Robert Bruce Trims General Motors, Amerco Positions

- By Tiziano Frateschi

Robert Bruce (Trades, Portfolio)'s Bruce & Co. sold shares of the following stocks during the fourth quarter.

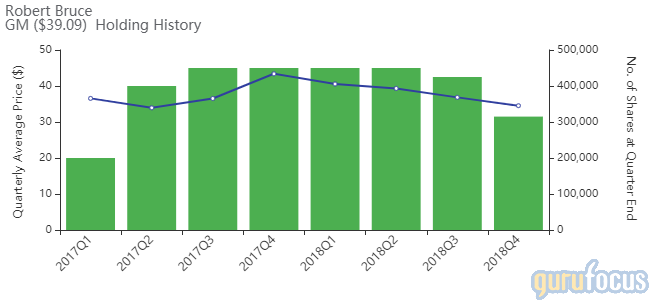

The firm trimmed 25.88% off its General Motors Co. (GM) position. The trade had an impact of -0.79% on the portfolio.

Warning! GuruFocus has detected 4 Warning Signs with SPN. Click here to check it out.

The intrinsic value of GM

The company, which manufactures cars, trucks and automobile parts, has a market cap of $55.1 billion and an enterprise value of $137.15 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. While the return on equity of 21.70% is outperforming the sector, the return on assets of 3.63% is underperforming 52% of companies in the Global Auto Manufacturers industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.26 is below the industry median of 0.61.

The largest guru shareholder of the company is Warren Buffett (Trades, Portfolio) with 5.13% of outstanding shares, followed by Hotchkis & Wiley with 1.2% and David Einhorn (Trades, Portfolio) with 0.85%.

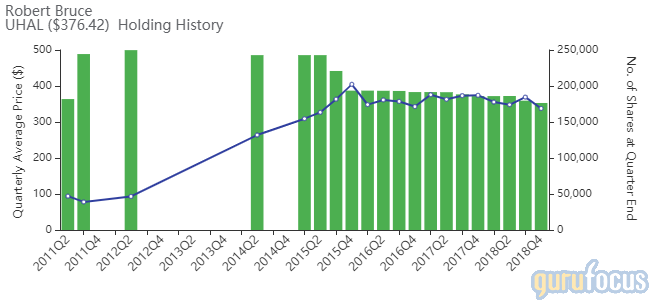

The firm's holding of Amerco Inc. (UHAL) was reduced by 1.78%. The trade had an impact of -0.24% on the portfolio.

The company, which provides rental trucks to household movers, has a market cap of $7.38 billion and an enterprise value of $8.24 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 10.79% and return on assets of 3.45% are outperforming 80% of companies in the Global Rental and Leasing Services industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.78 is above the industry median of 0.66.

The largest guru shareholder of the company is David Abrams (Trades, Portfolio) with 2.94% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 2.26%, Hotchkis & Wiley with 1.15% and Bruce with 0.9%.

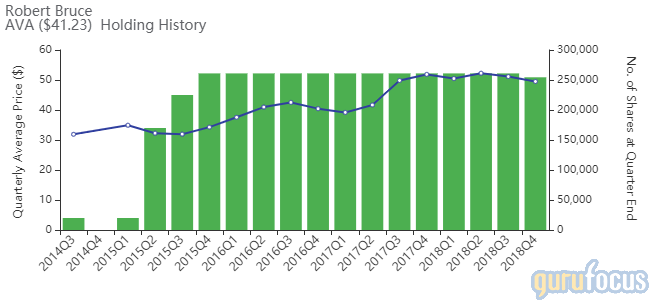

The Avista Corp. (AVA) position was curbed 2.49%, impacting the portfolio by -0.07%.

The company, which generates and transmits electricity as well as distributes natural gas in the United States, has a market cap of $2.71 billion and an enterprise value of $2.78 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 7.87% and return on assets of 2.48% are underperforming 65% of companies in the Global Utilities - Diversified industry. Its financial strength is rated 5 out of 10. The equity-asset ratio of 0.32 is below the industry median of 0.37.

The largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.23% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 0.39% and Hotchkis & Wiley with 0.13%.

