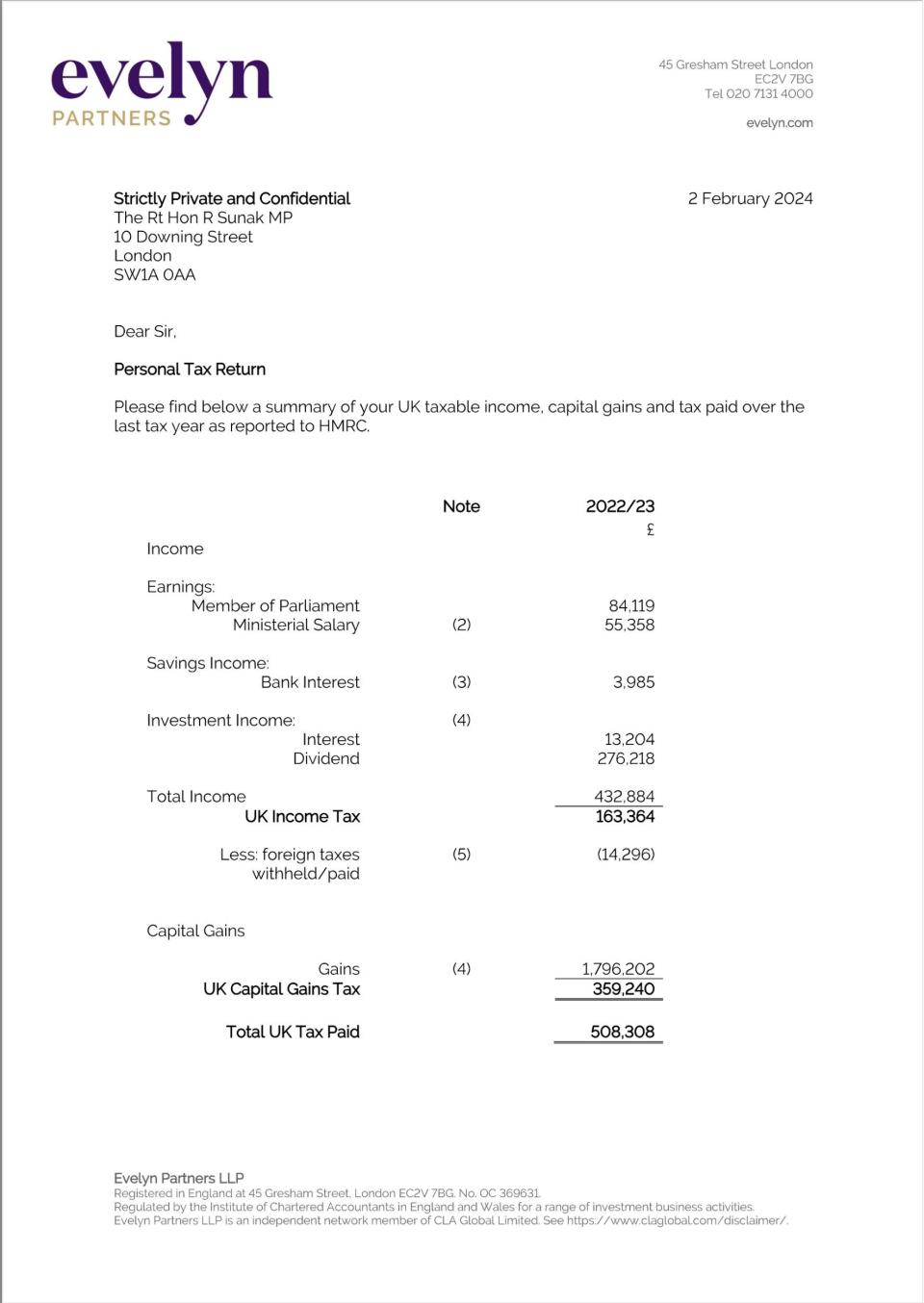

Downing Street published the Prime Minister’s tax return, which showed that in total he paid just over £500,000 in UK taxes in 2022-23.

His overall bill was kept low by the fact that £1.8 million of his earnings was put through as capital gains, meaning it was taxed at a lower 20 per cent rate.

Meanwhile, a person earning £100,000 a year would typically pay an effective rate of 33 per cent once income tax and national insurance had been levied.

Capital gains tax is levied on the sale of assets that have increased in value. It covers shares, business assets and personal possessions worth over £6,000, as well as properties that are not the person’s main home.

Mr Sunak’s tax return, prepared by accountants Evelyn Partners, showed that he earned £2.23 million in the financial year 2022-23.

His income was split, with £433,000 being subject to income tax, charged at an effective rate of 38 per cent, and the rest coming under capital gains. The £1.8 million he declared in capital gains was up from £1.6 million the previous year.

All those earnings were derived from the proceeds of a US-based investment fund listed as a blind trust, according to the return.

Mr Sunak, who used to live in California and still owns a penthouse there, also paid $6,847 in tax from share dividends of $45,646.

His return shows that he made £139,477 from his salary as Prime Minister, as well as £3,985 in income on his savings thanks to higher interest rates.

At the same time as his return was released, the Treasury also published details of how much tax Jeremy Hunt, the Chancellor, paid last year.

It showed he paid an effective tax rate of 28.5 per cent in the UK, though that rose to around 37 per cent once his worldwide income was taken into account.

Mr Hunt paid a total of £117,000 in domestic taxes on his annual income of £416,605, almost exactly half of which was declared as capital gains. He made £113,986 from his MP and ministerial salary and earned £4,160 interest on his savings, the return by Grunberg and Co revealed.

Like the Prime Minister he also has a blind trust, with some of the tax on its proceeds being paid in unnamed foreign jurisdictions.

Sir Keir Starmer, the Labour leader, is expected to release his tax return in the coming days.