Rising tide: Property values up as much as 20% in Taylor County

The Taylor County Central Appraisal District this week announced that property values have increased 15% to 20% compared to 2022 figures.

The average homestead value in Taylor County is $212,282, a jump from $188,165 in 2022, according to a news release from the appraisal district.

Even bigger news is the jump in new taxable value. That increased a whopping 38% from 2022, a sign that Abilene and the county are rebounding from the pandemic and that efforts to encourage growth here are succeeding.

Additions to the tax role for the county include Great Lakes Cheese in east Abilene, Bowie's Convenience Store near Tuscola, the new Warren Cat location on Loop 322, Allen Ridge north of the Abilene Christian University campus and the Dollar General location on South First Street. Other additions include car washes, medical offices and self-storage.

New homes also add to the roll, as well as the Denali and Sierra Sunset apartment projects.

The DoubleTree by Hilton is not yet on the tax roll, according to the appraisal district.

Here is a summary of preliminary values, comparing the past two years:

2023

Market value: $19.28 billion

Net taxable: $13.23 billion

Freeze adjusted taxable: $11.45 billion

New taxable value: $412.5 million

Average homestead: $212,282

2022

Market value: $17.11 billion

Net taxable: $11.6 billion

Freeze adjusted taxable: $10.1 billion

New taxable value: $298 million

Average homestead: $188,165

Market value is up 12.7%, net taxable up 14.1%, freeze adjusted taxable up 13.7% and new taxable value up $38.4%.

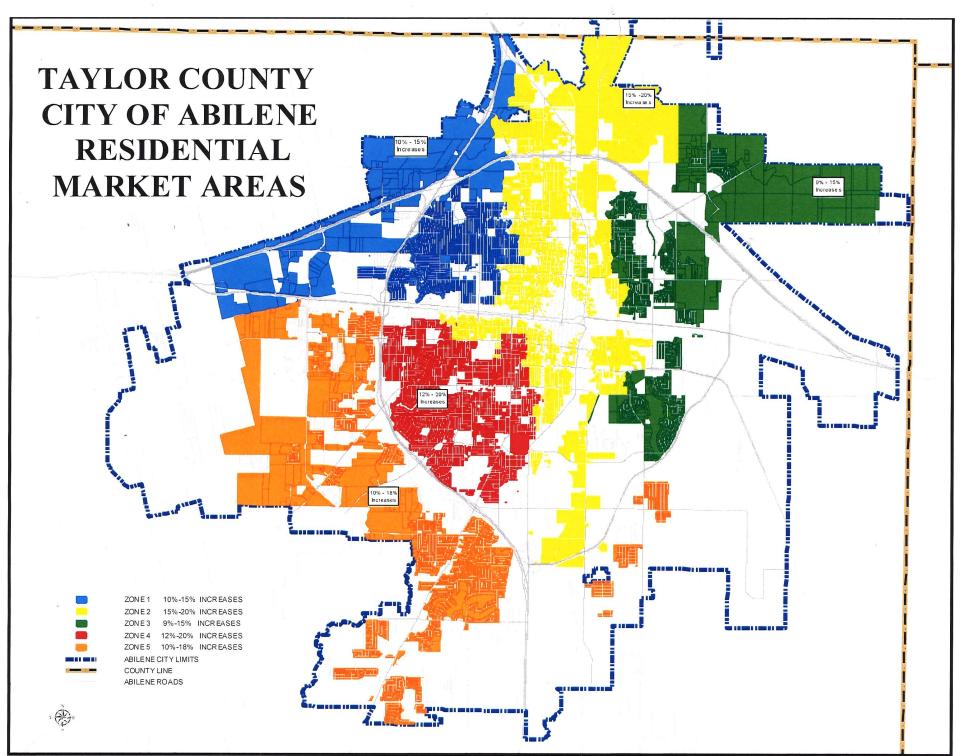

A city of Abilene residential map produced by the appraisal district is broken into five zones, with expected tax value increases:

Zone 1, northwest Abilene: 10% to 15%

Zone 2, central Abilene, from north of Interstate 20 to Loop 322, 15% to 20%

Zone 3, northeast and a small portion southeast, Abilene, 9% to 15%

Zone 4, south-central Abilene, from South First Street to the Winters Freeway, 12% to 20%

Zone 5, west and southwest Abilene, to Dyess AFB and south into the Wylie area, 10% to 18%

For school districts, the Taylor County CAD estimated these residential value increases:

Abilene ISD - 10% to 20%

Wylie ISD - 10% to 15%

Clyde ISD - 6% to 10%

Eula ISD - 10% to 15%

Jim Ned CISD - 12% to 20%

Merkel ISD - 12% to 18%

Trent ISD - 15% to 25%

Still, the tax rate will be lower this year.

As values go up, tax rates must come down to calculate a no-new-revenue rate. The goal is to produce the same amount of revenue as the year before.

By law, taxing entities can raise the NNR by 3.5%. School districts are excluded.

The appraisal district Friday will mail notices of value to 76,640 real estate property owners; notices to 7,455 business personal property owners will be mailed May 24.

Want to protest?

A real estate property owner can file a protest by May 31, or 30 days for the date on the notice, whichever is later.

The office in south Abilene can be contacted about protests. That includes going to www.taylor-cad.org, where a protest form can be found. The office is at 1534 S. Treadaway Blvd.; phone is 325-676-9381.

Gary Earnest, CEO of the appraisal district, said the district encourages property owners to review notices to ensure all qualifications are met. For example, the homestead exemption, the exemption for those who are 65 or disabled, and the disabled veteran exemption.

Those who turn 65 this year will qualify for that exemption.

A homestead exemption limits the taxable value to increase not more than 10% and a deduction of $350 to $400.

"We encourage property owners to contact our office and provide documentation related to the condition of their property or information about their neighborhood that will impact value," Earnest said. "Our charge is to support taxpayers' rights and provide transparency of information related to property taxes in Taylor County."

To qualify for a homestead exemption, the person must own and occupy a residence during the year.

This article originally appeared on Abilene Reporter-News: Rising tide: Property values up as much as 20% in Taylor County