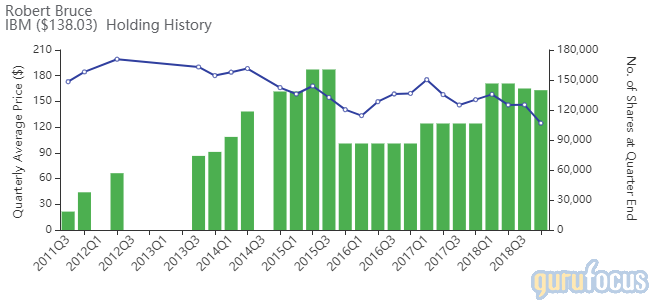

The holding of International Business Machines Corp. (IBM) was reduced by 1.2%, impacting the portfolio by -0.05%.

The company, which provides a variety of information technology services, has a market cap of $125.44 billion and an enterprise value of $159.39 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 48.03% and return on assets of 7.07% are outperforming 69% of companies in the Global Information Technology Services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.26 is below the industry median of 5.23.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.27% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 0.11%, Joel Greenblatt (Trades, Portfolio) with 0.06% and Ray Dalio (Trades, Portfolio) with 0.02%.

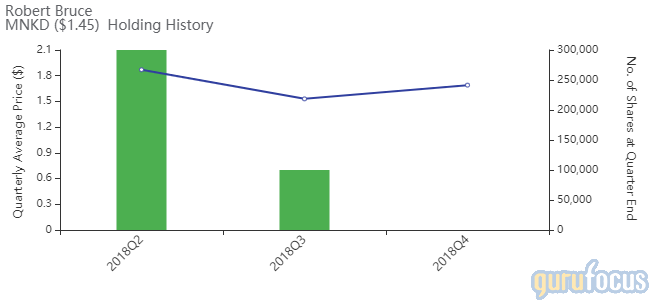

The firm divested of its MannKind Corp. (MNKD) position. The trade impacted the portfolio by -0.04%.

The company, which develops therapeutic products to treat diabetes and cancer, has a market cap of $231.42 million and an enterprise value of $326.45 million.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on assets of -177.18% is underperforming 93% of companies in the Global Biotechnology industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.10 is below the industry median of 64.02.

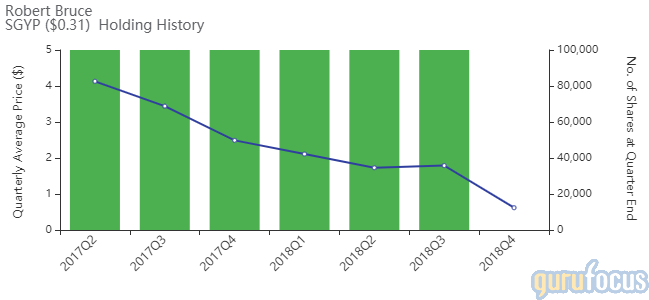

The Synergy Pharmaceuticals Inc. (SGYP) holding was closed, impacting the portfolio by -0.04%.

The manufacturer of drugs for the treatment of gastrointestinal disorders has a market cap of $76.97 million and an enterprise value of $150.9 million.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -109.90% is underperforming 95% of companies in the Global Drug Manufacturers - Specialty and Generic industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.38 is below the industry median of 2.03.

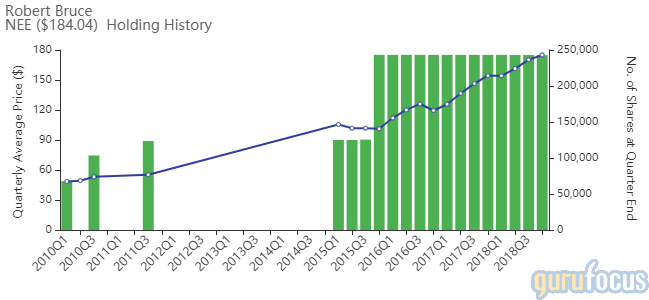

The firm curbed its NextEra Energy Inc. (NEE) position by 0.12%. The trade impacted the portfolio by -0.01%.

The power company has a market cap of $87.96 billion and an enterprise value of $128.3 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 20.45% and return on assets of 6.77% are outperforming 89% of companies in the Global Utilities - Regulated Electric industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.23.

Simons' firm is the company's largest guru shareholder with 0.18% of outstanding shares, followed by Pioneer Investments with 0.12%, Mario Gabelli (Trades, Portfolio) with 0.01% and Bernard Horn (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Lee Ainslie Buys Alphabet, Alibaba

David Tepper Sells Micron Technology, Facebook, Alibaba

Larry Robbins Buys Cigna, Alphabet

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with SPN. Click here to check it out.

The intrinsic value of GM