What rising gold prices can tell us about the economy in 2024

The price of gold hit an all-time high this month as the precious metal reflected signs of growing instability across the world.

The "haven asset" rallied as much as 3% to trade at a record $2,135 per ounce on 4 December, said the Financial Times, before falling by 2% the next day. The gains, driven by a fall in the US dollar against other currencies since the start of November, are "the latest leg in a powerful rally" that began last year, said commodities correspondent Harry Dempsey, driven by investor concerns over conflicts in Ukraine and Gaza. Overall, the price is 40% higher than it was in 2019.

But that pattern has accelerated in the past two months, with the Israel-Hamas conflict "boosting demand" for the asset, said CNBC. Analysts believe the value could remain above $2,000 next year thanks to global tensions, a likely weaker dollar and expected further cuts to interest rates.

"Gold tends to perform well during periods of economic and geopolitical uncertainty," said the news site, "due to its status as a reliable store of value."

Why is the price of gold rising?

November was a great month for Wall Street, said finance and business writer Kevin T. Dugan on Intelligencer. The Dow Jones Industrial Average went on a "furious rally", climbing more than 11%, while the bond markets "gave up much of their pessimism about inflation and went on a frolic".

The expectation was that the Federal Reserve would start cutting interest rates again, and that it was better to "buy, buy, buy just about everything that could be gotten before it was too late". But at the start of December, the rally "didn't so much as fizzle out as move elsewhere", said Dugan: "to bitcoin and gold".

On 4 December, the yield on a 10-year US treasury bond fell from its 16-year high of over 5% to 4.3%. Stocks also faltered, and the market turned its attention to gold.

"Gold pays no income," said The Wall Street Journal. Unlike bond yields, the price of gold is determined by supply and demand. Speculative demand for the metal "tends to wane when bond yields, after adjusting for inflation, go up". Conversely, it "waxes when these so-called real yields go down".

The price of gold also tends to increase as interest rates decrease. Gold is priced in US dollars, and lower interest rates weaken the dollar. The "softer greenback" makes gold cheaper for international buyers, said CNBC. The dollar fell by 3% in November, its biggest monthly slump in a year.

But the price of gold didn't fall below expectations this year despite a strong US dollar buoyed by rising interest rates, noted Naimul Karim in the Financial Post. The average price of gold this year is "at least $150 higher than in 2022". So there are other factors at play: namely geopolitical uncertainty.

Wars in Ukraine and the Middle East and tensions between the US and China make for a "fractured, febrile world", said global markets writer Anna Cooban on CNN. In times of stress, gold glitters. It's "tangible", finite and tends to hold its value.

What does this mean?

Analysts expect the US dollar to decrease next year, as the Federal Reserve starts cutting interest rates. But as Mark McCormick, global head of foreign exchange and emerging markets strategy at TD Securities, told Cooban: "A weaker dollar is a rising tide that lifts all boats."

A weaker dollar tends to mean more money in the economy, which means the gold boat could rise higher than ever before. In fact, "$2,200 per ounce [is] in view," Nicky Shiels, head of metals strategy at MKS PAMP, told CNBC.

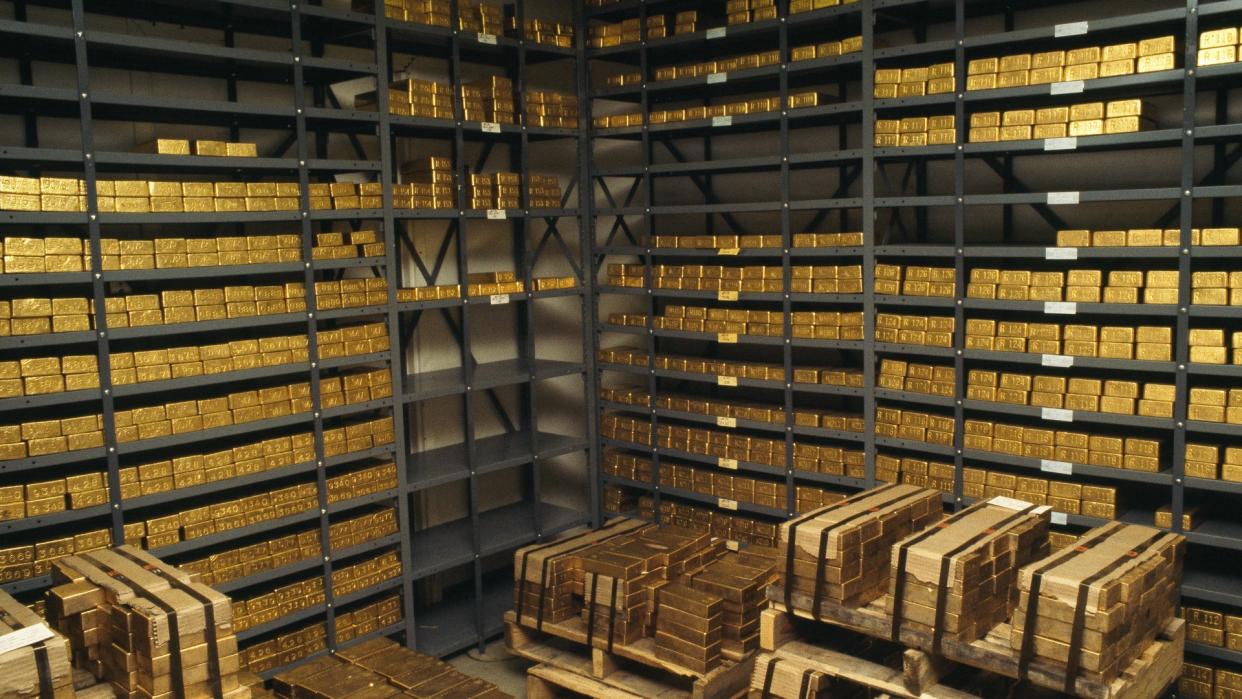

Nearly a quarter of central banks intend to increase their gold reserves next year, according to a World Gold Council survey in May, with China, Turkey and Russia adding to their stock. Central banks already own about a fifth of all the gold mined in human history.

Good news for Canada, perhaps, which is home to half the world's gold mining companies. But a higher price for gold doesn't necessarily mean more profit. There is a "massive disconnect" between gold price and the mining company's equity valuation, a mining company executive told the Financial Post.

We may be "flirting" with an all-time price high next year, economist David Rosenberg told the news site. But there is something that matters much more than demand. Ultimately, he said: "Gold is all about fear, not about greed."