A Rising Share Price Has Us Looking Closely At Zhongsheng Group Holdings Limited's (HKG:881) P/E Ratio

It's great to see Zhongsheng Group Holdings (HKG:881) shareholders have their patience rewarded with a 34% share price pop in the last month. Zooming out, the annual gain of 136% knocks our socks off.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

Check out our latest analysis for Zhongsheng Group Holdings

Does Zhongsheng Group Holdings Have A Relatively High Or Low P/E For Its Industry?

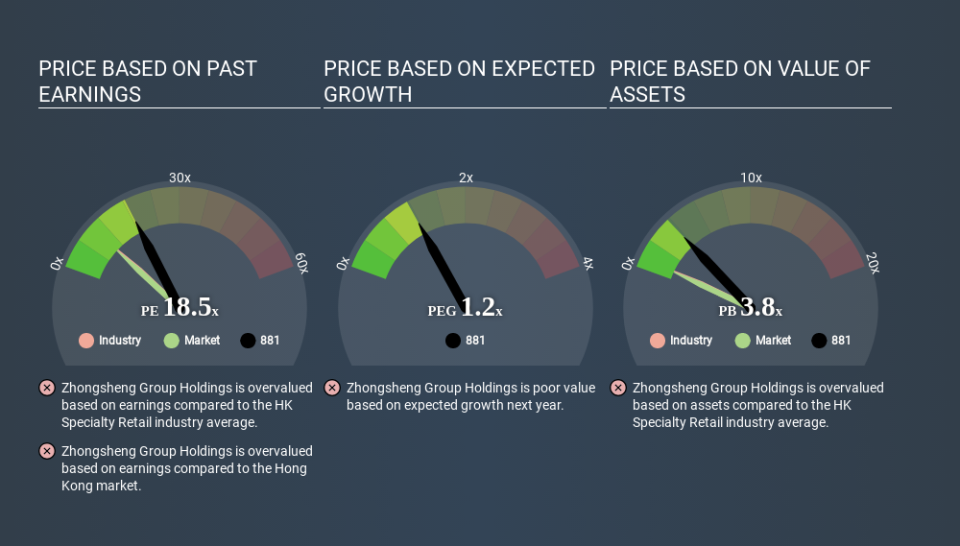

We can tell from its P/E ratio of 18.49 that there is some investor optimism about Zhongsheng Group Holdings. You can see in the image below that the average P/E (10.0) for companies in the specialty retail industry is lower than Zhongsheng Group Holdings's P/E.

That means that the market expects Zhongsheng Group Holdings will outperform other companies in its industry. Clearly the market expects growth, but it isn't guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. Then, a lower P/E should attract more buyers, pushing the share price up.

Zhongsheng Group Holdings increased earnings per share by an impressive 24% over the last twelve months. And its annual EPS growth rate over 5 years is 41%. With that performance, you might expect an above average P/E ratio.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. So it won't reflect the advantage of cash, or disadvantage of debt. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Zhongsheng Group Holdings's Balance Sheet

Net debt totals 22% of Zhongsheng Group Holdings's market cap. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Bottom Line On Zhongsheng Group Holdings's P/E Ratio

Zhongsheng Group Holdings's P/E is 18.5 which is above average (9.7) in its market. The company is not overly constrained by its modest debt levels, and its recent EPS growth very solid. Therefore, it's not particularly surprising that it has a above average P/E ratio. What is very clear is that the market has become more optimistic about Zhongsheng Group Holdings over the last month, with the P/E ratio rising from 13.8 back then to 18.5 today. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors have an opportunity when market expectations about a stock are wrong. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Zhongsheng Group Holdings. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.